Commercial

Oxygen sells assets

Oxygen Holdings is to sell its subsidiary Robertson Taylor to Entertainment Insurance Partners for an undisclosed sum.

AIR releases German flood catastrophe model

Catastrophe risk modelling firm AIR Worldwide has released an inland flood model for Germany that is said to offer a fully probabilistic approach for determining the likelihood of flood losses from all types of storms.

Aviva appoints chief risk officer

Aviva has promoted John Lister to UK chief risk officer.

Geddes says RBSI won't "crack open the champagne" just yet

Bosses at RBS Insurance have attributed a dramatic third quarter operating profit turnaround of £615m over the past 12 months to a combination of factors, including an exit from broking personal lines and general business re-pricing.

Post and features editor Leigh Jackson scoop prestigious awards

Post Magazine was acclaimed again at the 2011 Association of British Insurers Financial Media Awards.

RSA names regional manager

RSA has appointed Lee Mooney as regional manager, North east. He takes up the role with immediate effect.

Groupama reorganises commercial underwriting operations

Groupama has reorganised its commercial underwriting operations in Manchester in a move it hopes will maximise the potential of the growing number of business opportunities identified in each region.

RBSI sees slight dip in profit Q2 to Q3, but happy with performance YTD

Royal Bank of Scotland Insurance this morning reported an underwriting profit of £761m in 2011 to date - an increase of £591m versus September YTD 2010.

Thai floods: Insured losses creep up

Global reinsurance broker Aon Benfield has estimated the insured losses from the floods in Thailand could be at least US$4.6bn.

Markel recruits from Willis to strengthen Italian PI and D&O book

Markel has appointed Davide Balocco as senior underwriter in professional liability division to focus on its Italian book.

Ireland 123 aquisition drives RSA's profits up for Q3

The acquisition of 123 in Ireland last year and growth across central and emerging Europe has helped RSA to report further growth in quarter three of 2011.

View from the top: A digital era dawns for the London market

The time feels right for grabbing the jewel in the crown of the London insurance markets reform programme — electronic support of the placement transaction. Aon has a long track record in pushing forward with market reforms that bring 21st Century e…

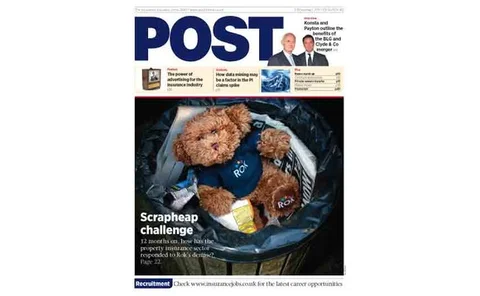

Rok - one year on: Bearing up after Rok

When Rok went into administration, insurers had to respond rapidly. One year on, how are they coping and what lessons have they learned?

Marketing: The power of advertising

Effective marketing can be a tough challenge for financial services providers and having a strong presence is not enough, it must also resonate with customers.

Post magazine – 3 November 2011

The latest issue of Post magazine is now available to subscribers as a digital and interactive e-book.

"Leaner and meaner" Oval to focus on wiping debt

Oval is aiming to wipe its net debt by 2014 but it is not ruling out making new hires and “selective acquisitions” in the meantime.

Building referral fee costs hit industry for ‘tens of millions of pounds’ – Insurance News Now

Post senior reporter Amy Ellis outlines this week's major general insurance stories including claims that referral fee costs that have escalated over the last two years to the point where they are now costing the industry tens of millions of pounds a…

AIG reveals $972m payment to US Treasury after MetLife deal

AIG has announced that it had paid the United States Department of the Treasury $972m to reduce the liquidation preference on one of the special purpose vehicles created as part of the government's assistance to AIG.

Fitch affirms ‘A’ IFSR of ACI

Fitch has affirmed the ‘A’ insurer financial strength rating of Amlin Corporate Insurance, reflecting the strategic importance of the commercial lines writer to the Amlin group.

LIU Europe opens Hamburg branch

Liberty International Underwriters has opened a new branch in Hamburg, Germany as it seeks to become a competitive, niche player in the region.

In conversation with RSA: distinguishing from rivals in SME commercial

The SME commercial market remains one of the most highly competitive in the UK insurance space.

Aon reports 38% jump in profits for third quarter

Aon net revenue increased 38% to $198m (£122.8m) for the quarter ended 31 September 2011, compared to $144m for the previous year.

Thai floods: Insured losses to be "managable", says Fitch

Insured losses from the Thailand floods will be “manageable” at $4.5bn and not trigger widespread solvency problems, or undue financial strain for the country’s non-life insurance players, according to Fitch Ratings

LV announces senior underwriting appointment

LV Broker has appointed Tom Maughan as a senior underwriter for its Bournemouth branch, which looks after brokers in Dorset, Hampshire, West Sussex, the Isle of Wight and the Channel Islands.