Politics

Finance Bill causes 'no major headaches' for insurers

Insurers are breathing a collective sigh of relief following the publication of today's Finance Bill, with firms expected to benefit from controlled foreign companies exemptions and unforeseen benefits for those looking to establish UK headquarters.

European Parliament wants EU-wide sanctions for cyber crime

Cyber attacks on IT systems will face criminal-law sanctions, according to a report by the Civil Liberties, Justice and Home Affairs Committee of the European Parliament released today.

Insurers gear up for Finance Bill detail in hope of simplified CFC process

This week's publication of the long-awaited Finance Bill could provide the catalyst for overseas investment, while also serving to safeguard the status quo of UK-headquartered insurance companies.

Post magazine - 29 March 2012

The latest issue of Post is now available to subscribers as a digital and interactive e-book.

ABI welcomes national planning framework recommendations

The Association of British Insurers has welcomed the government's national planning framework recommendation for local authorities to follow flood risk guidance to help avoid unwise developments in flood risk areas.

Philippines Insurance Commissioner promotes benefits of microinsurance

The Philippines Insurance Commissioner has urged members of the public to buy microinsurance to prepare for the future.

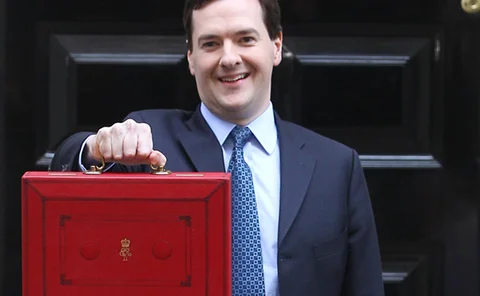

Budget 2012 Video: spotlight on insurance

Incisive Media editorial director James Gosling spoke to Jonathan Evans MP about the effect of the 2012 Budget on the insurance industry.

Chinese government tightens insurance supervision

Administrators at Chinese state-owned insurance companies have been brought under higher-level supervision owing to the promotion of senior industry figures.

Calls for telematics standardisation splits industry opinion

Rival firms raise question marks over Wunelli chairman Sandy Dunn's proposals

View from the top: Learning from our neighbours

As Italy takes a step towards combating motor fraud, can the UK follow suit?

Customer service: Brand reputation and the power of social media

Poor customer service in the social media age can be terrible for a firm's reputation, especially in the ultimate grudge purchase: motor insurance.

Budget 2012: Local authorities to receive support amid risk concerns

Zurich Municipal’s director of public services has played down fears of deteriorating risks within “overstretched” local authorities following claims that roads across the UK are in need of a £10bn upgrade.

Budget 2012: No nasty surprises for insurers as firms wait on Finance Bill

The insurance-specific measures announced in George Osborne's budget speech have been branded "wholly expected" by Deloitte insurance tax leader Anne Hamilton.

Budget 2012: Red tape reductions expected to enhance SME growth

Zurich SME boss Richard Coleman has praised the Chancellor's budget announcement concerning a consultation on how small business with turnover of up to £77 000 pay tax.

Analysts praise ECON vote on Solvency II

Industry experts have praised the European Parliament Economic and Monetary Affairs Committee decision to back a series of Solvency II amendments.

Budget 2012: More insurers to target UK move, claims PwC

The insurance implications of this afternoon's budget could result in an influx of international insurers moving to the UK over the coming 12 months, according to PwC insurance tax leader Colin Graham.

Budget 2012: ABI director general welcomes corporation tax cuts

The director general of the Association of British Insurers has "strongly welcomed" Chancellor George Osborne's promise to create a more competitive corporate tax regime in Britain by cutting corporation tax to 24%.

Axa index records consumer concerns over cost of motor cover

Axa personal lines boss Nick Turner believes last month's motor claims summit hosted by the Prime Minister has sparked "public consciousness" regarding the cost of cover and the perceived compensation culture.

Hong Kong insurance premiums grow 9% to $225.8bn

Hong Kong's insurance industry grew 9% in 2011, with total gross premiums reaching $225.8bn, according to the region's Office of the Commissioner of Insurance.

Lawyers respond to Sants' exit from the FSA

Mathew Rutter, regulatory partner at DAC Beachcroft, said that Hector Sants' departure from the Financial Services Authority at the end of June could not come "at a worse time" for regulated firms.

Sants set to quit FSA in June

The chief executive of the Financial Services Authority, Hector Sants, has announced his intention to leave the organisation at the end of June.

Apil issues justice warning despite Laspo bill exemptions

A decision by the House of Lords to exempt victims of industrial disease from the proposals for 'no-win, no-fee' in the Legal Aid, Sentencing and Punishment of Offenders Bill has been welcomed by the Association of Personal Injury Lawyers.