Claims

AIG adds $458m of Covid-19 losses in Q2

AIG reported an underwriting loss of $343m (£262.8m) for general insurance business in the second quarter of 2020.

FCA warns of action on BI claims deductions

The Financial Conduct Authority has warned insurers making deductions to non-damage business interruption claim payments based on government payouts that it will intervene if firms do not meet its expectations and treat customers fairly.

RSA to exit wedding insurance in early 2021

RSA will cease to underwrite wedding insurance when its John Lewis contract ends at the beginning of next year, Post has learned.

Further cost-cutting expected at RSA UK

RSA will look to cut further costs in its UK arm, RSA CEO Stephen Hester confirmed as the insurer released it first half results for 2020.

Hiscox bulks up Covid claims hit estimate as group faces loss

Hiscox swung into a loss for the first half of 2020 as it increased its Covid-19 claims hit estimate.

Interview: Michael Lee, First Central

A year into his role and Michael Lee, CEO of First Central, explains to Jen Frost what he believes are the three elements needed to be successful in motor insurance

NFU Mutual rejects accusation it misbehaved by deducting government grants from payouts

NFU Mutual has defended itself against claims by self-catering accommodation businesses that it is unfairly deducting the value of government grants from coronavirus-related payouts.

Thatcham publishes requirements for repair of ADAS vehicles

Thatcham releases insurance industry requirements for the safe repair of ADAS-equipped vehicles.

BI court case judges aiming for draft judgment in mid-September

Lord Justice Flaux has confirmed the middle of September as the target date for a draft judgment in the business interruption court case brought by the Financial Conduct Authority against UK insurers.

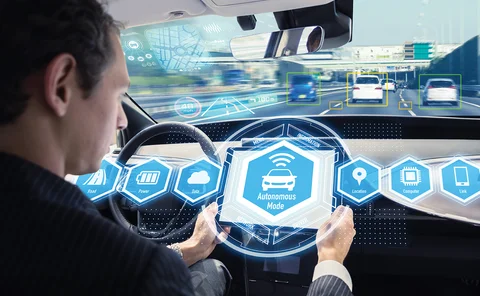

Connected claims is the driver to take telematics closer to the mainstream, says Trak Global CEO Corrie

The next generation of telematics will involve low cost hardware coupled with smart phones and be based around the connected claims journey.

Future Focus 2030: The future of property podcast - how IoT sensors, automation and granular data will shape the next decade

It is the year 2030. The explosion of internet of things devices has really taken hold impacting both the personal and commercial property markets.

Future Focus 2030: The future of property

As part of a monthly series, Post looks into the future at how the insurance market might change, with each part focusing on a specific issue through a 2030 lens. In the latest instalment, Jonathan Swift looks at how in 10 years new technologies from…

Claims Apprentice 2020: Episode three - Podcast challenge part two

With topics decided, guests lined up and vox pops taped it is time for Team Empower and Team KDA to enter the studio to record their podcasts.

ABI seeks to ‘tell the full story’ on industry’s Covid response: Huw Evans

The industry should not shy away from the business interruption insurance issue but equally it is not “the be all and end all of the Covid crisis”, according to Huw Evans, director general of the Association of British Insurers.

QC accuses FCA of failure to show causal connection between government action and the disturbance to the insured businesses

Insurers argued the Financial Conduct Authority is “unable to demonstrate” any meaningful connection between the action taken by the UK government on a national basis in response to Covid-19 pandemic and the locality of firms’ premises, as the court…

US Covid-19 liability shields: What do they mean for UK insurers?

As US states introduce a new wave of legislation intended to encourage businesses to reopen without the fear of an onslaught of Covid-related lawsuits, Andrea Best and Kristi Garrett of law firm Mc Dermott, Will & Emery ask whether these liability…

Sun Capital injected £7m into Mulsanne as SCR fell below 100%

The new backers of Mulsanne Insurance Company had to invest £7m into the Gibraltar-based underwriter this April to meet solvency capital requirements.

Insurers’ QC claims FCA is 'forcing a square peg into a round hole' in BI test case

Providers argue regulator’s case doesn’t work because access to premises was not prevented during pandemic as lawyers for Hiscox, Ecclesiastical, MS Amlin, Arch Insurance and Zurich make their submissions.

Trade Voice: Mass chair Paul Nicholls on delivering for claimants during Covid-19 and beyond

Paul Nicholls, chair of the Motor Accident Solicitors Society, addresses the insurance and legal industries’ responses to Covid-19 but warns the pandemic has delayed progress on the numerous issues that need to be tackled ahead of the implementation of…

Carter hails 'trampoline bounce back' after lockdown hit H1 volume at Sabre

Motor specialist insurer Sabre was pleased overall with the half-year results as the coronavirus pandemic pushed premiums down 14% to £86.9m, CEO Geoff Carter told Post.

Briefing: Tesla CEO Musk warns incumbents it is building a 'great, major insurance company'. Should they be worried?

On last week’s Q2 briefing call Tesla CEO Elon Musk told insurers he is coming for their actuaries, to help him start an insurance ‘revolution’. But could his obsession with data and math have blinded him as to where the real battle in motor insurance…

Claims Apprentice 2020: Episode two - Podcast challenge part one

Now that the six contestants have been split into teams and decided on their names, it is time for the apprentices to tackle their first challenge.

Hiscox QC accuses FCA of 'tearing up the rule book on causation'

Jonathan Gaisman, QC, branded parts of the Financial Conduct Authority’s arguments as camouflage, a misuse of language and “blurring every divisible thing into one amorphous mass” as he defended Hiscox in the ongoing business interruption test court case.

Cost of motor insurance at four year low due to lockdown

The cost of motor insurance fell to the lowest quarterly level since 2016, according to statistics from the Association of British Insurers.