Tax

Redomiciling: London calling as tax changes make the UK more attractive

Will a reduction in corporation tax and changes to the Controlled Foreign Companies regime make the UK a more attractive place to domicile?

Budget 2012: Red tape reductions expected to enhance SME growth

Zurich SME boss Richard Coleman has praised the Chancellor's budget announcement concerning a consultation on how small business with turnover of up to £77 000 pay tax.

Budget 2012: More insurers to target UK move, claims PwC

The insurance implications of this afternoon's budget could result in an influx of international insurers moving to the UK over the coming 12 months, according to PwC insurance tax leader Colin Graham.

Budget 2012: ABI director general welcomes corporation tax cuts

The director general of the Association of British Insurers has "strongly welcomed" Chancellor George Osborne's promise to create a more competitive corporate tax regime in Britain by cutting corporation tax to 24%.

Guernsey and Malta sign double tax agreement

Guernsey has signed a comprehensive Double Taxation Agreement with Malta, the third tax agreement for the captive favourite, after deals with the UK and Jersey.

Insurers in the Philippines reject tax waiver

Non-life insurers and reinsurers in the Philippines have rejected a government offer of a 10% reduction in annual aggregate tax, according to reports in the local press.

View from the Top: Future Flooding

Government must play its part in achieving a satisfactory solution to flood defence

Solvency poll results

Will Solvency II cause captives to re domicile?

Spotlight on environment: Getting protected

When the Statement of Principles on the provision of flood insurance expires next year, how will insurers address the 200 000 high-risk households left struggling for cover?

Bermuda’s Premier Cox signs tax agreement with Turkey

Bermuda has signed a tax information exchange agreement with the government of the Republic of Turkey.

A sustainable future?

Solar powered cities and hydrogen run transport systems might be close to reality than people realise. Christian Müller explains why insurers have an integral role to play in this world and must be at the forefront of embracing innovation.

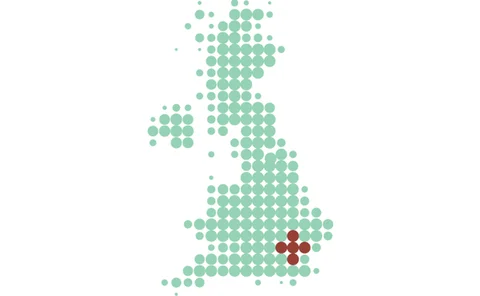

Aon London HQ move will bolster City’s position

Aon’s decision to move its corporate headquarters from Chicago to London could bolster the City’s position as a major insurance capital.

Guernsey financial services body welcomes India tax agreement

Guernsey has signed a tax information exchange agreement with India.

Insurance certificates removed from road tax application process

Motorists will no longer be obligated to produce a certificate of insurance in order to purchase road tax amid new government plans geared towards clamping down on forged documents.

Editor's comment: Impacting the market

Market-turning they may not be but market-impacting they evidently are. Revised loss estimates for the 1500 industrial units hit by the Thai floods have reached $20bn.

Equalisation reserve changes to impact insurers

Legislative changes to claims equalisation reserves will disadvantage insurers, a PwC analyst has warned.

Review of the year - Health insurance: Seeds of change

Despite a tough 12 months, and gloom forecast for 2012, the health insurance sector has planted important seeds for future growth this year.

Legal and tax issues top Airmic worries

Global economic and political uncertainty has had little impact on global insurance programmes, the second annual Airmic casualty benchmarking survey has found.

Roundtable - Global programme: Building successful global programmes

Delivering tailored coverage around the world is a boon for multinational insurers. However, keeping up with regulatory demands, both internationally and locally, can be be a strain. Post gathered a group of experts to debate the most pressing issues.

ANIA: tax burden hinders competitiveness in Italy

The Italian National association of insurance companies' managing director Paolo Garonna has lamented during a parliamentary audition that Italy's tax burden is significantly hindering companies' market competitiveness.

Rehabilitation: Providing the carrot

While the use of rehabilitation has made great strides in the past few years, is a more co-ordinated approach with tangible incentives needed?

US Taxation poll result

Will US tax proposals put European insurers off?

BP Marsh boss has ‘multi-million pound war chest’

Brian Marsh of venture capital firm BP Marsh has told Post he has a multi-million pound war chest to buy 20% to 40% stakes in internationally trading brokers.

Fraud occupancy: Occupational hazard

With a decrease in the number of mortgages being approved by lenders, insurers must be alive to a potential rise in occupancy fraud by those looking to buy-to-let.