Motor

Groupama acquisition could propel Ageas UK into top 10 insurer spot

The insurance industry is considering the effect of consolidation and change in the UK personal lines market after Ageas entered into exclusive discussions with Groupama with a view to taking over its UK insurance company.

Whiplash still on the agenda insists MoJ, as consultation delayed again

The Ministry of Justice has confirmed that the promised consultation on whiplash remains on its agenda, despite being delayed as a consequence of last week's government reshuffle.

Casualty insurers warned about recent legal deveopments

A ruling on pesticide manufacturers' liability, reforms to Spanish law on directors' and officers' cover and more stringent rules for Polish motor insurers, are among recent legislative changes with implications for European casualty insurers.

Autonet launches online vehicle information service

Autonet Insurance and software solution provider Cheshire Datasystems have developed a system that allows a vehicle's history to be checked online from its registration number.

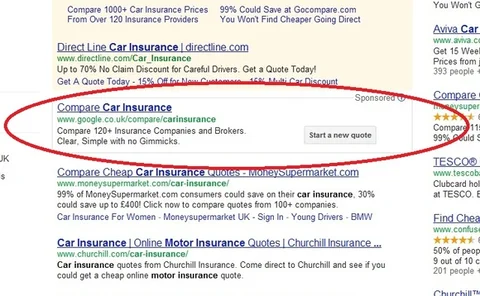

Google launches car insurance service

Motorists can now buy car insurance online from Google's comparison site.

Truell eyes up motor insurers

Edmund Truell, founder of Duke Street Capital and Pension Corporation, has not ruled out a future bid for Royal Bank of Scotland's insurance arm, Direct Line.

Tesco Underwriting CUO moves to RSA

Andy Baughan is to join the firm as motor product director.

Q&A with Chartis' Robert Schimek and Peter Csakvari

As the Russian insurance market continues to attract worldwide interest, Insurance Insight spoke to Rob Schimek, president of Chartis EMEA, and Peter Csakvari, general manager of Chartis Russia, about the potential in the Russian insurance market,…

Claims Club 10th anniversary: A decade of debate

The Post Claims Club will mark its 10th anniversary next year, and the group's advisory board looks back on a decade of change.

Esure profit up despite £8m flood loss

Esure has reported £60.2m in operating profit in the six months ended 30 June 2012 (H1 2011: £41.3m) and improvements to its loss ratio and combined operating ratio, despite the June floods adding £8m losses and 3.4% to the COR.

Autonet joins The Insurers' car insurance panel

Autonet Insurance has joined the car insurance panel with UK comparison site The Insurers, adding to its existing presence on the van and bike panel with the aggregator.

Groupama names bike underwriter

The French insurer has expanded its development team with the appointment of a new specialist motorcycle underwriter.

ABI to contest legal decision to bring forward 10% damages rise

The Association of British Insurers has requested a review of the Court of Appeal's decision to bring forward a rise in damages by 10% from April next year.

Motor start-up Purely Insurance scrapped after capacity walks away

A new motor underwriting start-up, fronted by a duo of former HSBC Insurance UK executives, has been scrapped, Postonline can reveal.

Italian motor policies five times those of European average

Third-party car insurance policies in Italy are five times more expensive than the European average.

Ageas mobilises anti-fraud database for motor book

Ageas has signed up to an anti-fraud database for underwriting and claims management in its motor book.

Zurich launches major UAE marketing campaign to raise GI profile

Zurich has launched a major new marketing campaign to support its suite of personal insurance products in the United Arab Emirates.

Admiral to slow UK growth despite 9% rise in profit

Admiral's pre-tax profit rose to £171.8m in the first half of 2012 (H1 2011: £160.6m) having increased the number of vehicles insured by 11%, or 350 000, to 3.5 million.

Carole Nash CEO pleased to defy "tough" 2011 with slight turnover growth

Carole Nash chalked up a modest increase in pre-tax profits to £5.93m last year (FY 2010: £5.86m), as turnover grew by just over £1m to £25.02m.

Equality Act: Age concern

The Home Office has exempted the insurance industry from the Equality Act, allowing underwriters to continue using age as a risk factor. But will Europe intervene as it did with gender?

Axa Assistance recruits former L&G boss for sales director role

Axa Assistance UK has appointed Adam Smith, pictured, as sales director to accelerate the growth of the company's large corporate partnerships business.

Autonet to launch on aggregator Uswitch

Motor broker Autonet is to place several van insurance products on price comparison site Uswitch imminently.

Italian motor and property markets offer opportunities, according to new report

Italy stands at the crossroads of economic and social change, and therefore offers interesting opportunities for the insurance industry.

IAG maintains silence on UK business sale

Insurance Australia Group has stressed that writing off its remaining goodwill and intangible assets in the UK business is not necessarily a sign that it will sell that division.