Jen Frost

News editor

Jen joined Insurance Post as a reporter in 2018.

She has won Willis Towers Watson’s insurance and reinsurance newcomer of the year twice in a row, in 2018 and 2019.

Also in 2019, Jen was Biba’s trade press journalist of the year and won the gold award for financial journalism category at MHP’s 30 to Watch awards, beating off competition from Guardian and Which?

In 2020 she was shortlisted in four categories at the Headline Money awards, including best B2B story and B2B journalist of the year, and took home the title of B2B General Insurance Journalist of the Year.

Follow Jen

Articles by Jen Frost

Jeff Brinley named Be Wiser CEO as Sharon Beckett steps down

Jeff Brinley has been named Be Wiser CEO with Sharon Beckett having left the role this year, Post can reveal.

Loss-making Markerstudy sniffing out investors as loan discussions continue post-deadline

Managing general agent Markerstudy made a loss in 2019, with discussions ongoing around its near £200m debt to Qatar Re.

Stock losses caused by Covid freight delays likely to be excluded from insurance policies

Damage to and deterioration of stock as a result of the ban on manned freight between France and the UK is unlikely to be covered by insurance, industry representatives have confirmed.

Aon/WTW merger faces further European Commission review

The European Commission will conduct a Phase II review into the $30bn (£22bn) merger of global brokers Aon and Willis Towers Watson, it has been confirmed.

Briefing: Compare the Market fine a fitting end to a sorry chapter

“Ridiculous”, “harmful”, “anti-competitive”. These were the words used by Money Supermarket managing director of financial services Graham Donoghue to describe wide ‘most favoured nation’ clauses during a Competition Commission hearing back in 2013.

Coronavirus the 'disease equivalent' of the Great Storm of 1987, Supreme Court hears

The Financial Conduct Authority’s counsel today likened the spread of coronavirus to the Great Storm of 1987, appearing in front of the Supreme Court for the third day of the business interruption test case appeal.

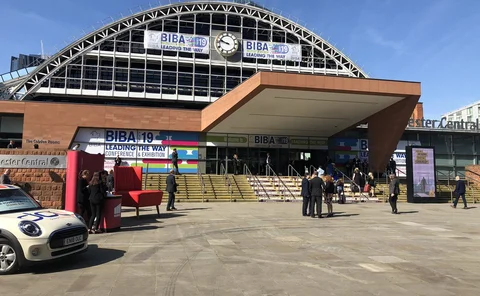

Briefing: As Covid pushes Biba 2021 online, a death knell sounds for 'in-person only' conferences

Last week the British Insurance Brokers’ Association followed others' footsteps as it moved its 2021 conference online. Post news editor Jen Frost considers the future of events.

Briefing: BI test case verdicts and appeals broken down – In pursuit of clarity

As the search for lesser-spotted clarity continues, simple confirmation from the regulator on which business interruption wordings are being contested, and by who, is a welcome aid.

Brokers and MGAs warned to remove staff who are not 'fit and proper' for SMCR rules

The Financial Conduct Authority has cautioned brokers and managing general agents not to assume someone is “fit and proper” for roles under the Senior Managers & Certification Regime, with the expectation being that “some” staff will not meet standards.

Aviva censured over ‘serious but not intentional’ preference shares breach

The Financial Conduct Authority has publicly censured Aviva for a 2018 announcement that the regulator found “had the potential to mislead the market”.

Lockton denies fraud as Axa hit with legal action

Broker Lockton has denied acting fraudulently regarding a property developer’s claim, as fresh legal action was brought against insurer Axa.

Briefing: False hope is no antidote - a business interruption appeal is still firmly on the table

The world is devoting a lot of energy into finding a vaccine or ‘cure’ for Covid-19. We should know by now that false hope is not an antidote.

Briefing: The BI test case – QIC’s failed intervention and the ‘spirit of co-operation’

The business interruption test case is meant to be about co-operation to find clarity. Qatar Insurance Company’s attempt to intervene has rocked the boat.

Inquiry slams Ecclesiastical over evidence 'failings' in Church of England child abuse report

Insurer Ecclesiastical has faced criticism after failing to provide evidence “in a candid manner” during the Independent Inquiry into Child Sexual Abuse’s investigation into Anglican Church abuse.

Interview: Penny James, Direct Line Group

Direct Line Group CEO Penny James spoke to Jen Frost about overseeing the business’s transformation programme under coronavirus, the group’s acquisitive appetite and having a healthy curiosity

Analysis: Price comparison websites warned of shrinking demand after dual pricing ban

Next year’s dual pricing ban will force price comparison websites to adapt if they are to stay relevant, experts have warned.

Briefing: The great home/office flip flop

This week will have seen many of us who had been ready to get back to the office reconsider, as guidelines across England shifted.

Enterprise faces £31m claims hit from Icebreaker tax avoidance scheme used by Take That

The liquidators of Gibraltar insurer Enterprise have predicted a £31m claims hit from tax avoidance scheme Icebreaker used by Take That and other wealthy creative industries professionals, Post can reveal.

Beazley doubles Covid claims hit estimate to $340m

Beazley has increased the estimated cost of coronavirus claims to its first party business, in a move labelled “disappointing” by analysts.

Direct Line Group completes Brolly buy

Direct Line Group’s deal to buy insurtech Brolly closed last week, Post can reveal.

Analysis: A year on from damning report and little progress to show on child abuse claims

A year ago the Independent Inquiry into Child Sexual Abuse released a report slamming the claims process as it stands and making a raft of recommendations. Post investigates the progress made since then.

Former Broadmoor psychiatrist faces investigation for role in Ecclesiastical abuse claims

Professor Tony Maden, psychiatrist and the former head clinician of Broadmoor’s dangerous and severe personality unit, is facing two separate investigations by the General Medical Council for his role as an expert witness in Ecclesiastical church abuse…

Zurich says its BI wordings not triggered in FCA test case

Zurich policies under scrutiny in the Financial Conduct Authority’s business interruption test case are not expected to pay out, the insurer has confirmed in an update.

Action group courts businesses as Marsh policy predicted to pay out

The Hospitality Insurance Group Action is seeking more members, after a court ruling suggested a policy brokered by Marsh for several insurers is likely to pay out.