Natural catastrophes (Nat Cats)

New Zealand faces mass withdrawal as earthquake claims stack up

Insurers and reinsurers could stop providing earthquake cover in New Zealand altogether, forcing its government to handle claims.

BIS 2011: Industry must up government lobbying or risk unsustainable losses

Stronger engagement with national governments is essential to overcome the current insufficient focus on natural disaster mitigation and to push through long-term reforms that will help reduce total event cost.

In series - Lloyd's & London Market: Technological challenges

After a slow start, Lloyd’s and the London market are embracing technological developments to drive down cost, time and errors. But is its embrace of new mediums firm and fast enough?

NZ faces mass withdrawal as earthquake claims stack up – Insurance News Now

Post reporter Callum Brodie outlines this week's major general insurance stories including the possibility that insurers and reinsurers could stop providing earthquake cover in New Zealand altogether, forcing its government to handle claims.

Zurich stops writing NZ earthquake cover

Zurich New Zealand will no longer write any new earthquake cover following the catastrophes in Canterbury and Christchurch in February.

Insurers “competitive but cautious” at Q3 renewals, according to Marsh

Despite significant insurance losses in the first half of the year, insurers remain “competitive but cautious”, according to global broker Marsh.

Marsh report points to 'stable rate environment'

Insurers have remained competitive but cautious despite suffering significant catastrophe losses in the first half of the year, according to a Marsh study.

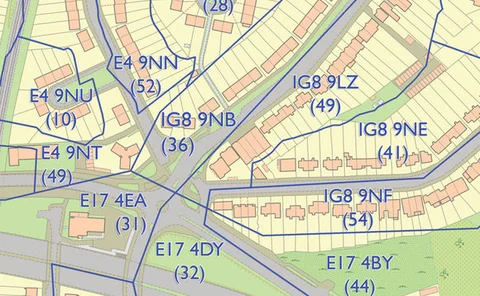

International geocoding in insurance: The challenges and opportunities

Use of geocoding is common in insurers and has been for some time but Tim Spencer asks if insurers really understand the data they have at their fingertips and are making the best use of it.

Ecclesiastical stops NZ quake cover

Ecclesiastical is to cease writing earthquake cover in New Zealand following the devastating series of earthquakes in Christchurch which contributed to the insurer’s biggest ever losses.

Editor's comment: Out of our hands?

With the bullish comments made by even the most cat-exposed insurers still echoing in our ears, declaring the global insurance market resilient in the face of one of the costliest years ever, the storm clouds are now gathering on multiple fronts from…

Lloyd’s places syndicates under financial scrutiny

Lloyd’s has begun an intense examination of syndicates’ 2012 business plans, in a bid to weed out unprofitable underwriting risk.

View from the top: Time for action

Insurers must fight to protect their fundamental purpose faced with the threat of external interventions, says Barry Smith, CEO, Ageas UK.

Atmospheric tanks: The big bang theory

The UK has recently seen a number of explosions involving atmospheric tanks, with major incidents at Buncefield and Pembroke. What caused the explosions and how can the risks be reduced?

Japan typhoon causing "minimal" damage

AIR Worldwide has estimated insured losses from Typhoon Roke are between $150m and $600m.

American broker blames barriers to entry for lack of interest in London

Reinsurance broker Tiger Risk Partners UK has claimed to be the first US-owned broker to set up a London office since 2003, blaming the lack of interest on the UK’s “significant barriers to entry”.

Lloyd's to only take on "inherently profitable" business plans

Lloyd’s has denied coming down harder on underwriters to write reasonably priced risks but admitted it will be more difficult to convince the market of profitable business plans.

Lloyd’s announces £697m interim loss

Lloyd’s made an interim loss before tax of £697m for the six-month period ending 30 June 2011, in what is already likely to be the second most expensive year ever for insurers.

AIR cuts loss estimates for Irene

Catastrophe modelling firm AIR Worldwide has cut its industry insured loss estimates for Hurricane Irene’s impact in the Bahamas to between $200m $400m (previously $300m to $700m).

View from the top: Business as usual

In May, when I last wrote this column, all eyes were on mid-year reinsurance renewals given the pummelling that the year’s natural catastrophes had already delivered to reinsurers.

AIR Worldwide links with Trillium to provide geocoding to insurers

AIR Worldwide and Trillium Software have reached an agreement to provide more precise geocoding.

French academic institutes join Willis Research Network

Willis Research Network has introduced two new French members to its network.

AIR updates European wind and earthquake CAT models

Catastrophe risk modeling firm AIR Worldwide has released updates to its Extratropical Cyclone and Earthquake Models for Europe.

Perils says cat total exceeded $2.5bn

Zurich-based European catastrophe insurance data group Perils has revealed that its industry loss index since the beginning of 2010 has exceeded $2.5bn.

Eastern European markets key to Austrian insurers' prospects

Prospects for Austrian insurers are closely linked to insurance markets in Central Eastern and Southern Eastern Europe, where more than one-third of their premium income originates, according to a new report.