Motor - personal

Staveley Head administrators reveal £27.7m in claims

Unsecured creditors have submitted £27.68m in claims against motor broker and managing general agent Staveley Head Limited, far in excess of the £9.98m on the company’s books when Duff & Phelps were appointed as administrators in February 2020.

Sabre top line suffers as motor insurer pushes through 10% price increases in 2020

Sabre CEO Geoff Carter has defended the insurer’s falling profits and premiums, saying that pricing increases pursued throughout 2020 stand it in good stead to take advantage of growth opportunities going forwards.

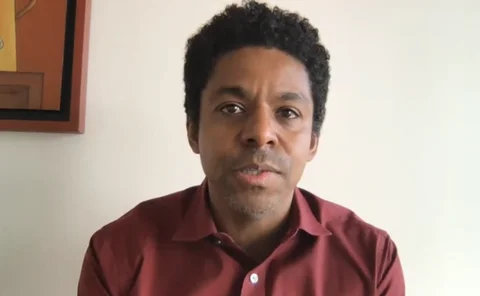

Brightside’s Brendan McCafferty on digital, scale and success

The Covid-19 crisis has turbo charged the market to make digital changes in months rather than years but there is still more to be done for brokers to stay relevant, says Brendan McCafferty, CEO of Brightside Group.

For the record: Wilson’s insurtech Abacai acquires Dayinsure; 250 job losses at BGL; GRS recruits Advanta team; and Howden acquires STA Group

Post wraps up the major insurance deals, launches, investments and strategic moves of the week not covered elsewhere on www.postonline.co.uk

IPO inevitable for 'reluctant unicorn' Zego: CEO Sten Saar

Zego, now valued at $1.1bn (£792m), has become the UK's first insurtech 'unicorn' with an initial public offering "inevitable" but not on the immediate horizon, the insurtech's CEO and co-founder Sten Saar told Post.

Esure CEO says PCWs remain key to ambition to be UK's pre-eminent digital insurer

Price comparison websites remain integral to Esure’s plans to be the UK’s “pre-eminent digital insurer” despite fears their market share could shrink after regulatory intervention, CEO David McMillan told Post.

Lockdown reins in 'Beast from the East Two' claims hit

At the beginning of February, national headlines warned of a ‘Beast from the East Two’ as snowy blizzards, heavy rain and gale-force winds were forecast to batter large parts of the country. But a repeat of the hefty claims dent left by its 2018 namesake…

Brightside buy first in a pipeline of deals, says Markerstudy's Humphreys

There will be no job losses from Markerstudy buying Brightside with the brand and Bristol office being kept, Gary Humphreys, group underwriting director at Markerstudy, told Post.

Covid curbs drive Admiral to record profits

Admiral has posted record pre-tax profits of £638m for 2020, reaping the benefit of fewer claims as a result of quieter roads during lockdown.

MIB bombarded with whiplash questions by confused and frustrated claims sector

The Motor Insurers' Bureau's first update on the whiplash portal since critical rules were released by the government was met with difficult questions and consternation from the claims sector.

Consumers put IPT almost bottom of the list for Budget tax rise targets

Exclusive research by Consumer Intelligence for Post has revealed that the UK public would support increases in almost any other tax ahead of insurance premium tax if the Chancellor opts to bring in rises to help pay for the costs of battling the Covid…

£77m Covid impact drives RSA UK loss

Scott Egan, RSA’s UK and international CEO, has said the division delivered a “strong” performance in 2020, despite the impact of Covid-19 bringing a halt to its return to profitability in the UK.

Briefing: Ex-Aviva CEO Mark Wilson's insurtech electric dreams

Mark Wilson might have not quite managed to turn Aviva into the 320 year old disruptor he had hoped, but Post content director Jonathan Swift reasons he might have more luck scratching that digital itch with his latest venture Abacai, even in a soft…

Fully Comp: Episode 13 - For all the hype, is there tangible evidence UBI, telematics and on-demand motor have seen lift off during the pandemic?

For the thirteenth episode of Post’s video series Fully Comp we gathered a group of experts together to consider if the Covid-19 pandemic has had any impact on the consumption of non-traditional annual motor insurance products.

FCA mulls timeline for dual pricing fix following consultation

The Financial Conduct Authority is reconsidering the implementation period for its dual pricing remedy proposals following consultation with the industry.

UK government plans to swerve EU Vnuk law

The British government is planning to avoid the European Union’s controversial Vnuk law, which requires compulsory insurance for vehicles including golf buggies and mobility scooters even on private land.

For the Record: BGL rolls out digital claims, Chubb backs Covid-19 cover, Covea in Vitality tie-up, insurtech funding hits £5.2bn and Tractable deals

Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Worsening outlook for UK non-life insurers, says Fitch

Fitch Ratings has a worsening outlook for the UK non-life company sector, Graham Coutts, senior director, head of EMEA reinsurance has confirmed with market combined ratios for motor and home likely to be above 100% in 2021.

Analysis: ERS goes commercial

Broker-only motor insurer ERS has the chance to make its mark in the commercial sector but will need to recruit well and target niche larger risks.

Tesco Bank switching to in-house underwriter for all home and motor insurance

Tesco Bank new and renewing home and motor policies will be underwritten by Tesco Underwriting from August, the business announced on Tuesday.

Blog: Whiplash portal may never live up to expectations but still time to prevent government IT disaster

The government needs to use the short delay to the Civil Liability Act wisely, says Matthew Maxwell Scott, executive director of the Association of Consumer Support Organisations.

Be Wiser’s David Russell on the FCA’s pricing review

David Russell, chief compliance officer at Be Wiser Insurance, was part of the Financial Services Authority team that brought in the Insurance Mediation Directive and statutory regulation of brokers. Here he looks at the implications of the Financial…

Briefing: Seven insurtechs to watch in 2021

For a sixth year running, Post content director Jonathan Swift scans the insurtech space and identifies up-and-coming businesses potentially worth watching over the next 12 months.

QBE’s Jon Dye on managing emerging risks in 2021

From trade tariffs on parts and whiplash reform, through to fraud, automatic lane keeping technology and connected vehicles, there is plenty for insurers to keep an eye on this year, says Jon Dye, director of motor at QBE.