Lloyd’s/London

Barbican turn-key approved by FSA

Whittington will retain a shareholding in its turn-key operation Barbican after the latter was granted conditional approval from Lloyd's and the Financial Services Authority to form its own managing agency.

RFIB appoints financial risk director

RFIB Group has appointed Neil Baker to the role of divisional director, financial and professional risks.

JLT boss draws parallels between terrorism and flood insurance

The Government’s £200m cuts on flood defences could have a catastrophic effect on the commercial property market by making flood insurance unavailable.

Beazley adds Tolle and Cox to its PLC board

Beazley has announced that Rolf Tolle has been appointed as a non-executive director and Adrian Cox as an executive director, both with immediate effect.

THB announces three London hires

THB Global Risks has recruited three staff to its London office.

Amlin targets professional lines with key appointment

Amlin has appointed Lloyd Fielder as leading class underwriter within its new professional lines business.

Beazley snowed under with a surge of event cancellation enquiries

Beazley said that widespread snow, ice and sub-zero temperature across the UK and Northern Europe – earlier in the year and more severe than ever before – have put thousands of events – pop concerts, sporting and racing fixtures, trade shows and theatres…

Kiln appoints new underwriter

R J Kiln has named former Brit Insurance employee Paul Blunden as a class underwriter of medical expenses insurance for Lloyd’s Syndicate 807.

Jubilee off the market as Ascot buys motor book

Jubilee group chief executive Andreas Loucaides has vowed that the Lloyd's underwriter is no longer for sale, despite Ascot Underwriting acquiring its commercial motor book.

RFIB sees 13% growth

Lloyd's broker RFIB has credited its 13% growth in turnover for the year ended 30 June 2010 to the performance of its marine and reinsurance divisions.

Foreign interest in UK firms rose over 2010

Interest from overseas in UK financial services and insurance companies has improved this year after the credit crunch caused investment and merger and acquisition activities to slow in 2009.

Legal review of the year: Less doing more

Consolidation among insurance law firms was the hot topic for 2010, as they try to meet insurers' demands. Veronica Cowan reports on an interesting year.

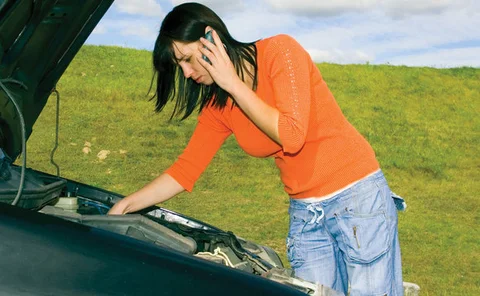

Broking review of the year: A breakdown in momentum

2010 was a fairly low key year for the broking market, as the sector kept a low profile during the financial turmoil. Daniel Dunkley reports on the opportunities that were taken up and deals made.

Chaucer ups underwriting interest in Lloyd's by 7.65% in 2011

Chaucer Holdings, the Lloyd's specialist insurance group, today announced that following completion of the Lloyd's coming-into-line process, including reinsurance arrangements, its total underwriting interests will be £707.2m for 2011.

Hardy Underwriting opens in Asia

Hardy Underwriting Bermuda Limited has announced the commencement of underwriting operations at Hardy Underwriting Asia within the Lloyd's Asia platform.

Barbican wins approval to act as a Lloyd's managing agency

Barbican has obtained conditional approval from Lloyd’s and the Financial Services Authority to act as a managing agency at Lloyd’s.

Brokers face North-South divide over M&A activity – Post in print: 2 December 2010

Senior reporter Leigh Jackson outlines the main news from this week's issue of Post, which includes claims that brokers in the ‘resilient South’ are standing their ground when it comes to getting the price they want for a sale, creating a divide between…

BMS recruits former Benfield head to expand liability arm

BMS has appointed Theresa Schugel as executive vice president to lead the expansion of its global specialty casualty practice which has expertise in medical professional liability, lawyers’ professional liability, workers compensation, D&O and other…

Swiss Re: insured losses up 34% to $36bn in 2010

According to initial estimates from Swiss Re’s sigma team, worldwide economic losses from natural catastrophes and man-made disasters were $222bn in 2010, more than triple the 2009 figure of $63bn.

Markel CEO to take two months out for medical treatment

Markel Corporation has announced that chairman and chief executive officer Alan Kirshner may be absent from the corporation's offices for most of December and January while receiving medical treatment.

White Oak seals Daimler deal

Specialist motor and equipment underwriting agency White Oak Underwriting has acquired the Daimler Truck Financial physical damage and related insurance business in the US.

Amlin awarded gold chartered status

Amlin Underwriting has become the first London market insurer to achieve the gold standard of corporate chartered insurer status.

ECIC appoints underwriting head

The Electrical Contractors’ Insurance Company has appointed Agneta Desouza as underwriting manager.

Cooper Gay restructures in London

Cooper Gay has restructured its London based marine and energy reinsurance team in a bid to continue growing its market share.