Harry Curtis

Chief Reporter, Post

Harry is chief reporter for Insurance Post covering commercial lines and the London market.

He joined Insurance Post in 2018 and won the British Insurance Brokers’ Association Most Promising Newcomer award in 2019. In 2022, he was highly commended in the Headlinemoney Awards General Insurance B2B Journalist of the Year category.

Follow Harry

Articles by Harry Curtis

Frustrated policyholders call for insurers to ‘take responsibility’ after Supreme Court rules many are due payouts

Policyholders and their representatives have called for insurers to “take responsibility” and “immediately start paying claims” in the wake of a bittersweet Supreme Court judgment on disputed coronavirus-related business interruption policies.

Analysis: The class of 2020 emerges

The emergence of a cluster of start up and scale up carriers, or a class of 2020, caught analysts by surprise despite the hardening market.

Hiscox response to BI ruling 'misleading' says Mishcon lawyer

A lawyer representing Hiscox's business interruption policyholders has called a statement by the insurer stating that fewer than one third of its policies may pay out following this morning’s Supreme Court judgment “misleading”.

Rightindem appoints Kieran Rigby as chair

Claims management insurtech Rightindem has appointed Kieran Rigby, formerly global president of Crawford Claims Solutions, as its chairman.

Former Lib Dem leader brands insurer Covid BI claims handling 'deeply depressing'

Former Liberal Democrat leader Tim Farron has called the conduct of insurers during the coronavirus pandemic “deeply depressing” and urged the Chancellor of the Exchequer to “take steps to protect insurance customers from the actions of insurers”.

Lockdown: Many insurer and broker offices to remain open as Lloyd's underwriting room closes

Insurers and brokers have told Post that the majority of their staff will continue to work from home and that offices will remain open to those few that need to access them, following the start of a third national lockdown in England.

Personal injury claimants mired in £240m pandemic litigation backlog for over a year

Road traffic accident claimants have waited over a year just for their cases to be heard in court due to backlogs exacerbated by the Covid-19 pandemic, according to an analysis of Ministry of Justice figures by Zurich.

Thingco secures £3m investment from BGL owner

Telematics insurtech Thingco has secured a £3m investment from BGL Group holding company owner BHL (UK) Holdings, Post can reveal.

Credit insurers warn of insolvency surge later this year as government extends trade credit scheme

The UK government-backed trade credit reinsurance scheme to guarantee up to £10bn of business-to-business transactions has been extended to run for the first half of 2021.

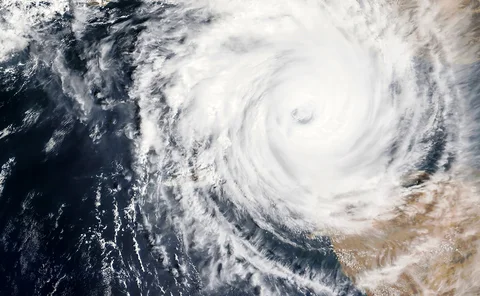

Q&A: McLarens' Kieran Gallagher and Dave Watts on hurricane season amid a pandemic

The 2020 hurricane season was unprecedented, both due to the number of storms and because it coincided with a global pandemic. Post spoke to McLarens’ Kieran Gallagher, executive director, and Dave Watts, executive adjuster and head of home foreign,…

Policyholders told to check cover as FCA imposes restrictions on insolvent construction broker

The Financial Conduct Authority has told customers who purchased cover through insolvent South West-based Professional Construction Risks Limited to contact their insurers directly to confirm the status of their policies.

No Supreme Court BI judgment before January, says FCA

Insurers and policyholders will have to wait until next year for the final outcome of the Financial Conduct Authority-led business interruption test case, according to an update from the regulator.

RSA names Steve Watson London market head

RSA has appointed Steve Watson as managing director of its London market business with immediate effect.

Intervene in contingency market by January to save 2021 events, government told

An open letter asking for the UK government to underwrite a Covid-19 contingency insurance product has been described as “a last throw of the dice” to save the 2021 entertainment and sporting calendar by one of the campaign’s architects.

Alarm sounded on bookings business that sold unauthorised Covid cancellation cover

The Financial Conduct Authority has issued a warning against a bookings software provider that marketed a cancellation insurance product to owners of UK holiday lets, following an investigation by Post.

FCA consults on proving presence of Covid-19 for BI claims

The Financial Conduct Authority has launched a consultation on guidance to policyholders, insurers and intermediaries on how the presence of Covid-19 in a particular area may be proved for the purposes of business interruption claims.

Co-op and Markerstudy: A deal 22 months in the making

Late on 25 November, the Prudential Regulation Authority and Financial Conduct Authority at last approved Markerstudy’s takeover of the Co-op’s underwriting business – 675 days on from when the deal was first announced.

Debenhams policies unscathed by chain's collapse, says Somerset Bridge

Insurance policies sold by Somerset Bridge through an affinity deal with Debenhams will be left by unscathed by the high street retailer’s collapse, the broker’s CEO Liz Bilney has told Post.

Interview: Julian James, Sompo International

Sompo International’s international insurance CEO Julian James sat down for a ‘virtual chinwag’ with Harry Curtis to talk returning from retirement, the business’s Lloyd’s exit and brand ambitions, the hardening market and ‘Armageddon scenarios’.

FCA's product governance proposals could have longer term impact than price walking ban

Proposed changes to the Financial Conduct Authority’s product governance rules could prove to have a greater long-term impact than the regulator’s prospective price walking ban, consumer research and compliance experts have said.

Q&A: Louise O'Shea, Confused

Louise O'Shea, CEO of Confused, spoke to Post about the comparison site's recent profits, its growth ambitions and what the FCA's pricing proposals will mean for consumers.

Lloyd's Brexit transfer of EEA business approved by High Court

Lloyd’s has received final approval from the High Court to transfer policies covering risks and policyholders in the European Economic Area to its Belgian subsidiary, Lloyd’s Europe.

Insurers told soul-searching, not superficial projects, will improve industry's reputation

Insurance companies must ensure they are “purpose-led” in order to restore the sector’s reputation, Blueprint for Better Business CEO Chris Wookey told members of the Worshipful Company of Insurers last week.

Lloyd's Brexit transfer decision expected next week after objection-free hearing

Lloyd’s is set to learn whether or not the High Court will approve a Brexit-necessitated transfer of European policies to its Belgian subsidiary next week, following the conclusion of a two-day sanctions hearing on Thursday.