Commercial

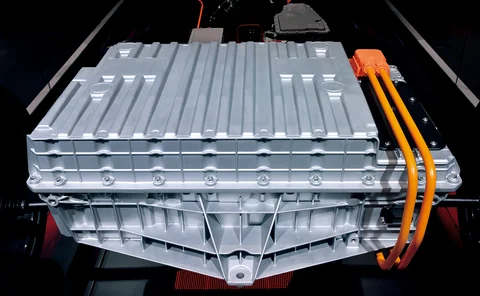

Blog: Electric vehicles - the risks associated with lithium batteries

With their ultra-low emissions, electric vehicles are a key part of the UK’s greener future. However, after reports of cars spontaneously catching fire, Andy Miller, technical risk control manager, Allianz UK, explains safety concerns could put the…

Turnover up but profits slip at Arag

Arag has posted a 14.7% rise in turnover to £14.1m for the year to 31 December 2019.

Managing General Agents - Indicative reading time: 30 minutes

A series of CPD knowledge learning opportunities that can be used to accrue reading time. The pass rate is 80%.

David Coughlan to replace Janet Connor as AA’s insurance MD

Janet Connor will be stepping down as managing director of insurance at the AA this summer with former RSA UK personal lines MD David Coughlan taking up the role, Post can reveal.

Online delegated authority capacity marketplace aims to slash transaction times

Capacity Place, an online marketplace for insurance programme capacity launched last week, could “massively shorten” the amount of time it takes to initiate and complete programme transactions, according to its CEO Marco Del Carlo.

AGCS embarks on €200m cost-cutting restructure

Allianz Global Corporate & Specialty will look to reduce its global headcount by a further 400 as it embarks on a transformation programme.

Briefing: Gefion hopes to go out with a whimper as brokers predict a bang

News that Danish unrated insurer Gefion had entered run-off and solvent liquidation left us and others in the industry feeling somewhat underwhelmed.

GRP expands into healthcare with first buy after Searchlight takeover

Global Risk Partners has bought Premier Choice Healthcare to become its healthcare hub as it moves into the sector.

Blog: Is coronavirus the catalyst insurers need to shake up how they treat SMEs?

A survey for the US National Federation of Independent Businesses showed that 76% of small businesses rate the impact of Covid-19 as profound. Sabine VanderLinden, co-founder and managing partner of the Alchemy Crew, explains why SMEs could be some of…

Trade Voice: MGAA’s Ben Busfield on responding in the face of unprecedented adversity

Ben Busfield, operations manager at the Managing General Agents’ Association, discusses how members reacted to the UK going into lockdown and how they are supporting employees and serving clients as the country eases along the pathway to a new normal.

Lloyd's working on non-damage BI cover for SMEs

Lloyd’s is working on non-damage business interruption cover for SMEs as part of recovery efforts to fast-track global economic and societal recovery from the “far-reaching” impacts of Covid-19.

Gefion liquidation 'no great shock' to brokers

Brokers have labelled unrated Danish insurer Gefion going into run off and ultimately liquidation as “no great shock”.

Aon u-turns on salary cuts

Aon will repay colleagues in full, plus 5% of the withheld amount, after cutting the salaries of 70% of its workforce.

MGAs hanker after face-to-face business return

A survey of the Managing General Agents' Association has found that despite the increased use of video conferencing services during the Covid-19 lockdown, managing general agents are keen to get back to face-to-face meetings.

Gefion to enter run-off as regulator revokes insurance license

Danish unrated insurer Gefion will enter solvent liquidation as the Danish regulator has chosen to withdraw its license, the insurer has said.

Insurance Covid-Cast: What next for managing general agents?

In the 30th episode of Post and Insurance Age’s video series we gathered together an expert panel to discuss what the future holds for managing general agents.

Profits nearly quadruple at Ecclesiastical in 2019

Ecclesiastical delivered £58m in post-tax profit last year, more than treble the £15.2m achieved in 2018, according to a filing at Companies House.

Mike Keating appointed MGAA managing director

Former Axa and UK General leader Mike Keating has been appointed managing director of the Managing General Agents’ Association, taking up the role on 8 September 2020.

Future Focus 2030: The future of personal injury podcast - the pathway to reform

It is the year 2030. After a number of false starts the government finally introduced its Whiplash reforms in April 2022 following delays due to the extended impact of Brexit and Covid 19.

Future Focus 2030: The future of personal injury claims

In the second of a new monthly series, Post looks into the future at how the insurance market might change, with each part focusing on a specific issue. Jonathan Swift fast forwards a decade to look at how a new era of collaboration and ethics changed…

Zego beefs up debt with Triplepoint

Insurtech Zego has taken on additional funds from venture capitalist debt provider Triplepoint.

Marsh bites back as RSA alleges it is on the hook for wording in FCA BI test case

Marsh has disputed RSA allegations its clients should be liable for brokered policy contract issues in the Financial Conduct Authority’s business interruption test case, as brokers were dragged into the ongoing proceedings.

Ex-Biba chair Lord Hunt steps up to GRP main board as NED

Lord Hunt, the former chair of the British Insurance Brokers’ Association, has stepped up to sit on the main board of Global Risk Partners as a non-executive director.

Insurers lock horns with FCA in BI test case defences

The eight insurers involved in the Financial Conduct Authority’s business interruption test case have filed their defences with the court, alleging among other arguments that the pandemic is a global issue rather than local and therefore not covered.