Legislation

PM health and safety war does not go far enough, says Garwyn CEO

Liability loss adjuster Garwyn has stated Prime Minister David Cameron’s attack on health and safety does not tackle the compensation culture.

Russian plant firms face ten-fold premium rises after new law

Stringent new legislation relating to the management and insurance of plants dealing in hazardous materials in Russia is set to have far-reaching implications for companies operating in the country.

Apil president raises 'grave concerns' following PM's promise

The president of the Association of Personal Injury Lawyers fears that David Cameron’s vow to clamp down on the perceived UK compensation culture could leave workers exposed to unnecessary risk of injury.

Cameron to ‘kill off’ health and safety culture

Prime Minister David Cameron’s New Year’s resolution is “to kill off the health and safety culture for good”.

EC data protection regulations could generate opportunities for cyber insurers

Draft regulations from the European Commission on data protection will impose significant demands on businesses and could generate new opportunities for cyber insurers, according to law firm DAC Beachcroft.

Insurers to continue payouts for pleural plaques

Insurers remain committed to paying out on pleural plaques cases in Scotland and Northern Ireland, despite claims that the Damages Acts in both countries are “fundamentally flawed”.

Fleet risk management: Risk on the roads

With government statistics showing a 7% annual increase in road accident fatalities during Spring 2011, should brokers be working harder on fleet risk management?

Review of the year - General insurance: Regulatory dramas

2011, a year dominated by regulatory and legislative change, could yet prove to be a landmark 12 months for the insurance industry.

Young women could see 11% rise in car premiums due to gender ruling

A study quantifying the economic impact on European consumers of the EU's gender ruling will hit young women hardest, with an 11% rise in car insurance premiums.

Equalisation reserve changes to impact insurers

Legislative changes to claims equalisation reserves will disadvantage insurers, a PwC analyst has warned.

Claims club: Claims teams must gear up to provide Solvency II documentation and evidence

Claims handlers are not exempt from the Solvency II requirements, according to Lloyd’s boss Luke Savage. The finance, risk management and operations director warned attendees that claims teams would have to ensure their documentation, technical provision…

Health & safety: A matter of interpretation

Health and safety reform is high on the government’s agenda, but is the problem with application rather than legislation?

Motor insurers set to share application data in suspected frauds – Insurance News Now

Post reporter Callum Brodie outlines this week's major general insurance stories including how motor insurers plan to share suspected application fraud data as criminals try multiple applications to get cars on the Motor Insurance Database as cheaply as…

Fire protection sprinklers: The market needs saturating

Despite research showing sprinklers significantly reduce economic damage and environmental impact following major fires, hopes for mandatory legislation remain low.

Taiwan's insurers urged to stop lending securities for shorts

Taiwan’s regulators have urged insurers to stop lending securities to short sellers seeking to bolster equities after the Taiex Index slumped.

Employment tribunal reforms likely to stir controversy

This law report has been contributed by national law firm Berrymans Lace Mawer.

Professional indemnity poll result

Are brokers in Italy prepared for an upsurge in business?

ANIA: tax burden hinders competitiveness in Italy

The Italian National association of insurance companies' managing director Paolo Garonna has lamented during a parliamentary audition that Italy's tax burden is significantly hindering companies' market competitiveness.

Agency workers: Temporary conditions

The Agency Workers Regulations will give temporary staff the same basic rights as permanent employees. What does this mean for liability policies?

Natcats and the insurance sector

The European Union is currently consulting on natural catastrophes. Vic Wyman reports on the part the insurance industry has to play.

The challenge of life sciences

Mid-sized life sciences firms offer an attractive opportunity for insurers in Europe with many entering the market. Yet as Francesca Nyman reports litigation and legislation make this a challenging market too.

US expected to achieve Solvency II equivalence

The US solvency regime for insurers is expected to achieve equivalence with the European Union's Solvency II requirements according to Fitch Ratings.

PI to be compulsory for professional body members in Italy

Professional indemnity insurance is to be made compulsory for all members of recognised professional bodies in Italy following new legislation.

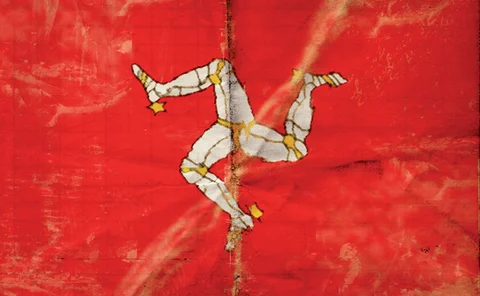

Island targets top spot as captive insurance domicile

Efforts to promote the Isle of Man as the captive insurance domicile of choice have been stepped up a notch following the island’s captive association attendance at the FERMA Conference.