News

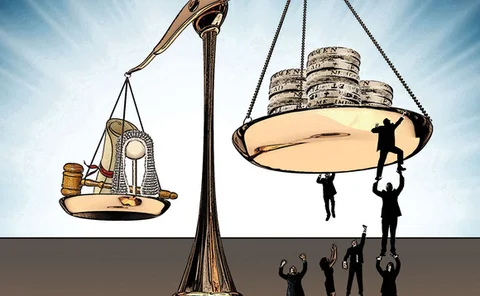

Claims Club: Senior NHS member blames claimant solicitors for hike in negligence cases

Heightened interest from claimant solicitors rather than a decline in standards is behind the significant rise in clinical negligence claims lodged against the National Health Service over the past three years.

Market Moves: Markel, Axa and Argo head the recruitment trail

Insurers hit the recruitment trail hard last week after recent broking dominance, with notable hires at Markel, Axa and Argo. It was a quieter few days for those on the periphery of the industry, although some of the slack was inevitably picked up by the…

Expertise-in-Action: Video: The importance of data validation

With data validation increasing in importance, Post sat down with Zurich’s director of personal lines, pricing and underwriting Darren McCauley to discuss this trend.

Lloyd's urged to lead the way in reputational risk cover

Lloyd's is uniquely placed to break new ground by insuring big firms’ reputational risk, according to a cyber liability panel.

MoJ sets RTA fixed costs at £500

The Ministry of Justice has confirmed that revised fixed recoverable costs for the Road Traffic Accident scheme will start at £500.

Solvency II delay is "golden oppurtunity" to solve run-off issues

The delay in the implementation of Solvency II offers insurers a golden opportunity to deal with their outstanding run-off and US APH liabilities, according to Ruxley Ventures.

Insurers to benefit from public sector framework worth £850m

A national framework agreement, potentially worth £850m over four years to the insurance sector, has been announced by the Government Procurement Service and national procurement consortium, the Pro 5 Group.

Wood will continue to hold 'vested interest' in Esure after IPO

Peter Wood is expected to remain Esure’s largest single shareholder by holding in excess of 30% of the shares following its planned float on the London Stock Exchange.

Biba raises regulatory concerns in budget submission

The British Insurance Brokers Association has asked the government for “a more dynamic regulatory regime in place that recognises the impact of regulation on our sector.”

US Risk targeting Lloyd’s brokers for marine, energy growth

US Risk chief executive Randall Goss has told Post he currently in talks to buy three Lloyd’s brokers.

Towergate sells Power Place to Open GI

Open GI has acquired Power Place from Towergate for an undisclosed sum, in a deal which will see 48 staff – including chief executive Nick Giddings – move across to the software provider.

Brit has "natural opportunity" to grow top line as it eyes new markets

Brit group chief executive Mark Cloutier said the insurer is likely to see top line growth in 2013 having repositioned the business to "opportunistically" target profitable specialist lines business.

Bluefin committed to motor after 2012 travails

Axa-owned broker Bluefin has said it remains dedicated to its motor business, despite noting that repricing its motor book had contributed to dipping revenue for 2012.

Lockton recommends reservation of rights clause

Broker Lockton has told its clients to add a clause to their insurance contracts to help counteract negative effects of the reservation of rights by insurers.

Insurers must embrace mobile to bring "dramatic change" in acquisition ratios

As acquisition costs remain high insurers must invest in mobile and social media channels to keep and capture new customers, according to Capgemini’s World Insurance report.

Markel and Alterra shareholders give green light to acquisition

The Markel acquisition of Alterra Capital Holdings has been given the go-ahead by shareholders at both firms following a vote.

Independent midwives seek cover ahead of legislation

An organisation representing independent midwives is in discussions with a broker over plans to secure affordable professional indemnity insurance, ahead of the launch of new legislation.

Bluefin Ebitda increases 27.5%

Bluefin Insurance has reported a 27.5% rise in Ebitda to £22.7m (2011: £17.8m) and a 54.3% pre-tax profit of £17.9m (2011: £11.6m).

PI law firm to expand after securing equity

A Scottish personal injury legal firm has received a "six-figure" loan from Clydesdale Bank with the view of doubling its office space.

Aviva to sell Russian life business for €35m

Aviva is selling its Russian life and pensions operation to Blagosostoyanie, a non-state pension fund in Russia, for a consideration of €35m (£30.17m).

Brit Insurance unveils Chinese intentions as post tax profit rises to £84.7m

Lloyd's insurer Brit has today announced it has developed "prudent options" to assess growth potential in China, to grow its specialty underwriting business "cautiously and profitably".

Aviva sells Russian life and pensions business to state insurer

Aviva today announced the sale of Aviva Russia to Blagosostoyanie, a non-state pension fund in Russia, for a consideration of €35m.

Esure confirms IPO intention as improved COR of 92.8% is chalked up

Esure chairman Peter Wood has this morning confirmed the intention of his firm to proceed with an initial public offering.

Brit COR improves to 93.2% in 2012

Brit has produced an operating profit of £113.6m for the full year 2012 (2011 restated: £68.4m) and an impoved combined ratio of 93.2% (2011 restated: 99.6%).