News

Pemberton launches €500m private fund

Specialist private equity firm Pemberton Capital Advisors is launching a €500m European Services Fund targeting the financial services and telecommunications sectors in Europe.

XL tackles under and over insurance with property valuation product

XL insurance has joined forces with American Appraisal to offer what it claims are independent and unbiased valuations to customers.

Douetil departs in Brit boardroom coup

The consultant advising Brit Insurance on future strategy, Mark Cloutier, is to replace the insurer’s current chief executive Dane Douetil from 27 October.

Solvency II forces actuaries back on the government’s skills shortage list

A shortage of actuaries to deal with Solvency II projects has forced the UK government to relax its visa rules, according to Re Think Recruitment.

Bruce Stevenson boosts private clients

Scottish broker Bruce Stevenson has promoted Mark Richards, the former managing director of auction house Bonhams, to be director of its private clients team raising the importance of high net worth business.

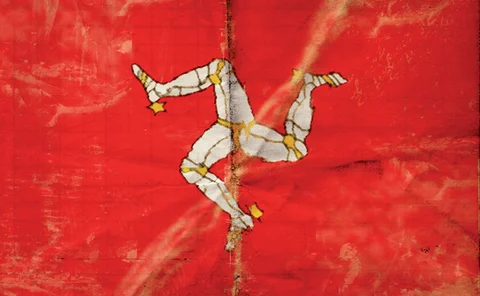

Charles Taylor Consulting acquires Alico Isle Of Man

Charles Taylor Consulting has agreed to acquire Alico Isle of Man, a closed international life assurance company, with equity shareholders’ funds of £1.8m, from American Life Insurance Company.

JLT acquires majority interest in Chilean Orbital Corredores de Seguros

JLT Group has confirmed it has completed the acquisition of an initial 50.1% interest in the share capital of Alta SA with an option to acquire a further 25% in 2020.

Ecclesiastical to rebuild Scottish ring

Ecclesiastical has secured the return of an amethyst stone from a Church of Scotland ceremonial ring.

Swedish Sirius has rating affirmed

Sirius International Insurance Corporation of Sweden has has its financial strength rating of A (Excellent) and the issuer credit rating of "a" affirmed by AM Best.

JLT completes Chile broker buy

JLT has completed the £10m acquisition of an initial 50.1% stake in Alta, the holding company of Chile’s fourth biggest broker Orbital Corredores de Seguros.

US P&C insurers’ H1 COR hits 110.5%

Private US property and casualty insurers’ net income after taxes fell to $4.8bn in the first-half of 2011 from $16.8bn in first-half of 2010, a report from ISO and the Property Casualty Insurers Association of America says.

E&Y says insurers are best insulated against Euro debt default worries

Ernst & Young has said insurers and reinsurers are best insulated against Eurozone sovereign debt default worries.

RBSI reveals £15m referral fee windfall

Royal Bank of Scotland Insurance benefitted from referral fee income of £15m in the first half of this year – more than 7% of its H1 profits.

IFB calls for vigilance following latest crash for cash conviction

Insurance Fraud Bureau director Glen Marr has highlighted the organisation’s successful partnership with police following the latest in a long line of ‘crash for cash’ convictions.

Eurozone sovereign risk manageable says Fitch

Eurozone sovereign risk is the biggest threat to insurers’ credit ratings, but despite this a default by Greece or Portugal would not trigger significant downgrades, Fitch said today.

Manchester police authority calls on loss adjusters to look at riot claims

The Greater Manchester Police Authority has appointed a panel of loss adjusters to help with riot-related claims.

Insurance Insight October is now live

Insurance Insight October is now live with an article on ratings across Europe; a look at how a huge cloudburst in July has affect the Danish insurance market; and an interview with Alberto Corinit, formerly of the CEA and CEIOPS.

Cooper Gay's Jackson to represent Brokerslink Latin American

Broker network Brokerslink has announced changes to its representation in Latin America.

Cross-border exchange of information poll result

How exchanging of information on traffic offences across borders affect European insurance claims?

UK regulator expects Solvency II to be delayed

The UK's Financial Services Authority has said it expects insurers to have to comply with Solvency II rules from the delayed 1 January 2014 date.

Ablett outlines WCI modernisation goals

The newly installed master of the Worshipful Company of Insurers Tim Ablett has vowed to attract younger members and improve the WCI’s communications.

Direct Line boss backs tough stance on dangerous drivers

Direct Line’s director of motor underwriting has praised a tough new government stance on dangerous drivers which could see offenders who “devastate lives” jailed for up to five years.

Keoghs calls for law reform on fraudulent claims

Law firm Keoghs, which helped LV= secure a conviction against a personal injury fraudster, has called for legislative reform to deter criminals seeking damages.

Police chief to head insurance fraud unit

A senior City of London Police detective has been appointed to lead the specialist insurance fraud police unit.