Lloyd’s/London

Post magazine – 2 February 2012

The latest issue of Post magazine is now available to subscribers as a digital and interactive e-book.

Ace boss Greenberg sees "firming rates" in Q4 as 2011 profit falls 49% to $1.59bn

Ace Insurance has reported 49% change in its year end profit having reported net income of $1.59bn (2010: $3.11bn) in 2011.

London market technology provider launches cloud offering

London Market technology firm TriSystems has launched an electronic underwriting service called Lime-St.com For underwriters to complement its broking platform.

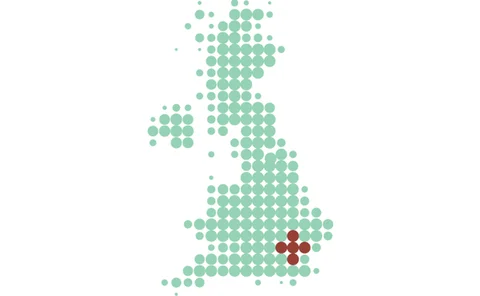

Ex DA Constable MD joins syndicate 2525

Whittington Capital Management syndicate 2525 has appointed Stephen Fitzgerald to develop business in UK regions not currently accessed through the Lloyd’s broker channel.

Lloyd's to spend £150m on modernisation plans

The Lloyd’s and London Market is considering a £150m overhaul of its processes in a bid to modernise operations but this could render Xchanging’s services redundant.

Thirty insurers linked to Costa Concordia disaster

More than 30 insurers are likely to carry the cost of stricken Costa Concordia cruise ship.

Newly acquired Chesterfield eyes further expansion

Lloyd’s broker Chesterfield, recently acquired by HW Kaufman Financial, plans to “more than double in size” in the next two years.

Hurst-Bannister joins Xchanging board

London Market stalwart Barnabas Hurst-Bannister is to join the Xchanging Ins-Sure Services board as a non-executive director from March.

Reinsurance - January renewals: Toughen up

Despite the catastrophes of 2011, the predicted — and much needed — January renewal rate hardening has failed to materialise.

Post magazine – 26 January 2012

The latest issue of Post magazine is now available to subscribers as a digital and interactive e-book.

Montpelier Re and Mitsui stay quiet on Hardy bids

Bermudan-based reinsurer Montpelier Re and Lloyd’s insurer Mitsui Sumitomo have refused to comment on rumours that they will bid on troubled Lloyd’s insurer Hardy.

LMA names Atkin as new chairman

The chief executive officer of Talbot Underwriting, Rupert Atkin, has been appointed as the new chairman of the Lloyd’s Market Association.

Travelers targets brokers with event cancellation cover expansion

Travelers has expanded its event cancellation cover from the firm’s Lloyd’s syndicate to its insurance company operation in a move which is expected to provide regional brokers with better access to the product.

Jubilee says regulators thwart better PPI

Jubilee says insurers are being put off creating payment protection insurance products because of uncertainty following reviews by regulators.

Barbican makes fresh Omega bid

Barbican sent a letter to rival Omega this week outlining a “merger of equals”.

Lockton Dubai gains Lloyd’s broker status

Lockton Dubai has received Lloyd’s broker registration.

Hyperion courts Windsor as it takes firm steps towards flotation

The proposed acquisition of Lloyd’s broker Windsor by international broking and underwriting group Hyperion could lead to additional takeover deals in 2012, and would bolster the latter’s chances of initial public offering success, following confirmation…

Aon London HQ move will bolster City’s position

Aon’s decision to move its corporate headquarters from Chicago to London could bolster the City’s position as a major insurance capital.

Market moves: Insurers and consultants up the pace

As the insurance sector settles into 2012 its activity in the recruitment space has gathered momentum. Insurers had a busy week, with Markel, Mitsui Sumitomo and Royal Bank of Scotland Insurance bringing in fresh faces. Brokers, meanwhile, had another…

View from the top: Lessons from the East

Catastrophes in Japan showed the resilience and strength of the industry, says Andrew McKee.

Arab Spring: Life during wartime

Continuing civil unrest in the Middle East and North Africa presents a challenge to the property insurance market — especially concerning the limits placed by the war risks exclusion.

Capital adequacy: Alternative finance

With Solvency II just 12 months away, and 2011 an unprecedented catastrophe year, how difficult will it be for insurers to attract equity or secure alternative funding?

Post magazine – 19 January 2012

The latest issue of Post magazine is now available to subscribers as a digital and interactive e-book.

Costa Concordia claims could cost £1bn

Insurers could face claims of up to $1bn from the Costa Concordia cruise liner disaster making it the biggest marine loss ever, analysts have warned.