News

IFB levy increase not prohibitive to members who see ‘value for money’

The Insurance Fraud Bureau’s decision to increase its levies for 2014 will not be an obstacle to membership, according to market commentators, as its data sharing capabilities are seen as “value for money”.

Scepticism remains over ‘underwriting discipline’ in Q3

Full-year results expected to take a hit from St Jude storm.

Plum Underwriting expands renovation product to ROI

Plum Underwriting has launched its Home Works product in the Republic of Ireland to protect homeowners undertaking extensive building extension projects and renovations.

Esure posts 1.7% increase in GWP in Q3

Esure posted a 4.8% increase in gross written premiums to £427m in the first nine months of 2013, with motor recording a 4.8% increase and home up 4.2%.

Operation Catcher team to be dissolved in Met streamlining

A Metropolitan Police team charged with prosecuting insurance fraudsters is to be dissolved and amalgamated with another unit within the force, raising concerns in the industry about resourcing for insurance fraud operations.

Insurers dismiss MP’s fear that medical panels could become their ‘captives’

Pre-medical offers remain a fraud concern for Apil.

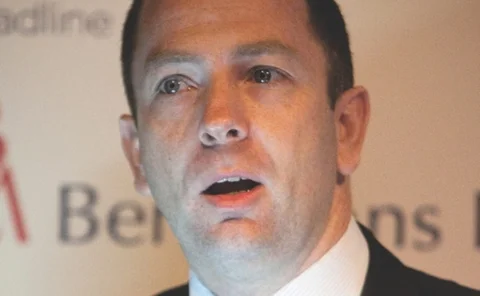

RSA’s Lee facing ‘personal crisis’ amid share price drop and future uncertainty

Simon Lee’s position as RSA group chief executive is under threat following a week that saw the insurer issue two profit warnings, which triggered a share price plummet, market insiders have claimed.

AIA Singapore makes offer to HSBC's agents

AIA Singapore has agreed with HSBC Insurance (Singapore) to make an offer to the agents of HSBC Insurance (Singapore) to join AIA.

Vietnam escapes worst of Haiyan

Typhoon Haiyan, which devastated many islands in the Philippines over the weekend, weakened to a category 1 storm before striking Vietnam.

Fitch affirms RSA ratings but increases scrutiny of governance procedures

Fitch Ratings has affirmed RSA’s insurer financial strength rating at 'A' and long-term issuer default rating at 'A-' following the profit warning issued by the insurer last week.

Fraud Conference 2013: Cybercrime threat needs to move up the agenda to boardroom level

Fighting cybercrime should be an executive board consideration, insurer panellists at Post’s Fraud conference in London said last week.

Fraud Conference 2013: Insurers demand fundamental reassessment on data sharing

Concerns have been raised about plans by the Chartered Insurance Institute to reform data sharing between insurers and others using section 29(3) of the Data Protection Act.

Fraud Conference 2013: ABI considers anti-fraud advertising campaign to drive message home

The Association of British Insurers may consider advertising in the national media to tackle public perception of insurance fraud, its head of property fraud and specialist lines Aidan Kerr has said.

Everest Re first to use Xuber’s reinsurance product

Everest Reinsurance will be the first company to implement insurance software business Xuber’s new product for reinsurers.

CII opens consultation on changes to chartered status

The Chartered Insurance Institute has released a consultation paper seeking feedback to proposed changes to the standards underpinning chartered status for insurers and brokers.

Lockton urges fire safety ahead of scheduled firefighters’ strike

Lockton’s Real Estate and Construction group has warned that property owners and developers could be at risk during tomorrow’s Fire Brigade Union strike because 80% of them do not have a current fire insurance valuation of their property assets.

BGL unveils new chief information officer

BGL Group has appointed Stuart Walters as its new chief information officer.

Riot Damages Act recommendations could lead to improved underwriting

Recommendations in the independent review of the Riot (Damages) Act 1886 could be a blessing in disguise for insurers according to industry insiders.

Bupa and UK Sport extend partnership deal

Bupa partnership with UK Sport is set to continue until March 2014.

Booth promoted to active underwriter for Syndicate 1955

Barbican Group has promoted David Booth to the position of active underwriter, Syndicate 1955.

Cloud-based portal for schemes brokers launched

Wonder Holdings has announced the formation of a new subsidiary, The Broker Cloud, a portal dedicated to scheme brokers and niche traders in insurance.

Increased typhoon activity in East Asia expected, says Munich Re

Overall insured losses from weather events in the last three decades in East Asia have hit $6bn as floods and typhoons increase. The situation could be about to worsen.

Good fourth quarter renewal prospects for airlines, says Willis

Abundant capacity, high levels of competition, limited loss activity and an aggressive broking community will benefit airline insurance buyers renewing in the final quarter of 2013, according to Willis Group.

Airline insurance buyers to benefit from high capacity and competition

Abundant capacity, high levels of competition, limited loss activity and an aggressive broking community will benefit airline insurance buyers renewing in the final quarter of 2013, according to Willis Group.