Solvency II

Solvency delay poll result

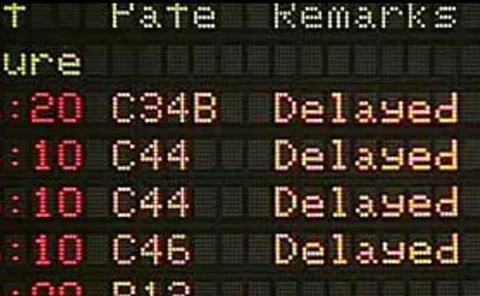

Is insurers' biggest concern the delays that are occurring in Solvency II?

Eiopa chairman warns against further Solvency II delays

Gabriel Bernardino has urged the European Commission, the Parliament and the Council to agree on a clear timetable for Solvency II implementation.

Acquisition-hungry Beazley still in profit

Lloyd’s insurer Beazley reported a profit of $62.7m, down 75%, despite catastrophe losses and said it had a war chest of more than $400m to buy Hardy, other Lloyd’s businesses or European insurers struggling with solvency II.

Eiopa chairman 'concerned' about Solvency II delays

Gabriel Bernardino, chairman of the European Insurance and Occupational Pensions Authority, has said in a letter to the European Commission what supervisors, industry and consumers would "benefit most from is certainty on the implementation of Solvency…

RSA job cuts not mark of wider trend says recruiter

Regulatory changes are likely to keep technical roles in-house, however, the number of support function redundancies are expected to rise as an industry-wide outsourcing trend continues in 2012.

View from the top: Expect the unexpected

The industry must continue to adapt and evolve to meet constant changes to the market, says Mark Hodges.

Solvency poll results

Will Solvency II cause captives to re domicile?

Fresh delay for Solvency II

Solvency II may not be implemented until 2015 – two years later than planned, according to a report in the Financial Times Deutschland.

Solvency II faces further delay

Solvency II may not be implemented until 2015 – two years later than planned, according to a report in the Financial Times Deutschland.

Mergers & Acquisitions: Bucking the trend

As the market weighs up the value of assets such as Groupama and Brit’s UK arms, deal making by insurers appears to be buoyant, especially when compared to other industry sectors. But is this a trend that is set to continue?

Solvency II run-off concerns still not met

The Solvency II exemption for run-off companies fails to meet the expectations of many in the industry, according to run-off specialist Ruxley Ventures.

News analysis: Groupama UK up for sale — but who will buy the group?

Will Groupama be sold lock, stock and barrel or broken into an insurer and its broker parts?

Broking - Mergers & acquisitions: Do not disturb

2011 was a relatively sleepy year for merger & acquisition activity in the broker sector. Could 2012 be a wake-up call or will the market stay snoozing?

Capital adequacy: Alternative finance

With Solvency II just 12 months away, and 2011 an unprecedented catastrophe year, how difficult will it be for insurers to attract equity or secure alternative funding?

Solvency II capital proposals bad for captives, says Fitch

The latest QIS5 Solvency II regulatory capital proposals could significantly increase the capital and compliance burden of the European captive market, according to a report by ratings agency Fitch.

Guernsey still top European domicile with 50% captive rise

The number of insurance licenses issued in Guernsey last year rose more than 50% compared to the previous 12 months.

Solvency II vote pushed back to spring

The European Parliamentary vote on Omnibus II has been delayed until the spring, Post understands.

Solvency II compliance challenges remain

European insurers have identified reliance on third parties for data, sophisticated risk modelling requirements and obtaining sufficiently detailed fund data among the challenges to be overcome in order for them to achieve Solvency II compliance.

Reliance on third parties for data Solvency II challenge

Reliance on third parties for data, sophisticated risk modelling requirements and obtaining sufficiently detailed fund data were top of a list of challenges identified by European insurers in order for them to meet Solvency II requirements.

Editor's comment: Battle of the brands

From scrap yards to scrap heaps. Last week, the industry was getting agitated about the soaring problem of metal theft, while this week it’s more a sad tale of two well-known insurance names finding themselves destined only for the brand graveyard.

Roundtable - Analytics: the true value of quality data

As investment in analytics increases, Post gathered a group of experts to debate the rise in the use of data in all areas of the insurance industry.

News analysis: Lloyd’s CEO Ward outlines diversity message with ambitious three-year plan

The start of every New Year is inevitably accompanied by the desire to deliver on resolutions made the month before — and Lloyd’s is no different.

Solvency II will drive UK M&A, Fitch predicts

Fitch Ratings expects Solvency II and low valuations to result in further merger and acquisition activity in the UK non-life insurance sector in 2012.

Ask the expert

Do you have any feel for what recruitment trends are likely to arise in 2012 within the insurance industry?