Insurer

Driverless cars commitment and reinsurance backing prominent in 2015 Budget

Chancellor of the Exchequer George Osborne has pledged £100m to the development of driverless cars in a bid to make the UK "a centre of excellence" for the technology.

Development blamed for high disaster losses

Preliminary results of a catastrophe modelling study presented at the Third UN World Conference on Disaster Risk Reduction showed little prospect of reducing economic losses from present levels of $240bn (£163bn) per year.

Task force enlists ABI and Biba to update application fraud guidance

The Association of British Insurers and the British Insurance Brokers’ Association have agreed to update their guidance on the prevention of application fraud by the end of 2015 after being prompted by the government’s insurance fraud task force.

ABI study examines the behaviour of fraudsters

The Association of British Insurers has published research into what motivates insurance fraudsters.

Allianz launches PI product for e-trading platform

Allianz has launched a new e-traded professional indemnity product for the UK broker market.

Improved training not the only answer, claim motorcycle insurance firms

Enhanced basic training for motorcyclists is a step in the right direction, but other changes are needed to reduce the rising number of riders killed and seriously injured in Great Britain, according to specialist motor players.

Blog: A loss adjuster walks into a bar ... looking for a surge solution

Having a pint with a senior member of the loss adjusting fraternity recently, the thorny issue of surge response/management came up again.

Blog: Welcome to Mexico

It's not every day you get invited to the Mexican Ambassador's Official Residence in London. Rarer still when the event is held to praise a British insurance agency.

Blog: Client retention and counter fraud

Fraud management is a delicate balance. Insurers have to walk a fine line in order to keep fraud at bay and keep costs and renewal rates under control in order to retain their customer base, says VFM's Sally Griffiths

Local talent pools

How can insurers develop pools of talent in areas outside the capital, and how do tools such as Linked In and Skype facilitate this?

Ageas unveils small fleet policy

Ageas' specialist policy, Optima Small Fleet, has gone live through the company's extranet service.

Ex-ERS underwriting duo May and Hill move to Bluefin MGA

Bluefin’s newly launched managing general agent Bluefin Underwriting has appointed Jon May and Andy Hill as head of underwriting for specialist motor and head of underwriting for bike respectively.

Post magazine – 19 March 2015

The latest issue of Post Magazine is now available for Post subscribers. Download the latest Post iOS App Edition on the App Store or read the Post Digital Edition online.

FBI investigates insurer cyber attack

US intelligence service the FBI is investigating a hack attack on US health insurer Premera.

Editor's comment: Learning from the whizz kids

My six year-old is a whizz on the iPad and has been since he was four. While I carefully follow the instructions to the apps we download, he learns as he plays and instinctively works out when he needs to tap, tilt or shake the tablet.

Crawford's Muress thanks staff and clients as CMA signs off on GAB Robins deal

The Competition and Markets Authority has unconditionally cleared the acquisition of GAB Robins by Crawford and Company after concluding its review of the purchase ahead of schedule.

C-Suite: Risky business

Ace’s Toby Merrill outlines the risks of employees being allowed to access company data on their own devices.

Quindell still in talks over £640m business arm sale

Quindell has told the stock market that it is still involved in talks to sell its professional services arm, and has given details of a potential price of the deal for the first time.

Arson: No smoke without fire

While fire risk has dropped considerably over the past decade, almost half the £1bn paid out in fire claims each year is as a result of deliberate acts. So what can be done to reduce the losses caused by arson?

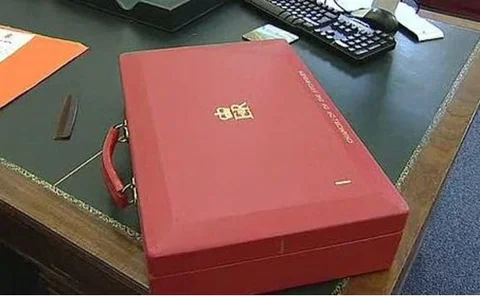

What issues top the GI industry's 2015 budget wish-list?

As Chancellor of the Exchequer George Osborne prepares to deliver his annual budget tomorrow (18 March), Post found out what the general insurance industry hopes to fin inside the famous old briefcase.

New Zealand Earthquakes: Kiwi crisis

New Zealand insurers were exposed to intense pressure following the devastating earthquakes in Canterbury in 2010 and 2011. Post investigates the lessons learned from these events for insurers in both New Zealand and the UK

Spotlight: Big data: Insurers must embrace the wider use of data

Insurers must embrace the wider use of data in order to interact with customers or risk being left behind

Spotlight: Big data, big opportunities

Imagine having access to a digital record of potential customers’ daily lives. The information is there – it’s just a question of how insurers can use it

Insurance Census - Age: Just a number?

Attracting the best young people into the insurance industry can be an uphill struggle. Coupled with an ageing population, is the sector encouraging diversity?