News

Root taps into UK’s embedded insurance fervour

South African distribution platform Root is seeking to establish a “strong foundation” in the UK, following a fresh cash injection from one of its seed funders.

Allianz and Intact pondering Aviva takeover, reports claim

The Times has reported that "market chatter" has suggested Allianz and RSA owner Intact, are considering lining up a bid to buy Aviva.

Percayso tackling fraud for CHO; LMA’s Blueprint Two playbook; Jensten appoints M&A director

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

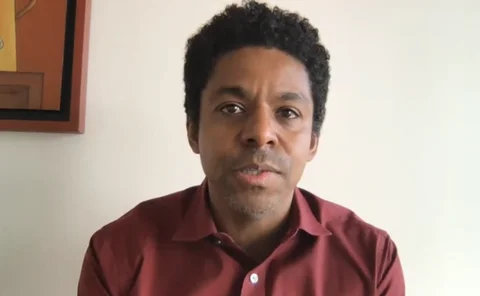

Allianz's Graham Gibson, Aviva, NFU and Zurich among winners at 2023 Claims & Fraud Awards

Allianz chief claims officer Graham Gibson, pictured, won the prestigious Achievement Award at the Insurance Post Claims and Fraud Awards yesterday evening (5 October) at The Brewery.

Aviva teams up with Swiss start-up to tackle AI risks

Aviva and Calvin Risk have collaborated in a move the Swiss start-ups bosses claim will "make artificial intelligence safe, transparent and trustworthy for the insurance industry."

Motor and home premiums at ‘peak of the pricing cycle’

Figures released by Pearson Ham have revealed that home and motor premiums have further increased in the third quarter, as we reach ‘the peak of the pricing cycle’.

PRA plans to supervise insurance branches post-Brexit

The Prudential Regulation Authority has set out how it will assess and supervise insurers based overseas with branches operating in the UK.

Gender inequality is leading to a global ‘economic and social catastrophe’

During a Dive In Festival event, industry leaders shared how ‘gender allyship’ is the missing ingredient for gender equity.

FCA rules out banning broker commission

The Financial Conduct Authority has ruled out banning broker commission, despite being concerned by “high” 62% charges for arranging cladding insurance.

Regulator monitoring motor insurance premiums

The Financial Conduct Authority is “monitoring” motor insurance prices amid skyrocketing premiums.

FCA promises action against overcharging brokers

The Financial Conduct Authority has warned brokers it will “take action” against those charging inflated commissions for arranging cladding cover, with some charging up to 62%.

Insurance Post’s Top 75 MGAs revealed

Markerstudy and Policy Expert have been the named the country’s two biggest MGAs after achieving revenues of between £80m and £100m for UK-based non-life risks in 2022.

PRA to undertake general insurance stress test in 2025

In a statement released today, the Prudential Regulation Authority has revealed its intention to run a “dynamic general insurance stress test” some time in 2025.

Gallagher Re warns of climate litigation risk to liability books

Liability insurers must take of the rising tide of climate litigation, which could present a massive – albeit uncertain – exposure to multiple portfolios, Gallagher Re has warned.

Top five steps insurers can take to be disability confident

Collecting data, avoiding non-inclusive terms, and remaining authentic were some of the key actions given to insurers at the Dive In Festival, as the sector was urged to become disability confident.

More women are being urged to consider a career in cyber insurance

Members from Aon’s Women in Cyber network joined with cyber professionals at Dive In Festival to discuss the importance of diverse thinking, and gender diversity, in creating a successful cyber team.

John Lewis halts offering EV cover amid repair cost concerns

John Lewis has "temporarily paused offering new policies and renewals on fully electric vehicles", citing repair cost concerns.

Confiscation order gives serial fraudster three months to pay back £210,000

A court has granted a confiscation order against a man who was jailed in 2021 following 62 fraudulent insurance claims, ordering him to pay £210,000.

Aon unveils operational risks solution; Admiral launches PI policy; Clear inks another deal

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

FCA to hit brokers with fresh leasehold insurance reforms from 2024

The Financial Conduct Authority has issued a wave of reforms around leasehold buildings insurance, coming into force in the new year.

How allies helped insurance’s LGBTQ+ community

During a Dive In Festival event, LGBTQ+ community members explained the impact allies who “show up” and don’t “shy away” from important conversations have had on the insurance industry.

Property claim times to benefit from migrant construction worker influx

The government’s decision to relax the rules for construction workers to enter the UK from abroad, should increase the pool of skilled workers available for property repairs, said Verisk’s head of property Ben Blain, following the release of Verisk’s…

Insurance must ‘level the playing field’ and accept more diverse ideas

Industry experts have challenged what diversity really means and how creating diverse teams reduces the risks of “blind spots” at this year’s Dive In Festival.

Lloyd’s captive pipeline ‘strong’ as government explores separate regulatory regime

Lloyd’s has signalled that the launch of the market’s first captive syndicates in decades could be close at hand.