Insurer

Two join Towers Watson in Asia

Towers Watson has strengthened its private markets research resources in Asia with the appointment of Richard Tan and Agnes Lee to its Hong Kong office.

Penny Black’s insurance week

Globetrotting Penny was expecting to see many things on her recent holiday to Berlin — the Reichstag; the Brandenburg Gate and the Holocaust Memorial Museum — but what she was not expecting was a rather fancy-looking Allianz building right in the middle…

Your say: Work flow enhancements

I write in response to the article on WNS Assistance’s property service launch and just wanted to clarify the new technology invested in to deliver an innovative claims service for the insurer and broker market.

Your say: No underclass from telematics

I would like to take issue with Tom Woolgrove of RBS Insurance; telematics will not create an insurance underclass, as he fears. In fact it will do the opposite.

Editor's comment: Yet another call for action

How often do we hear that rallying cry for the insurance industry to up its lobbying credentials and persuade government to deliver change that will safeguard both citizens and businesses alike? All too often.

Hogarth’s Imperial exit sparked by ‘difference of opinion’

A “fundamental difference of opinion” in how Imperial Consultants should be run led to the departure of managing director Ian Hogarth to LAS Claims Management.

IFB seeks to double staff numbers with 25% increase in industry levy

The Insurance Fraud Bureau is to double its staff by increasing its industry funding levy income by 25% to £2.8m.

Ask the Expert

I’m starting to hear mutterings that a higher proportion of my staff than usual could be considering a move elsewhere. We’ve always had a great retention policy so this surprises me. Is this being witnessed by the industry as a whole?

Market moves - 20 October 2011

This week the main movers and shakers were loss adjusters, with Davies, Woodgate & Clark and Advanta all making major appointments.

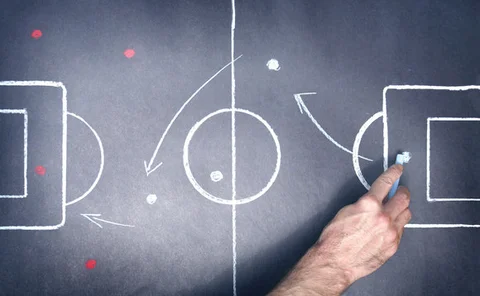

My best 11 Paul Muir, One Answer Network

One Answer Network managing director, and possible Crystal Palace fan, Paul Muir selects this week’s Best XI for a potential insurance start-up firm. Muir has chosen a blend of underwriters and brokers as well as football icon David Beckham to skipper…

Claims event: PI lawyers unmoved as insurers call for legal claims costs reduction

Personal injury lawyers refused to bend to insurance industry demands for the cost of processing legal claims to be reduced, following the imminent abolition of referral fees, in a heated panel debate.

Claims event: Record unemployment could boost interest in industry

The UK’s record level of unemployment could provide a recruitment opportunity for the insurance claims sector, Aviva technical claims manager Tim Andrews suggested.

Claims event: Seddon: social media use is ‘bonkers’

Using social media in claims handling is “bonkers” and companies risk “shooting themselves in the foot” if they embrace Facebook and Twitter, the insurance industry has been warned.

Claims event: ABI urges ‘shared responsibility’ for flood cover

Homeowners living in high flood risk areas could potentially see their insurance part-covered by government subsidies after the Statement of Principles agreement expires.

Claims event: Straw blasts 'made-up' whiplash injuries

Former Justice Secretary Jack Straw, pictured, has backed Ken Clarke’s proposals to make the payment of referral fees a criminal offence, while also branding whiplash a “made-up injury”.

News analysis: Call for mandatory sprinkler systems reignited by Dunelm Mill fire

On 6 October 2011, local fire fighters lamented the absence of sprinklers in a Dunelm Mill store that suffered a major blaze on the Orchard Retail Park in Willenhall, Coventry.

View from the top: Diversity dilemma

Better gender diversity will boost the industry's understanding of cultural, social and economic issues, says Nicolas Aubert, managing director, Chartis Insurance UK.

Broker report reveals Aviva, Chartis and RSA drop in underwriting service

Insurers must do more to boost satisfaction among brokers, according to a Brokerbility survey that suggested Axa is currently the only firm performing above the 80% approval benchmark.

Cyber liability: Getting hacked off

Back in 1983, when Hollywood produced a film about a young boy inadvertently hacking into military systems, the possibility of such an occurrence seemed the stuff of fantasy and doom-mongers.

Fraud occupancy: Occupational hazard

With a decrease in the number of mortgages being approved by lenders, insurers must be alive to a potential rise in occupancy fraud by those looking to buy-to-let.

Risk modelling - Riots: Out of control

The recent riots across England emphasised the destruction such uprisings can inflict. But why do riots start and can their triggers be predicted and planned for?

Climate change: A changing environment

With insurers rushing to provide environmental cover, how are they performing themselves in the climate change stakes?

In series: Lloyd's & London Market: Staying number one

Tightening regulation and a less advantageous tax regime are making it tough for Lloyd’s to retain its pre-eminence, but is protectionism the greater threat?

MIB pledges support to police in uninsured drivers sting

Motor Insurance Bureau bosses have praised a Metropolitan Police operation designed to clamp down on uninsured drivers by seizing hundreds of cars in the capital.