Commercial

Blog: Importance of robust agency arrangements in insurance sales and supply chains

With Axa suing Santander for £624m over its payment protection insurance policies, Caroline Harbord, partner, and Charlie Paddock, trainee solicitor at law firm Forsters, discuss the importance of robust agency arrangements in insurance sales and supply…

LV, Axa and Keoghs smash fraud ring; Flood Re launches Build Back Better; Howden buys SPF; Go Insur backs start-up Insuristic

For the record: Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

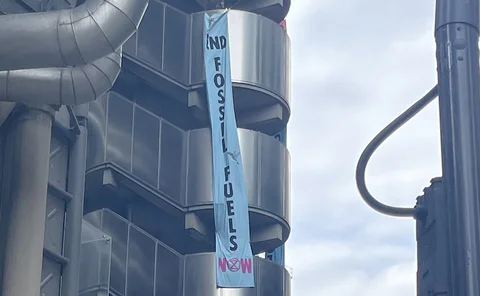

Lloyd’s HQ closed for day as Extinction Rebellion blocks entrances

Lloyd’s has closed its headquarters for the day as protesters from Extinction Rebellion blocked entrances into the building.

Blog: Ocean investment is critical to protect the welfare of ecosystems

As Axa and WTW join a new global finance ecosystem designed to channel funds into coastal and ocean natural capital by 2030, Chip Cunliffe, biodiversity director at Axa XL and co-chair of Ocean Risk and Resilience Action Alliance, takes a deep dive into…

Intelligence: Our duty to protect must begin now

Protect Duty legislation has been touted as a way to reduce the potential for catastrophic events from terrorist attacks at publicly accessible locations, and it is likely to affect public and employers’ liability polices. But, as Edmund Tirbutt reports,…

Trade credit insurers face 'elevated risk' from remaining trade with Russia, warns ratings agency

DBRS Morningstar has warned that trade credit insurers “should expect to deal with an inflow of credit default claims” as Russian buyers start missing payments as a result of the fallout of the war in Ukraine.

Nikhil Rathi pledges to make the FCA more assertive and quicker in stamping out wrongdoing and consumer harm

The Financial Conduct Authority has launched a three-year strategy to improve outcomes, with the CEO Nikhil Rathi pledging to make the regulator more assertive and quicker in responding to changing financial services sector.

Revolut in Allianz tie-up; AUB confirms Tysers talks; QBE poses resilience challenge; and Rear’s SPAC Financials Acquisition Corp to raise £150m via listing

For the record: Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Lords Committee expresses concerns of ‘overly demanding’ and ‘burdensome’ regulation of London Market

The Industry and Regulators Committee has written to the Economic Secretary to the Treasury John Glen to outline concerns about lack of proportionality in the regulation of the London Market by the Financial Conduct Authority and the Prudential…

British Insurance Awards: 2022 shortlist revealed

This year the British Insurance Awards return back to their spiritual home at the Royal Albert Hall after a two year absence.

Dual appoints European executive chairman to spearhead 'hire and acquire' strategy

Howden-owned managing general agent Dual has appointed Maurizio Ghilosso as executive chair of its European business.

Interview: Kelly Ogley, A-Plan

Four months after stepping up to the role of CEO at A-Plan, Kelly Ogley tells Pamela Kokoszka about her three passions, discusses the growth plans for the broker, and reveals how it has managed to remain relevant for the past 58 years

Citizens Advice ethnicity penalty campaign a ‘wake up call to FCA’

Citizens Advice ethnicity penalty report must be "a wake up call to the Financial Conduct Authority” to act on its promise to HM Treasury as insurers face warnings the fallout from this could be as far reaching as the Test Achats gender ruling.

Woodgate & Clark acquires media and entertainment adjuster Spotlite

Woodgate & Clark has acquired media and entertainment adjuster Spotlite as it continues to build specialist expertise.

RSA's Norgrove promises broker service improvements

RSA UK and international CEO Ken Norgrove has promised to materially improve the insurer’s level of service to brokers by the end of the year, admitting that it had fallen short in recent years.

Tokio Marine voids 'fraudulently obtained' Greensill policies

Tokio Marine has accused Greensill of fraudulently obtaining insurance policies and said it will “vigorously defend any claims against it” under the policies it has now voided.

Clyde & Co merges with BLM; Beazley unveils underwriting structure; KGM buys Eridge Underwriting Agency; Blanc becomes WWF ambassador; and Swiss Re warns of global protection gap

For the record: Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Robust e-scooter regulation needed at 'earliest opportunity', sector urges Shapps

Four insurance industry trade associations have called on the government to bring in 'robust' legislation around the use of e-scooters as soon as possible if they are to be permitted beyond current trials.

Judgment closing dental liability loophole could herald insurance step change

A Court of Appeal judgment has closed a legal loophole that meant dental practices were not liable for injuries caused by individual dentists during treatment, potentially further opening up the market to commercial insurers.

Axa will not appeal Corbin & King BI verdict

Axa has decided not to appeal a £4.36m Commercial Court business interruption judgment against it.

Blog: The lost art of underwriting

James Gerry, chairman of MX Underwriting, argues that the insurance industry is losing sight of the art of true underwriting, as technology continues at pace to replace the human interactions with brokers.

Data analysis: FOS insurance backlog tops 9000 cases

Freedom of information requests by Post and sister title Insurance Age have laid bare the scale of insurance case delays at the Financial Ombudsman Service.

Inside Out: A former BI insider looks at what the insurance industry should have learnt in the past two years

Post invites industry insiders affected by key issues they believe insurance is getting ‘inside out’ to share their perspective and state their case for change. Here, a former business interruption insider talks about how the recent Corbin & King v Axa…

Trade Voice: Airmic's Julia Graham on how captives can help organisations to manage risk in uncertain times

As the turbulence in the world increases and throws up new – and different – risks, now is the time for captives to undergo a renaissance, argues Airmic CEO Julia Graham.