News

New model can highlight political violence exposure, says Towers Watson

Professional services firm Towers Watson has unveiled its new Sunstone model, designed to give firms a better understanding of their terrorism exposure.

Post Claims Club: Online experts blast insurers for poor social media performances

Insurers are “petrified” of engaging with their customers through social media, according to Jonathan Callcut, chief sales officer at cloud-based social commerce firm Reevo.

Post Claims Club: Claims forms need a rethink to obtain honest answers

Insurers’ claims forms encourage dishonest answers from policyholders, according to Consumer Intelligence chief executive Ian Hughes.

Post Claims Club: London market should follow other sectors’ lead in implementing standards

The London market could benefit from the introduction of a road traffic accident portal-like electronic system with fixed timelines and costs consequences for delays in decision making, according to Martin Thomas, chief claims officer at Aon Risk…

Equity names Xchanging’s Yorke as its first COO

Equity Insurance Group has continued to restructure its leadership following yesterday’s confirmation that the Aquiline purchase had completed.

Acord hires chief standards VP from Zurich

The Association for Cooperative Operations Research and Development has hired Monique Hesseling for the role of vice president and chief standards officer.

2013 British Insurance Awards shortlist announcement at noon today

Today at noon Incisive Media insurance division editor-in-chief Jonathan Swift will unveil the nominees for the 2013 British Insurance Awards.

Barnett & Barnett rebrand delayed by Equity sale

A rebranding exercise at Barnett & Barnett and NBJ was delayed by the sale of Equity Insurance Group to US private equity house Aquiline, according to managing director Neil Campling.

Guernsey and Hong Kong sign double taxation agreement

Guernsey has signed a double taxation arrangement with Hong Kong, taking the number of jurisdictions it has full DTAs in place with to seven.

Private equity houses tipped as frontrunners in Giles sale

Giles backer Charterhouse will find a welcoming audience in private equity markets as it seeks to sell its stake in the broker.

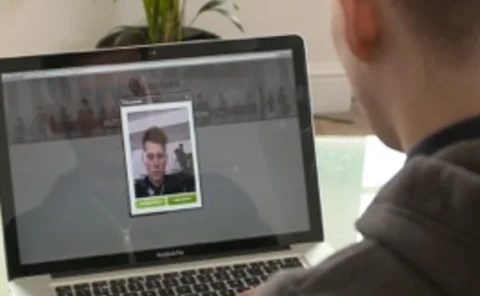

Video chat firm targets insurers with facial recognition software

The company behind a new online facial recognition technology has claimed insurers that sign up to use the software will make significant savings by reducing fraud and winning back market share from aggregators.

Xchanging names former Charles Taylor London Market boss as chief reinsurance adjuster

Technology provider Xchanging has promoted its head of delegated lead to a new position as chief adjuster for reinsurance in its claims services business.

Tripoli bomb exposes weak state security

The bombing of the French Embassy in the Libyan capital of Tripoli earlier today tells of the country’s faltering security, IHS said.

Brokerbility inks law firm partnerships

Broking group Brokerbility has complete partnership deals with law firms Berrymans Lace Mawer and DAC Beachcroft that will see members provided with services.

Former Catlin boss Freshwater to take on CFO role at Zurich

Zurich has appointed Neil Freshwater to the role of chief financial officer for its general insurance and shared services business in the UK.

Career file: Carl Beardmore

BMS CEO resigns from role as business concentrates on strategic development.

Market Moves: Ace, Bluefin, LV and Charles Taylor Insurance make new hires

It was honours even between the insurer and the broking sectors this week, with Ace once again leading the way for insurers with a couple of key hires.

Towergate’s B rating affirmed by Fitch

Fitch Rating has affirmed Towergate’s B rating and revised its outlook to stable from negative.

Generali opens Global Corporate and Commercial unit

Operations have begun at Generali’s Global Corporate & Commercial business unit, a platform established to integrate insurance services for medium and large multinationals.

Top 5 European news stories

The top five European news stories from www.insuranceinsight.com over the past seven days.

Survey shows execs unclear on D&O risks

Regulatory investigations and enquiries, criminal penalties, and anti-corruption legislation, are among the top concerns for directors and officers, according to a new survey by broker Willis.

LMA unveils plan to cut whiplash bill

The Lloyd’s Market Association has laid out a five-point plan for reducing the annual cost paid out of over £2bn for whiplash claims.

100 000 left homeless by Sichuan earthquake

A 6.6 magnitude earthquake in the Sichuan province of China has left nearly 100 000 Chinese homeless, and may have dealt severe damage to insured industrial facilities in the region, according to Eqecat.

Critical infrastructure vulnerable to hacking

Infrastructure systems are increasingly susceptible to wireless hacking attacks according to security consultancy Digital Assurance.