Analysis

Chilean earthquake – insurance lessons learnt one year on

Lessons learnt from the massive earthquake that struck Chile 12 months ago should facilitate the future handling of complex business interruption claims, says Jenny Larner.

Career development & CSR: the death of the working wardrobe

Television series such as the popular Mad Men give viewers a unique glimpse into the bygone era of office wear. Suits and ties for men, dresses for women - no exception.

Escape of water claims: Trickle becoming a torrent

Escape of water now represents the same proportion of household claims as personal injury does for motor. Kevin Kiernan looks at this growing trend and how it can be addressed.

Directors' & Officers': A market hampered by soft rates and over capacity?

The number of insurers looking to grab a piece of the SME directors' & officers' market shows no sign of slowing. Amy Ellis reports on the attraction of a market still hampered by soft rates and over-capacity.

Predictive analytics: the benefits to insurers

With insurers getting an increasing amount of data about their customers, Matthew Palmer looks at the benefits of predictive analytics.

Comment - liability claims: Insurers take a hard line on claims costs

With liability rates showing no sign of rising, Nick Patterson looks at why insurers have to take a hard line on claims costs.

Solvency II - Equivalence: The cost of regulation to cross-border trading

The regulatory costs associated with cross-border trading have long been a burden on international insurers, but things may be improving explains Nick Lowe.

After the Cancun climate summit: Will global action follow?

At the recent United Nations’ climate conference in Cancun, nations came together to discuss environmental plans. David Bresch explains what happened in Cancun and what the new consensus means for the insurance industry.

Post Europe: After the Cancun climate summit: Will global action follow?

At the recent United Nations’ climate conference in Cancun, nations came together to discuss environmental plans. David Bresch explains what happened in Cancun and what the new consensus means for the insurance industry.

In Series - Geography & Solvency II: What are the risks for insurers?

With the implementation of Solvency II looming, Sam Barrett asks if insurers are forgetting to look inwards at the risks their own companies face.

Insurer mergers & acquisitions: Is 2011 the time to strike?

After a lean period for insurer mergers and acquisitions through the economic downturn, Daniel Dunkley reports that the first rays of sunlight might begin to show in 2011.

Learning from life: Could Solvency II bring life and general insurance closer together?

When the First Life Assurance Directive was passed in 1979, it spelled the end for new composite insurers. Steven McEwan explains why the advent of Solvency II may bring life and general insurance back in contact again.

Legal expenses - ATE ruling: Playing at being an insurer

Has the recent judgment in Sibthorpe and Morris v London Borough of Southwark put another nail in the coffin of after-the-event insurance? Paul Asplin looks at the result of the case.

Comment - Branding & aggregators: Driving greater success

With direct writers accounting for 40% of the motor market, Peter Thompson looks at the importance of branding when it comes to selling on aggregators.

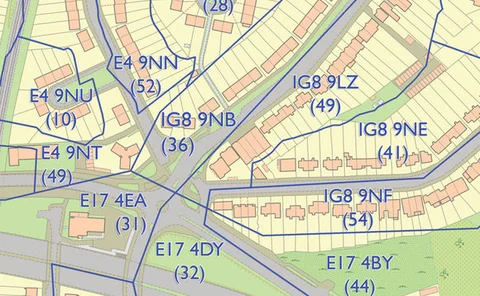

In Series - Geography & Solvency II: Using geographic information for contingency plans

Dr Marc Hobell explains how geographic information can help managers with contingency plans if an incident occurs.

Legal expenses: The end of after-the-event insurance?

The Jackson Report could see the end of after-the-event insurance. Veronica Cowan canvasses the views of those in the industry to find out if the market would still be viable.

Schemes - Conception & construction: Special delivery

Setting up schemes to cover specialist sectors can be a lucrative business - but it requires brokers, insurers and customers to work together. Stephanie Denton looks at this evolving market.

In series - Geogaphy & Solvency II: National geographical risks

With 80% of business data having a geographical element, Sarah Adams looks at the way this insurers can improve their data.

Post Intelligence Benchmarking: How do insurers measure up in the high net worth market

High net worth clients demand a high standard of service, as do their brokers, but which insurers are delivering it? Peter Joy unveils the answer.

Legal update - Successor practice rules: A legal minefield

As law firms acquire work from distressed practices, both they and professional indemnity insurers need to be wary of the rules regarding succession. Craig Jones reports.

APPG - 20 years in force: Representation for the industry

With its 20th anniversary just passed, David Worsfold looks at the success of the All Party Parliamentary Group on Insurance & Financial Services, detailing some key highlights from two decades of debate.

In series - Georgraphy & Solvency II: A new way of looking

A better understanding and quantification of risk portfolios will be provided by Solvency II. Sam Barrett assesses the benefits and potential pitfalls.

Mobile technology - Brokers: How can technology benefit the way brokers do business

With more advanced smartphones and tablet computers, Rachel Gordon asks if mobile technology is merely the latest passing fad, or the shape of the future for the broking community.

Post Europe: Affinity insurance in Central and Eastern Europe ripe for picking

There are undeniable signs that affinity markets in Central and Eastern European markets, including Poland, the Czech Republic, Slovakia, and Hungary, are ripe for expansion. However, as Jane Bernstein discovers moving in to tap this market might not be…