Natural catastrophes (Nat Cats)

No market swing despite cat loss accumulation

Loss adjuster Crawford & Company has already settled approximately $1.05m (£653 000) worth of losses from the “high frequency, low severity” claims resulting from Hurricane Irene.

Lloyd’s heading for tough times as catastrophe losses hit profits

Lloyd’s first half-year results will be adversely affected by this year’s “unprecedented” level of catastrophes and could see its combined operating ratio hit 100% for the first time in six years, according to market observers.

Interview - Jon Hancock: Getting under the skin

As UK commercial managing director for RSA, Jon Hancock is on a mission to find out what brokers really think of the insurer

North of the boarder: Redesigning structured settlements

In the recent case D’s Parent & Guardian v Greater Glasgow Health Board (2011), a 10 year old child, D, suffered catastrophic neurological trauma during forceps delivery at birth.

Monte Carlo Rendezvous: A year of catastrophes

2011 has seen a series of serious natural catastrophes follow fast on those of 2010. How will this shape debate next week at Monte Carlo?

9/11 Contract certainty: The first steps taken

A rush of legal cases always followed a catastrophic loss before contract certainty was introduced. The attacks on 11 September 2001 thrust the issue into the spotlight but were other factors at play?

Reinsurance market reassured by AM Best there is hope

AM Best said there are hopeful signs emerging for the global reinsurance industry after years of a soft market, weak investment returns, lukewarm investor interest and sluggish consolidation activity.

AM Best offers hope for reinsurance

AM Best says hopeful signs are emerging for the global reinsurance industry after years of a soft market, weak investment returns, lukewarm investor interest and sluggish consolidation activity.

Moody's changes global reinsurance outlook to stable from negative

Moody's Investors Service has changed the outlook on the global reinsurance sector to stable from negative reflecting the momentum for a hardening in reinsurance rates, a refocusing on the value of reinsurance, and the good risk management and discipline…

Insurance-linked securities market poised for continued growth

The market for insurance-linked securities is poised for continued growth according to Swiss Re.

Chaucer’s Ball to write property treaty

Specialist Lloyd’s insurance Chaucer has named Simon Ball as international property treaty Underwriter within Chaucer Syndicate 1084’s property division.

Axis promote cat claims manager for the Caribbean

Loss adjuster Axis has promoted a new regional manager to take over responsibility for the delivery of adjusting catastrophe claims in the Caribbean.

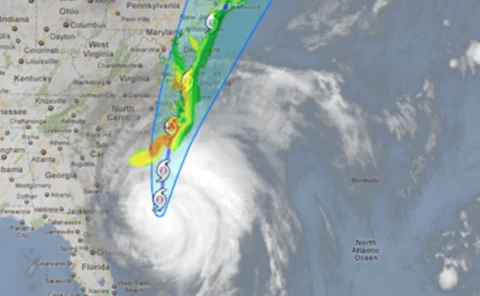

Insured losses for Hurricane Irene "manageable" $6bn

The insured loss estimate for Hurricane Irene is said to be between $3bn to $6bn making the impact on insurers “material” but “manageable”, according to Fitch Credit Ratings.

Governments leveraging private insurance skills

More governments are leveraging private insurance skills and the growing capacity of the sector to cover catastrophe losses as well as a wide range of other risks, according to Swiss Re in its latest sigma research publication.

No major Caribbean losses from Irene

The Caribbean Catastrophe Risk Insurance Facility has announced that, while Hurricane Irene resulted in registered losses in six of its member countries (Anguilla, Antigua & Barbuda, the Bahamas, Haiti, St. Kitts & Nevis and the Turks & Caicos Islands),…

Hurricane Irene could cost insurers as much as $6bn

Catastrophe modeling firm Air Worldwide estimates insured losses from Hurricane Irene to onshore properties in the US will be between $3bn and $6bn.

US reinsurers hit by claims

The Reinsurance Association of America says its group of 19 US property and casualty reinsurers wrote $13.8bn of net premiums during the six months ended June 30, 2011, an increase from the $12.3bn written in the first six months of 2010

Irene to cost insurers as much as $6bn

Catastrophe modelling firm AIR Worldwide estimates that insured losses from Hurricane Irene to onshore properties in the US will be between $3bn and $6bn.

Willis develops interruption cover in wake of recent disasters

Willis has responded to the devastating impact of the earthquake and tsunami that struck Japan in March by developing an insurance product to cover business interruption costs for companies in catastrophe hotspots.

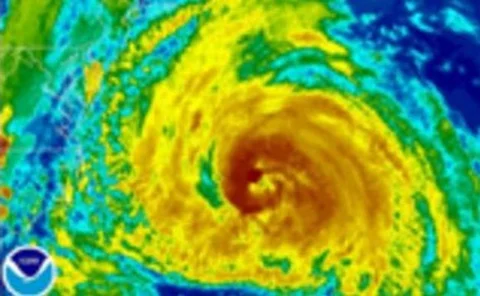

Hurricane Irene expected to reach cat 4

Colorado-based Lloyd’s underwriters ICAT has warned that Hurricane Irene strengthened significantly overnight and is now a category three hurricane.

Hardy's catastrophe losses still 'uncertain'

Specialist Bermuda-based Lloyd’s insurer Hardy Underwriting has said catastrophe losses added 30 points to its combined ratio and warned revisions of estimates could paint an even worse picture.

Market update - High net worth: Time to raise rates in HNW?

Rates in the high net worth market are failing to reflect the risks posed, despite high claims costs. Chinwe Akomah reports on a sector that is starting to come under pressure to deliver results.

Ecclesiastical hit with £419m catastrophe costs

Specialist insurer Ecclesiastical has managed to make a pre-tax profit of £15.6m despite a £7.6m loss in the first half of the year and catastrophe claims costs of £419m.

US insurers lost $27bn on H1 catastrophes

AM Best estimates US insurers’ pre-tax catastrophe-related losses in the first half of 2011, were $27bn, up $15.1bn, or 127%, from $11.9bn reported during the same period a year ago.