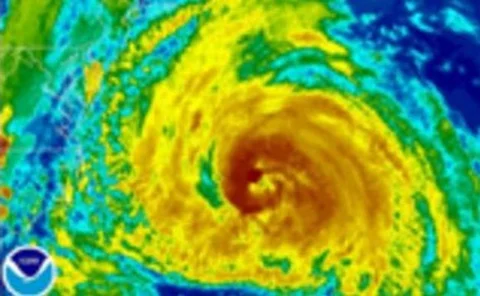

Hurricanes

View from the top: A very bad year

Despite reinsurers' initial talk that the Australian floods and the New Zealand & Japanese earthquakes were earnings — not balance sheet — events, and there would be no impact on rates, the chatter has changed recently, with some now actively hinting at…

Reinsurer cat budgets exhausted after Q1

Reinsurers' annual budgets have been exhausted after the major natural catastrophe losses in the first quarter were followed by 150 tornadoes hitting 13 south-eastern US states last month. According to Dominic Simpson, vice president, senior credit…

Aviva boss: earthquake will not impact GI rates

Global general insurance rates will not be dramatically affected by Japan's earthquake and tsunami, according to Aviva's chief underwriting officer.

Swiss Re exceeds claims budget following Japan quake

Reinsurer Swiss Re has revealed that it has already gone beyond its claims estimates for 2011 following the Japanese earthquake.

Chilean earthquake – insurance lessons learnt one year on

Lessons learnt from the massive earthquake that struck Chile 12 months ago should facilitate the future handling of complex business interruption claims, says Jenny Larner.

Claims Club news: Extra capacity demands place pressure on loss adjusters

The big freeze over the winter of 2010/2011 is the latest event to raise the issue of how loss adjusters and other service providers find extra capacity to meet insurer and policyholder demands.

In series - Geography & Solvency II: Accurate data is key to Solvency II requirements

The need for more accurate data and improved infrastructure is occupying insurers' Solvency II teams. However, Sam Barrett finds that UK firms are well prepared when it comes to accuracy of information.

Natural catastrophes: A model example of assessing earthquake exposure

Earthquake costs are rising steadily. Jane Bernstein examines insurers' current use of modelling, recent event responses and solution sustainability.

$50bn loss needed for reinsurance rates to rise, Flagstone Re chief warns

Reinsurance renewal pricing was down by eight per cent in the US, according to Gary Prestia, Flagstone Re’s chief underwriting officer for North America.

Risk modelling - Underwriter responsibility: Model behaviour

Models have quickly become a valued tool for underwriters. Matthew Washington examines how the advent of Solvency II could really make them fly.

Flagstone Re and RMS in $210m placing

Flagstone Reassurance Suisse SA and Risk Management Solutions have confirmed the successful placement of $210m of multi-peril Montana Re 2010-1 Notes, the second offering sponsored through the Montana Re shelf program.

Flagstone Re and RMS in $210m placing

Flagstone Reassurance Suisse SA and Risk Management Solutions have confirmed the successful placement of $210m of multi-peril Montana Re 2010-1 Notes, the second offering sponsored through the Montana Re shelf program.

Earthquakes top reinsurance losses in 2010 according to Guy Carpenter

The earthquakes that devastated parts of Chile and New Zealand were the largest source of losses in 2010, costing the reinsurance industry $8bn (£5.07bn) and $4bn respectively, according to a new report by Guy Carpenter & Company.

Earthquakes top reinsurance losses in 2010 according to Guy Carpenter

The earthquakes that devastated parts of Chile and New Zealand were the largest source of losses in 2010, costing the reinsurance industry $8bn (£5.07bn) and $4bn respectively, according to a new report by Guy Carpenter & Company.

Aon Benfield annual cat report reveals $38bn loss for (re)insurers in 2010

Aon Benfield, the global reinsurance intermediary and capital advisor of Aon Corporation, has released its Annual Global Climate and Catastrophe Report, which reviews the natural disaster perils that occurred worldwide during 2010.

Aon Benfield annual cat report reveals $38bn loss for (re)insurers in 2010

Aon Benfield, the global reinsurance intermediary and capital advisor of Aon Corporation, has released its Annual Global Climate and Catastrophe Report, which reviews the natural disaster perils that occurred worldwide during 2010.

Lloyd’s & London market – review of the year: Troubled times

A succession of natural catastrophes got 2010 off to a bad start and the market continued to struggle - but the resolution of Brit’s future and the prospect of consolidation could see the year end on a high. Mairi Macdonald reports.

Scor places €75m catastrophe bond

Global reinsurer Scor has placed a catastrophe bond worth €75m (£62.9m) to protect against European windstorms and Japanese earthquakes.

RMS: 2010 saw second most hurricanes since 1851

The 2010 Atlantic Hurricane season, which officially ended on 30 November, had the second highest number of hurricanes since records began in 1851, according to analysis by Risk Management Solutions.

Lloyd’s research winner aims to predict future hurricanes

New research that aims to predict hurricane activity years in advance has won a forecasting specialist from the Met Office, the inaugural Lloyd’s Science of Risk prize.

Lloyd's results show first half year profit halved to £628m

Lloyd’s this morning reported that its half year profit before tax had fallen significantly to £628m (June 2009 £1.32 bn) in 2010.

Monte Carlo preview - Destination: Monaco

Reinsurers viewing customers as commodities - Barbican.

Aon Benfield ILS benchmarker

Aon Benfield Securities has launched an insurance-linked securities (ILS) benchmarking tool, Aon Benfield ILS Indices, which provides a quantitative view of ILS returns since December 2000.

Q2 cat bond issuance surge

Guy Carpenter has announced the completion of eight catastrophe bond transactions, totaling $2.05bn of risk capital as investor appetite remains strong.