News

UN chief urges insurers to ‘green’ investments to manage climate risk

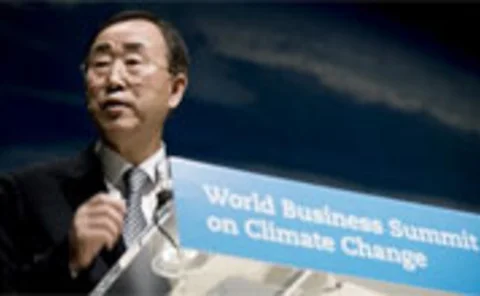

United Nations secretary-general Ban Ki-Moon has urged the insurance industry to "green" its investment portfolios and double its investment in clean energy to help manage the impact of climate change.

Insurance fraud in Australia rises above A$2bn a year

According to the Insurance Fraud Bureau of Australia, insurance fraud is costing Australians more than A$2bn (£1.1bn) a year.

Beazley hires three for Asia-Pacific marine division

Specialist insurer Beazley has hired three marine underwriters to be based in its Singapore office.

Markel in talks to make trio of redundancies following restructure

Markel International is in redundancy talks with three of its employees, following a wholesale business restructure announced on 13 April, Post understands.

Markel reduces number of operating divisions

Markel International has reduced the number of its operating divisions from seven to three, with the changes effective from 1 May.

Romero targets £4m in premiums for Nottingham office

Romero Insurance Brokers will aim to place around £4m in premiums in the first year of operation from its new Nottingham branch.

British Insurance Awards: The 2016 shortlist

Have you made the cut as a potential headliner? Well the wait is over - as today we reveal those companies that made it onto the British Insurance Awards 2016 shortlist.

Gen Re CEO to retire by end of 2016

Tad Montross, CEO at Berkshire Hathaway-owned global reinsurer Gen Re, will retire by the end of the year, according to a spokeswoman at the firm.

Gallagher swoops for two US retail brokers

Arthur J Gallagher has acquired two US retail insurance brokers in deals that closely follow it agreeing an $800m unsecured credit facility earmarked for acquisitions.

McDermott to leave FCA in July

Acting Financial Conduct Authority CEO Tracey McDermott is to leave the organisation on 1 July, the regulator has confirmed.

CJCA s57 fundamentally dishonest ruling sends 'strong message' to fraudsters

The first fundamentally dishonest ruling under section 57 of the Criminal Justice and Courts Act 2015 will act as a significant deterrent to potential fraudsters, according to the Association of British Insurers and law firm Horwich Farrelly.

Businesses urged to understand terrorism exposure as European risk rises

2015 was the most lethal year for terrorist violence in Europe in nearly a decade, according to research from Aon Risk Solutions, which also found one-third of all attacks in the western world since January 2015 targeted private citizens and public…

UK insurtech start-up Guevara to follow US P2P provider Lemonade and launch licensed insurer

One of the investors behind insurtech start-up Guevara has warned others they will need "a lot of patience” to bear fruit in the insurance market.

Fraudsters targeting insurance staff in ‘pubs, cafes and on social media’

Insurance employees are the latest target of criminals looking for sensitive customer data with fraudsters following staff from their workplaces and approaching them online, according to officers from the Insurance Fraud Enforcement Department.

London market insurers will struggle with investment returns in 2016

Investment income will remain a sticking point for London market insurers as reserves are hit by low rates in popular short-term investments, according to a report by Fitch Ratings.

Simply Business indicates growth appetite after Aquiline purchase

SME broker Simply Business is expecting a "suite of investments" following its purchase by Aquiline Capital Partners, as CEO Jason Stockwood said the two companies have a shared ambition.

NCI targets £1.2m GWP as it enters equine market

NCI aims to net £1.2m gross written premium in the first year from its first venture into equine cover.

Wunelli unveils ‘plug and play’ telematics device

Telematics provider Wunelli is launching a data collection device, cutting the cost of telematics by around 85% on current hardwired options.

Gallagher earmarks $800m facility for acquisitions

US-headquartered Arthur J Gallagher has entered into a five-year $800m (£561m) unsecured credit facility with a group of banks pegged for acquisitions.

Young insurers, broking attraction, terror cover and roaring motors

The best of Post the last week in case you missed it

RSA promotes Coughlan to head up UK personal lines

David Coughlan has been appointed managing director of RSA's UK personal lines business, overseeing the More Than brand, personal lines broker and affinity.

KGM retrieves costs after first fundamental dishonesty ruling under CJCA s57

KGM, the UK motor insurance subsidiary of Sompo Canopius, will be repaid £6100 in costs after the first ruling of fundamental dishonesty under section 57 of the Criminal Justice and Courts Act 2015.

Howden's Rootham to leave the business in June

Howden UK retail division boss Stuart Rootham is to leave the broker at the end of June.

#PostPeople 11-15 April 2016

All the latest insurance industry market moves between 11 and 15 April 2016.