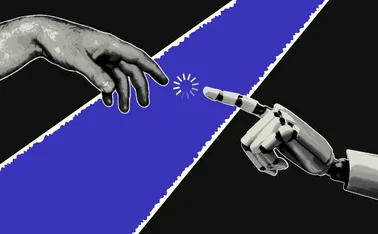

Editor's Comment: What would AI make of insurance?

At a recent Claims Club meeting I was introduced to IBM’s Watson, an artificial intelligence technology platform that uses natural language processing and machine learning to reveal insights from large amounts of unstructured data, and it got me thinking.

Watson has been developed to access millions of data sources to correlate relevant information very rapidly but it is also able to learn. In 2011, Watson took on contestants at the US TV show Jeopardy and during the course of the recording not only learnt the format – that the answers were actually questions – but also beat the show’s best ever contestants using reasoning.

Earlier this year Watson added to its skills set softer skills by editing a cognitive movie trailer for a Morgan.

The concept of an AI system is no stranger to the world of films. Since 1984 we’ve been aware of Skynet in Terminator and more recently actor Will Smith battled VIKI in I, Robot. But today we are now learning about its benefits in the real world, with Watson being used to help in oncology and to predict crime.

Insurers are already dealing with the issue of Big Data, the distribution ledger blockchain is hovering on the horizon and automated systems are commonplace in the motor manufacturing world. So what of AI?

Last year, Swiss Re started using Watson to develop underwriting solutions so surely it won't be long before machine learning is common in the UK insurance sector.

The idea of a human-error free system and the end to the ‘computer says no’ scripts will be welcome by many but I can’t help but wonder what Watson, Skynet and VIKI would make of the insurance world.

For Skynet to continue its mandate of “safeguarding the world” it launched attacks to stop humans destroying it and VIKI almost succeeded in enslaving humans, as she concluded they have embarked on a course that can only lead to their extinction. With insurance an arrangement by which a company provides a guarantee of compensation for specified loss, damage, illness, or death in return for payment of a specified premium, surely the logical conclusion would be to remove humans from all those risks.

In a recent interview with CNN's Fareed Zakaria, IBM CEO Ginni Rometty's view on the threat posed by machines like Watson is: “You and I will always be in charge. For the foreseeable future, we do believe that.” Do you think she included insurance in that future view?

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: https://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk