Solvency II

Moore Stephens hires ex Mazars insurance partner

International consultancy firm Moore Stephens has appointed Omar Ripon as partner in its insurance industry group.

UK expected to lead on Solvency II related disposals in 2015

The impact of the Solvency II directive has been attributed for an expected sixth year of growth in the European run-off market, according to PWC’s annual survey.

Solvency II capital requirements prove too onerous for Gibraltar‑based firms

Smaller motor insurers line up to leave market as EU capital‑raising measures loom

Aon launches simplified Solvency II calculation tool

Aon’s risk management business has developed a new tool to simplify the calculation of capital totals under Solvency II.

Demand for risk managers grows amid shifting regulatory environment

The looming implementation of Solvency II has contributed to a boom in demand for risk management specialists, according to recruitment consultancy Merje.

Small firms struggling to be ready for Solvency II despite repeated delays

Survey reveals dissatisfaction over directive’s perceived cost-benefit ratio

Only 6% of insurance execs believe Solvency II costs are ‘reasonable’

A survey conducted by Grant Thornton has revealed that only 6% of insurance industry executives described the costs associated with Solvency II are "reasonable".

Supervision, contract law reform and sanctions are top IUA concerns

Supervision by the Financial Conduct Authority and Prudential Regulation Authority, reform of UK insurance contract law and international trade sanctions are the top regulatory concerns for members of the London companies market.

International: Best Practices for EU Insurers Filing US ORSA Summary Reports

Kristi M Robles gives a few pointers on filing ORSA reports in different jurisdictions

Eiopa consults on Solvency II guidelines

The European Insurance and Occupational Pensions Authority is seeking responses to a consultation on the first set of guidelines for Solvency II legislation.

Europe: M&A activity set to pick up?

Edmund Tirbutt investigates what is behind the current decline in merger and acquisition activity on the Continent, and looks at what the future could hold for deals

Insurers urged to scrutinise 'far reaching' Solvency II guidelines

KPMG has called on insurers to scrutinise draft Solvency II guidelines published by the European Insurance and Occupational Pensions Authority yesterday as they are broader in scope than the first technical standards released.

Gibraltar recruits former FSA insurance director for Solvency II project

Gibraltar’s Financial Services Commission has swooped for a former UK insurance regulator to lead its Solvency II implementation project.

Singapore targets 2017 for RBC 2

The Monetary Authority of Singapore has set out a timetable for the improvement of its risk-based capital model for insurers.

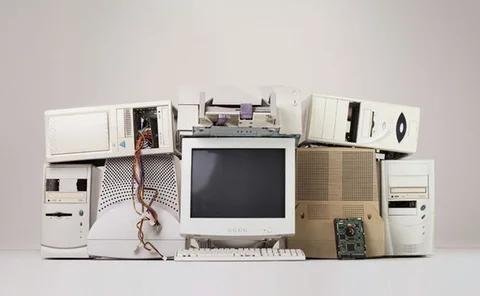

In Series: Legacy Systems: time for an upgrade

How can insurers running on outdated legacy systems prepare themselves for the host of new data demands set to be ushered in by Solvency II?

In Series: Legacy Systems: Breaking the cement shoes

With customer demand evolving faster than ever, insurers must break free from restrictive legacy systems

Geneva Association zeroing in on social value of insurance

The Geneva Association is conducting research on the social and economic value of insurance, according to its annual report.

Solvency II: It’s the final countdown

With a definitive date of 1 January 2016, Solvency II is finally set to be implemented – and insurers must make sure they are prepared

CMC launches global insurance consultancy

CMC Insurance, a global consultancy aiming to rival the big four in the insurance and reinsurance space, has been launched by the team behind banking consultancy CMC Europe.

C-Suite Europe: Insurers and banks - an important distinction

You will be familiar with the expression: "If it looks like a duck, swims like duck, and quacks like duck, it probably IS a duck."

Cross-border insurance: a new opportunity?

As prudential regulation across Europe is set to become unified with the planned implementation of Solvency II, Katie Marriner looks at how the likelihood of cross-border insurance becoming a reality is being considered.

UK among most SII ready but Pillar 3 presents 'major challenge'

Nearly 80% of European insurers expect to meet Solvency II requirements before January 2016 with Dutch, UK and Nordic firms outstripping their French, German, Greek and Eastern European counterparts in terms of readiness.

Market Moves - 3 April 2014

A round up of who has moved where in the market this week.