Reinsurance

GRF marks a year of progress

The Global Reinsurance Forum is a body of the world's largest reinsurers formed to respond to international policy and regulatory issues. Reinsurance reports on its latest activity.

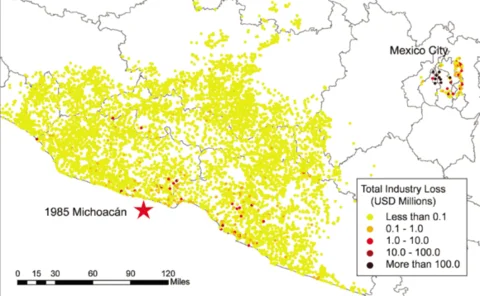

Country report: Mexico - An impact felt 25 years later

Though lessons have been learned since the Michoac√°n earthquake, many buildings in Mexico City remain at great risk, write Tao Lai, Khoshrow Shabestari and Vineet Katiyar.

Exposure management: Forewarned is forearmed

Suki Basi argues that further market transparency is necessary in order to deliver improved exposure management

Talent: Mind the gap

Gordon Vater highlights the need for (re)insurance to beware of a looming recruitment crisis as experienced industry personnel edge toward retirement and graduates stampede towards better-known areas in financial services.

Arbitration use rising

Global corporations are becoming increasingly sophisticated in their understanding and use of arbitration, according to Professor Loukas Mistelis, director of the School of International Arbitration at Queen Mary University London.

S&P upgrades Swiss Re outlook to 'positive'

Standard & Poor's (S&P) has affirmed Swiss Re's A+ rating in a statement, adding that the company had "demonstrated very strong resilience and recovery in its credit profile and, in our view, further de-risking should result in strong and more stable…

Run-off liabilities down

KPMG's annual run-off survey of UK non-life insurance shows that liabilities have shrunk by 21%.

Bermuda politics: Under starter's orders: Bermuda's leadership race

The confrontational bombast of Bermudan premier Ewart Brown is shortly to come to an end, much to the relief of international business on the island. Matthew Taylor reviews the candidates to succeed him.

Global business, hidden danger

The US and EU have new trade sanctions against Iran. (Re)insurers must be aware of both sets of regulations as well as potential for supra-national jurisdiction, argue Jamie Rogers and Pieter van Tol.

Everest's Taranto extends stay at summit

Joseph Taranto is to reconsider his decision to retire and to remain as chairman and chief executive officer at Everest until the December 2012 in the wake of the resignation of Ralph Jones, president and chief operating officer.

Talent: Shooting stars

Reinsurance uncovers the reasons behind the successes of some of the industry's brightest young things.

Monte Carlo roundtable: State of play

Mairi Mallon leads proceedings at the annual PricewaterhouseCoopers-sponsored Reinsurance roundtable at the Monte Carlo Rendezvous, where industry experts gathered to talk about the industry's hot topics.

Viewpoint: The Hitchhiker's Guide to Solvency II

Solvency II is looming large on the horizon but, argue Henry Sopher and Ann Duffy, despite the guidelines' complex language and detailed instructions, the run-off market can make it through this new universe by simply applying sound business sense and…

Liberty adds agriculture and weather lines

Liberty Syndicates Management is entering the agricultural and weather reinsurance market by hiring a team of specialist underwriters.

Exposure management in action - Munich Re

In 2009, Munich Re - which pursues an integrated business model consisting of both primary insurance and reinsurance - achieved a profit of €2.56bn on premium income of around €41bn. It operates in all lines of insurance, with around 47,000 employees…

EC sets out plan to raise billions through financial sector tax

The European Commission has set out its ideas for the future taxation of the financial sector.

EC sets out plan to raise billions through financial sector tax

The European Commission has set out its ideas for the future taxation of the financial sector.

SII to drive M&A in run-off sector

KPMG’s annual run-off survey of UK non-life insurance, has shown that liabilities have shrunk by 21%.

Amlin gets greenlight for Swiss redomicile

Amlin has today completed the change in the corporate domicile of its wholly-owned subsidiary Amlin Bermuda from Bermuda to Switzerland.

SII to drive M&A in run-off sector

KPMG’s annual run-off survey of UK non-life insurance, has shown that liabilities have shrunk by 21%.

Amlin gets greenlight for Swiss redomicile

Amlin has today completed the change in the corporate domicile of its wholly-owned subsidiary Amlin Bermuda from Bermuda to Switzerland.

German government gives local insurers a tax break

The German insurance trade association GDV has welcomed a move by the government to tweak its new tax regime.

LMA warns of over-regulation of Lloyd's

The Lloyd’s Market Association has warned the proposed regulatory system for the UK is being created around the banks which will make it over-engineered, unsuitable and unjustifiably costly for the general insurance industry.