Broker

Clutterbuck to succeed Moylan as Allianz commercial director

Allianz Commercial director for underwriting and technical Geoff Moylan is to retire from the business.

Head of specialist markets latest to leave Axa

Mike Phillips, head of specialist markets at Axa commercial, has become the latest high profile name to leave the business, Post has learnt.

Post magazine – 21 April 2011

The latest issue of Post magazine is now available to subscribers as a digital and interactive e-book.

Acquisitive Invicta seals two more deals

Invicta Insurance Services will complete its seventh acquisition, the entire general insurance portfolio of Wiltshire-based Keith Montgomery Insurance Services, on 1 May.

MoJ and mobile operators join forces to eliminate text pests - Insurance News Now – 21 April 2011

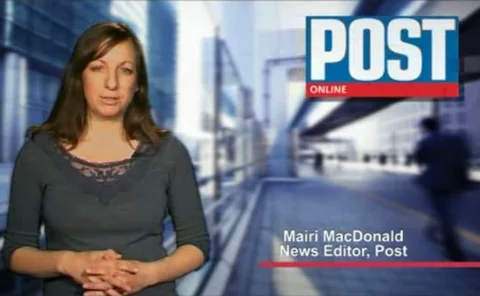

Post news editor Mairi MacDonald outlines this week's major general insurance stories including an announcement that the MoJ is to set up a dedicated working group with the UK’s major mobile firm operators to tackle the problem of unsolicited text…

MoJ and mobile operators join forces to eliminate text pests - Insurance News Now – 21 April 2011

Post news editor Mairi MacDonald outlines this week's major general insurance stories including an announcement that the MoJ is to set up a dedicated working group with the UK’s major mobile firm operators to tackle the problem of unsolicited text…

Hebburn to retire from Allianz

Roy Hebburn is to retire from his role as divisional claims manager (technical) at Allianz.

High Court backs FSA in PPI rulling

A High Court judgment has upheld the Financial Services Authority rules on how complaints into payment protection insurance are handled.

RSA expands SME e-trading proposition

RSA has expanded its e-promise team, which supports brokers e-trading with RSA.

Only 12% believe Government FSA overhaul will meet 2012 deadline

Almost three fifths (58%) of insurance professional questioned by the Chartered Insurance Institute think that the industry’s needs have not been taken into account in the plans to overhaul the Financial Services Authority.

New Towergate chair remains tight lipped about successor to Andy Homer

Towergate’s new non-executive chairman Alastair Lyons has refused to give a timescale for it to find a successor to Towergate chief executive Andy Homer.

Axa confirms senior commercial departure

As a result of the senior management restructure at Axa commercial, distribution director Keith Hector has left the business.

Aon Benfield: reinsurance capital hits all time high at year end 2010

The total global reinsurer capital reached an all-time high of $470bn (£288bn) at December 31, 2010 – a 17% increase over the 2009 period, according to Aon Benfield.

Aon Benfield: reinsurance capital hits all time high at year end 2010

The total global reinsurer capital reached an all-time high of $470bn (£288bn) at December 31, 2010 – a 17% increase over the 2009 period, according to Aon Benfield.

European insurers call for Solvency II non-compliance fines

European insurers would like to see the European Insurance and Occupational Pensions Authority fining regulators where Solvency II is not applied equally across the European Union.

European insurers call for Solvency II non-compliance fines

European insurers would like to see the European Insurance and Occupational Pensions Authority fining regulators where Solvency II is not applied equally across the European Union.

Acquisitive Higos buys another broker in South west drive

Higos Insurance Services has acquired Plymstock Insurance Centre, near Plymouth.

JLT granted South Africa license

Jardine Lloyd Thompson Group has confirmed that its South African business has been awarded a license to operate by the Financial Services Board.

Biba: regulation is bigger burden than tax

The regulatory burden imposed by the Financial Services Authority (FSA) on the insurance broking sector is a greater competitive disadvantage than the amount of corporation tax it pays, the British Insurance Brokers’ Association has warned.

Biba: regulation is bigger burden than tax

The regulatory burden imposed by the Financial Services Authority (FSA) on the insurance broking sector is a greater competitive disadvantage than the amount of corporation tax it pays, the British Insurance Brokers’ Association has warned.

RFIB appoints aviation broker

Neil Coldwell has been appointed as an aviation broker at RFIB Group.

Willis: sufficient coverage harder to retain in politically volatile regions

A report from Willis has revealed that companies operating in politically volatile regions of the world may soon struggle to retain sufficient insurance coverage to protect their assets and staff.

FSA confirmed to discuss the FSCS

The Financial Service Authority is set to discuss the future and funding of the Financial Services Compensation Scheme at an All Party Parliamentary Group on Insurance and Financial Services meeting.

PwC welcomes “clearer” view of Solvency II

PwC has responded to the speech made by Julian Adams, FSA Director of Insurance, at the FSA Solvency II Conference today.