United States of America (USA)

Solvency II action remains vital despite delay proposal

Firms have been urged to continue working towards the 1 January 2013 implementation deadline for Solvency II, despite the European Parliament announcement that the regime should be delayed until 2014.

Editor's comment: The wheels of industry

The schools may be out for summer and European business fast grinding to a halt as workers decamp to the coast but it's good to see the wheels of British commerce continue to turn, albeit at a rather less than frenetic pace.

Lloyd’s receives reduced collateral approval in NY

Lloyd’s has received approval from the New York Insurance Department to post reduced collateral on reinsurance contracts.

Prominent insurance leaders to join IIS board of directors

Eight insurance leaders will join the board of directors at the International Insurance Society, effective 1 August.

Danish government asks TRIA broker to review local terrorism capacity

US RE, the international reinsurance broker, has been selected by Finanstilsynet, the Danish Insurance Supervisory Authority, to conduct a study of terrorism risk reinsurance capacity in the Danish market.

US legislative changes offer opportunities for London Market

Legislative changes in the US could present “significant” business opportunities for London market companies, according to the International Underwriting Association.

Scheffel replaces Berger as Allianz corporate boss in London

Allianz Global Corporate & Specialty has confirmed new CEOs from within its existing management team for two of its most important regions with effect from October.

Brit appoints property treaty head

Brit Insurance has appointed Jon Sullivan head of property treaty reinsurance. He is expected to take up the role in the autumn.

Amlin sees international cat renewal rates rise by 50%

Lloyd's insurer Amlin estimates net claims from the two major US tornadoes during April and May 2011 of approximately $50m.

Interview - Rob Brown: The best job in the market

Despite being one to shun the limelight, Rob Brown, chief executive of Aon UK, has no qualms about answering his critics over the firm's carrier charge and contingent commissions, admitting he is pleased with progress to date. Daniel Dunkley reports.

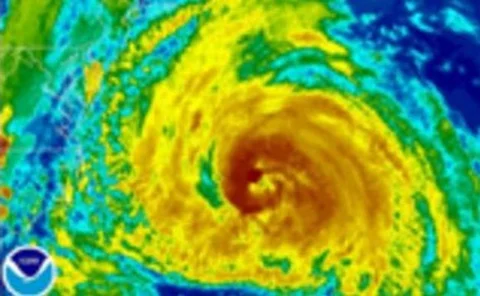

Property cat rates rise after global losses

US property catastrophe rates have increased due to global losses and new versions of catastrophe models. However, the reinsurance sector's capital position remains dependent on the hurricane season.

Chaucer takeover completed

Chaucer has confirmed its takeover by US-based The Hanover Insurance Group has been completed.

Flagstone: US reinsurance rates rise 10%

North American reinsurance renewals have increased by an average of 10%, according to Flagstone Re.

US tornadoes cost Hiscox £35m

Hiscox has estimated net claims arising from the April and May tornadoes in the US to be approximately £35m based on insured market losses of $15bn-$25bn.

Lockton announces Memphis expansion

Bosses at Lockton are planning a recruitment drive after deciding to open a Memphis-based risk management and employee benefits operation.

Severe weather costs Zurich $295m

Zurich has estimated claims caused by the severe weather-related events that hit the US in April and May to be approximately $295m for both Zurich North America and Farmers Re.

Bloodstock - Market Update: Dark horse

With race lovers flocking to Royal Ascot this week, Jane Bernstein reports on a bloodstock insurance market still hampered by soft rates and self-insurance.

Ex-Guy Carp MD joins BMS board

Former Guy Carpenter managing director Philip Campbell has joined BMS as executive vice president of its US-based operations and a member of its US strategy board.

Transatlantic and Allied World in $8.5bn merger

Transatlantic Holdings and Allied World Assurance Company have confirmed the signing of a definitive merger agreement.

Ascot appoints John Karns

Ascot Underwriting has appointed Mr Karns as an underwriter for Ascot Underwriting in Houston.

Xchanging disposes of US asset

Outsourcing firm Xchanging has sold its US Cambridge workers' compensation operation for $22.7m as part of plans to restructure its business.

Auclair Re expands practice with new hire

Auclair Re International has expanded its reinsurance practice with the addition of Rory Young as senior vice president, life accident & health.

Transatlantic to launch UK personal lines brand

Transatlantic Re is set to launch a new UK personal lines general insurance venture, as the US giant looks to capitalise on hardening premium rates in the motor market.

Editor's comment: Still after a piece of the motor market action

Despite the horrendous combined operating ratios and losses that have piled up in the UK personal lines motor market in recent years, it still holds a fascination for many.