Analysis

Europe: Ready for the digital challenge?

It is difficult to overstate the impact of the digital revolution. To take one metric, the number of global mobile phone subscriptions is now 6.8 billion, according to UN agency The International Telecoms Union. It predicts that this figure will…

Underwriting Property: Going for gold

Cited as a key factor in the British cycling success at the London 2012 Olympics, the philosophy of marginal gains can also be applied to underwriting.

Terrorism: Global threat

How has the insurance industry adapted to the steady rise in terrorism and civil unrest across the world in the past decade?

Directors’ & Officers’: Much aD&O about nothing

Despite some predicting an uncertain period for the directors’ & officers’ sector following a government discussion paper and a high-profile claim refusal, unconcerned market insiders explain why education is their current priority.

Europe: Disaster area?

More people than ever before are being exposed to natural disasters due to the increase in global urbanisation, according to a recent report from the Institution of Mechanical Engineers.

Legal Update: Whiplash Claims: Lack of action by government on small claims limit gives time for constructive talks

Alistair Kinley says the government’s latest motor measures have little connection to insurance claims and whiplash and there is a failure to implement Transport Select Committee recommendations.

International: Europe: Changing the channel

A recent study suggests insurers are failing to take advantage of digital channels. How can they harness the benefits on offer?

Pet Insurance: Paws for thought

The cost of pet insurance claims has skyrocketed in the past five years, prompting some insurers to withdraw from the sector altogether. How can those that remain respond to the difficult market conditions?

High Street Brokers: Word on the street

While many had expected the increase in alternative methods of buying insurance to signal the demise of high-street brokers, they are still going strong. What are they doing right?

Europe: Changing the channel

In a competitive market such as insurance, industry players need to keep up with their customers to target the most effective channels for communication and engagement.

Motor Insurance: Jumping the gun

Motor insurers’ over-eagerness to reap the anticipated benefits of the Legal Aid, Sentencing and Punishment of Offenders Act has resulted in a sharp drop in rates. With unprofitability increasing, where does the sector go from here?

Opportunistic Fraud: Zero tolerance

With opportunistic fraud attracting little public attention compared with large-scale organised fraud, the insurance sector is battling to change attitudes to such crime and develop methods to catch its perpetrators.

Europe: Should we stay or should we go?

Earlier this month, Conservative backbencher Adam Afriyie called on the government to bring forward the referendum on the UK leaving the European Union from 2017 to October 2014.

Roundtable: Legacy systems: Knowing when to move on

How can insurers improve their approach towards the daunting but essential task of keeping their IT platforms up to date?

Legal Update: Product Recall: No room for horsing around when it comes to product recall insurance

Jim Sherwood says the furore surrounding a zebra toy found to contain a carcinogen emphasises the importance of being protected by robust product recall cover.

Whiplash: Choosing the right path

Several ideas have been suggested to alleviate insurers’ whiplash woes – but which method represents the best solution for all parties?

Private Investigators: Watching the watchmen

Three insurers were named among the firms being probed by the Information Commissioner’s Office for their use of rogue private eyes, but how will the wider industry be impacted by the investigation?

Expertise in Action: Broker: Fully customised

A tailor-made risk management proposition provides the best result for clients, brokers and insurers alike.

Expertise in Action: Broker: Preferential treatment

Few clients are interested in commission disclosure, however, the issue of preferential treatment for brokers that produce the most business for insurers could soon face regulatory scrutiny.

Europe: Turkish delight

Has Turkey got what it takes to be the next big thing in insurance? Francesca Nyman investigates.

The Claims Event 2013

Claims managers fear hearing loss could become the ‘new whiplash’

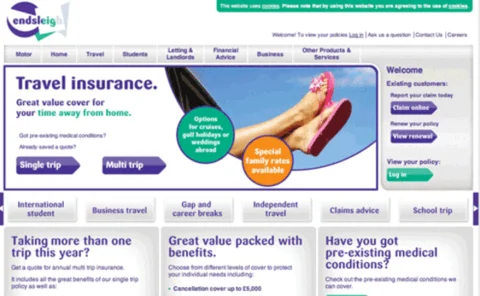

Website review: Endsleigh travel insurance site slow to land

Web performance specialist Gomez looks at Endsleigh’s travel website.

Road Traffic Act: Two-way traffic

Many motor insurers are in limbo because of uncertainty over the interpretation of a crucial section of the Road Traffic Act. However, a forthcoming Supreme Court judgment could provide much-needed clarity.

Legal Market: Joining forces

Mergers and acquisitions in legal markets show no sign of abating. But what is behind the desire to consolidate law firms, and what does it mean for the insurance industry?