Former Lib Dem leader brands insurer Covid BI claims handling 'deeply depressing'

Former Liberal Democrat leader Tim Farron has called the conduct of insurers during the coronavirus pandemic “deeply depressing” and urged the Chancellor of the Exchequer to “take steps to protect insurance customers from the actions of insurers”.

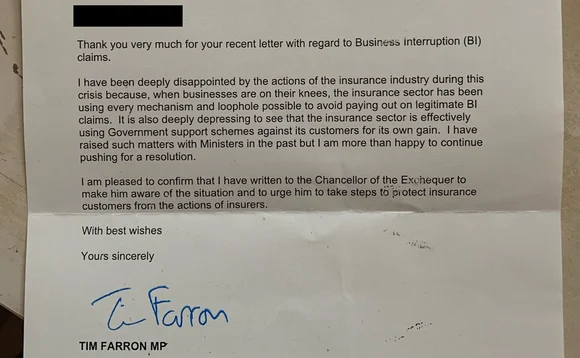

Farron, pictured, who is the Member of Parliament for Westmorland and Lonsdale, made the comments in a 5 January letter to a constituent, seen by Post.

In their initial letter, the constituent had raised the issue of insurers deducting the value of government support funding, including furlough scheme payments, from businesses’ claims awards.

In his response, Farron wrote: “I have been deeply disappointed by the actions of the insurance industry during this crisis because, when businesses are on their knees, the insurance sector has been using every mechanism and loophole possible to avoid paying out on legitimate BI claims.

“It is also deeply depressing to see that the insurance sector is effectively using Government support schemes against its customers for its own gain. I have raised such matters with Ministers in the past but I am more than happy to continue pushing for a resolution.”

He went on to confirm that he had written to the Chancellor of the Exchequer on the matter.

The Treasury rebuked insurers in September for deducting government grants from BI claims payments, with a warning of further action if the practice persisted.

In a letter to Association of British Insurers director general Huw Evans, economic secretary John Glen MP said: “It is the government’s firm expectation that grant funds intended to provide emergency support to businesses at this time of crisis are not to be deducted from business interruption insurance claims.”

The letter followed one sent by Evans to the Treasury giving notice of a commitment made by 12 firms not to deduct money received by businesses under specified government support schemes.

These schemes were the Local Authority Grant, the Small Business Grant and the Leisure/Retail/Hospitality grants.

In the letter sent to Farron, his constituent alleged that the “lack of explicit reference” to other support measures such as the furlough scheme had been taken by insurers as a “green light to utilise funding intended for small businesses for their own advantage.”

Speaking to Post in November, Jonathan Samuelson, a loss assessor at Harris Balcombe, said of the hundreds of business interruption claims the firm was then working on: “All of them, without exception, have said that furlough payments are going to be deducted because they believe they are savings.”

Commenting on the letter, an ABI spokesperson said: “The vast majority of the market committed last year to not deducting the government grants issued to support businesses from any valid Covid-19 claims payments.

“This was a voluntary initiative by the ABI, after individual consultation with our major insurer members, to give added certainty and reassurance to business customers on what can be a confusing issue of government support. In the minority of cases where grants had already been deducted, firms committed to reviewing those claims and to contacting customers to adjust the settlement accordingly.

“We appreciate this continues to be a difficult time for many businesses and we supported the test case on business interruption insurance to help bring clarity for customers. We expect over £1.7bn to be paid out in Covid-19 related claims, including £900m on business interruption policies.”

Last November a spokesperson for the trade body, speaking specifically about furlough deductions, said: “Furlough payments were payments to employees, made via employers for administration purposes. They were not intended to be income replacement for businesses and, as they do not cover a loss incurred by the claimant, should not be included in any claim.

“Grants are very specifically designed to help businesses; they go to the business owner and can be used for whatever purpose.

“Given the individual specifics of a businesses’ circumstances and the details of their claim, claims will be assessed on a case-by-case basis.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: https://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk