Claims

Rate rises could see upturn in market performance

The industry could see an upturn in the motor market this year, if rates continue to rise faster than claims inflation, but it ultimately hinges on whether insurers release or strengthen reserves.

Motor claims: Senior Labour MP dismisses LASPO as a ‘Christmas Tree’ Bill

The Legal Aid, Sentencing and Punishment of Offenders Bill has been criticised for limiting access to justice for poorer claimants and disguising the abuses of insurers and claims management companies as a compensation culture.

Market moves: MGAs making the moves

This week the recruitment space belonged to managing general agents.

Post Intelligence Benchmarking Financial and Professional Lines: Positive experience

The Insurance 360 Financial and Professional Lines report found standards to be high.

RTA Portal extension divides opinion due to lack of clarity and timescales

ABI welcomes changes but industry raises concerns over timescale for implementation.

Career development: CILA launches new diploma

The Chartered Institute of Loss Adjusters has launched a new claims handling diploma.

Market fears for unintended consequences as first ABS approval nears

The first alternative business structure could be greenlighted as early as next week.

Immediate medical triage may cut whiplash costs

Treatment Network boss Jonathan Cook told delegates that offering whiplash claimants immediate medical triage when they first phoned in their claim prompted 15% of callers to "spontaneously recover" from their injuries.

Government rules out legal curfew for young drivers

The government has dashed insurer hopes of legal intervention to curtail and curfew young drivers.

Comment: ELTO is not fit for purpose

Improvements are needed to help people trace their insurance policies, says Peter Watson, managing partner at Simpson Miller.

Law report: Assault by employee cases have contrasting outcomes at Court of Appeal

This law report has been contributed by national law firm Berrymans Lace Mawer.

Law report: Subcontractor was in clear and deliberate breach of order

This law report has been contributed by national law firm Berrymans Lace Mawer.

Law report: Common sense over costs result

This law report has been contributed by national law firm Berrymans Lace Mawer.

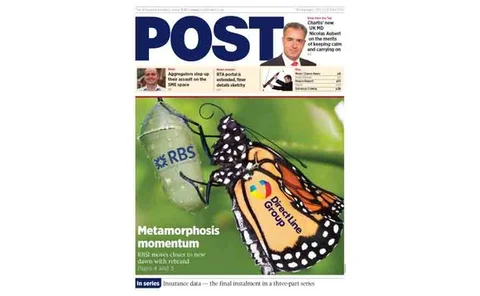

Post magazine – 16 February 2012

The latest issue of Post magazine is now available to subscribers as a digital and interactive e-book.

The Co-operative and Zurich keen to move on PM motor premium initiatives

The Co-operative is hopeful the insurance summit with Prime Minister David Cameron will lead to stamping out fraudulent personal injury claims while continuing to settle genuine ones.

Business continuity plans can save companies, Biba research reveals

New research from the British Insurance Brokers’ Association and the Cabinet Office has revealed business continuity plans are likely to stop companies from failing after a major disruption such as a flood or fire.

New year European windstorm damage estimated at €267m

Perils has today disclosed an initial loss estimate for windstorm Andrea, which occurred in Western Europe from 4-5 January 2012, of €267m.

Law firm accuses PM motor premium war of limiting access to justice

Spencers Solicitors fears the Prime Minister's approach to tackling the rising cost of motor insurance will "chip away at the public's right to justice under the law".

Lloyd's takes $2.2bn hit for Thai floods

Lloyd's of London estimates its net claims from the flooding in Thailand last year to be $2.2bn.

Lloyd's puts Thai flood losses at £1.4bn

Lloyd's has estimated its net claims from the flooding in Thailand last year to be $2.2bn (£1.4bn).

Law firms' ABS will lead to M&A activity

Alternative business structures that allow non-lawyers to control and own law firms will result in a frenzy of mergers and takeovers, according to the latest Insurance Market Update from Deloitte.

Axa: fraud adds £607 to a home claim

Axa Personal Lines says it has seen an ongoing rise in the number of people exaggerating their home insurance claims.

Middle East guest blog: Consumer protection my foot

The insurance broking fraternity in the United Arab Emirates met on 9 February to discuss how, through concerted effort, they can enter into a meaningful dialogue with the UAE Insurance Authority to reverse the recently released, notorious Directive 2.

To ‘E’ or not to ‘E’ – that is the question?

As the European insurance industry slowly starts to emulate the UK and adopt e-trading, Simon Ronaldson asks how European insurers can learn from the experience of their more mature counterparts.