Personal

Transactor ramps up claims management software

Insurance software provider Transactor Global Solutions has unveiled a number of new features to its claims management software having completed a review and rewrite of the product.

IAG sheds $300m assets ahead of potential UK business sale

Insurance Australia Group has written off AUD$297m (£196.6m) remaining goodwill and intangible assets associated with the UK business just months before it decides whether to sell its loss-making divisions.

Ecclesiastical CEO upbeat despite significant H1 underwriting losses

Ecclesiastical chief executive Michael Tripp has blamed “turbulent times” after his group chalked up a first half underwriting loss of £14.4m (H1 2011 £6m).

Claims management companies come in for regulatory consultation

Verbal contract agreements between claims management companies and consumers could become a thing of the past, following the launch of a consultation process by the Claims Management Regulator.

Brokers told to up game in face of HNW competition

Intermediaries operating in the high net worth arena have been warned they must concentrate on improving their bespoke offering to clients if they are to win out over growing competition in the high-end home insurance market.

Suncorp GI profit up 26% despite cat loss

Suncorp has reported a significant year-on-year growth in net profit after tax of $724m (£478.7m)for the year to 30 June 2012 compared to $453m in 2011.

Junction hires ex AA ecommerce boss Queen

Junction has appointed the former head of ecommerce at The AA Jamie Queen to the role of associate director on the BGL Group’s affinity arm.

Aviva recruits former Bupa fraud boss amid uncertainty over senior jobs

Aviva has appointed Anne Green to the newly created role of head of fraud for underwriting, pricing and product.

Historical hurricane costs upwards of $10bn in 2012, claim cat experts

Experts have stated that 28 out of almost 180 hurricanes that have occurred in the United States since 1990 would have caused $10bn (£6.3bn) or more in insured losses had they happened today.

Chinese car insurance market faces further losses

Insurers operating in China's compulsory motor insurance market face further significant underwriting losses in the next two years due to rising claims, tightly regulated pricing and the potential for further competition.

Millionth uninsured vehicle seized by police

The UK's millionth uninsured vehicle is set to be seized this morning by police in the West Midlands.

Groupama to underwrite 10 000 free home insurance policies

Groupama is underwriting 10 000 home insurance policies for residents of a south east England housing association.

BGL employee engagement smashes targets

BGL Group’s most recent staff survey is said to have exceeded the target set for employee engagement, with 88% stating they felt part of a team.

Saga bolsters home insurance product to cover students

Specialist insurer Saga has unveiled a new add-on product whereby policyholder parents can extend their home insurance to cover their children’s assets, saving almost £100.

Rias: Travel cover a must for families

Rias has reminded grandparents to take out adequate insurance when travelling abroad with their grandchildren.

Open GI boosts protection against credit card fraud

IT solutions provider Open GI has enhanced its card payment solution, CreditLine Plus, to incorporate additional fraud prevention measures to validate card details and verify the cardholder’s billing address.

Schemes deal sealed between Arc Legal and new OIM Underwriting division

Arc Legal has reached an agreement on two legal expenses schemes with the new division of OIM Underwriting ‘e-Underwriting’ to provide cover as part of its household and property owners portfolios.

Aon Benfield and Ambiental join forces on flood mapping

Aon Benfield has teamed up with Ambiental to enhance the firm’s flood model development capabilities.

Sutton Winson recruits ex-Towergate account director

Insurance broker Sutton Winson has appointed Steve Barber, pictured, to commercial client account executive, based in Burgess Hill.

Niche broker Campton to tap into Auto Trader site via Wanna Insure deal

Campton Insurance Brokers expects to have access to around 10 000 motorhome quotes per month following a deal with software firm Wanna Insure, which enables integration with Auto Trader’s price comparison website.

Welsh police crackdown on metal theft

Police in Gwent have arrested 862 people in connection with metal theft offences in the past 16 months- as the ongoing countrywide effort to crack down on the crime gathers pace.

Amlin adds experienced non-executive director to its ranks

Amlin has appointed Shonaid Jemmett-Page, former chief operating officer of the UK government's CDC development finance institution, as a non-executive director.

Argent hands ex-Willis manager Scott business development role

Argent, a division of the Parabis Group, has recruited former global vacant property specialists VPS boss Chris Scott to the role of business development director.

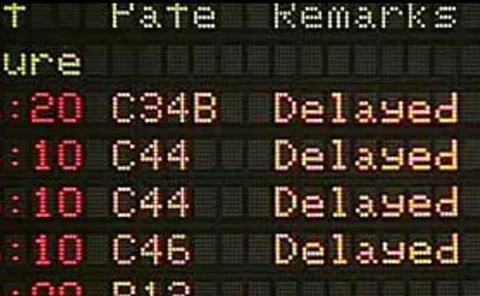

Travel claims double in China with flight delays main culprit

Flight delays are the main reason for claiming on travel insurance policies in China.