Insurer

CIFAS: fraud remains “rife” in the UK

Data provided by the 265 member organisations of CIFAS – the UK’s Fraud Prevention Service - has revealed fraud remains rife in the UK.

Giles-owned MGA Ink rebrands

Giles-owned managing general agent Ink Underwriting Agencies has rebranded as Ink Insurance.

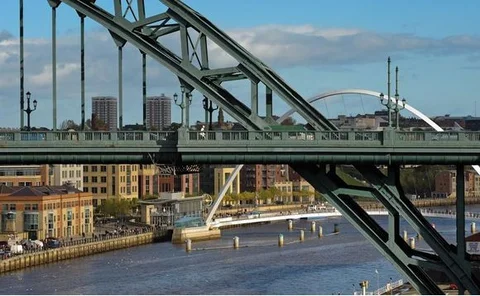

Allianz sets Newcastle in its sights

Allianz Commercial is set to expand its regional branch network with the opening of a new office in Newcastle.

Post Magazine and news editor Mairi MacDonald scoop major awards

Post Magazine scooped two prestigious gongs at last night's Association of British Insurers Media Awards.

Swiss Re almost doubles Q3 profit and terminates Berkshire Hathaway loan

Swiss Re reported third-quarter net income of $618m, compared to $314m in the prior-year period.

Swiss Re almost doubles Q3 profit and terminates Berkshire Hathaway loan

Swiss Re reported third-quarter net income of $618m, compared to $314m in the prior-year period.

Zurich reports 22% decrease in GI profit in 2010 Q3 results

Zurich this morning reported a business operating profit within general insurance of £2bn, a reduction of 22%.

Zurich reports 22% decrease in GI profit in 2010 Q3 results

Zurich this morning reported a business operating profit within general insurance of £2bn, a reduction of 22%.

RSA expects year end UK NWP to be up 10% after Q3 results

RSA this morning reported net written premiums for the nine months to 30 September 2010 of £5.531bn, an increase of 10% (7% at constant exchange) compared with the same period in 2009.

RSA expects year end UK NWP to be up 10% after Q3 results

RSA this morning reported net written premiums for the nine months to 30 September 2010 of £5.531bn, an increase of 10% (7% at constant exchange) compared with the same period in 2009.

Insurers appalled over surgeon’s ‘voluntary erasure’

Health insurers were “astonished” to be given only 24 hours to respond to a Harley Street surgeon’s application for ‘voluntary erasure’ from the medical register — after four years of building a case of evidence regarding improper conduct.

Markerstudy launches Malta insurer for non-motor risks

Markerstudy has been granted permission by the relevant authorities to launch a new Malta-based insurance company, St Julian's, as part of a push to broaden its risk appetite into more non-motor areas.

In series - Property claims: Wait less programme

Technology has the ability to deliver improvements and increase efficiency in property claims handling. Sam Barrett reports on some of the advances being made and the benefits they can bring.

Penny Black's insurance week

Penny understands that one managing director of an insurance firm had his moment in the sun last week.

Tesco Bank non-standard risk panel delayed for now

Tesco Bank has sidelined plans to launch a non-standard risks panel for its motor insurance customers.

Editor's comment: Fog clears for Allianz

The news that Allianz is to open its long-delayed office in Newcastle is certainly going to be greeted warmly by North-east brokers.

Repair Choice aims to reduce costs

Repair Choice has vowed to save insurers "substantial" time and cost on claims fulfilment, following the launch of its end-to-end vehicle repair service.

Postscript - 50 years ago: FPA gives advice on fire safety

Looking through Post's back catalogue paints a unique picture of more than 150 years of insurance news, as this highlight from 50 years ago reveals.

Claims - Private equity backing: Unlocking private equity

Private equity is not just the preserve of the insurer and broking sectors. Daniel Dunkley looks at how the claims sector has seen a fair share of PE investment, asks why this is the case and what it means for the firms involved.

McMillan: 'hard yards' in terms of savings already done

Aviva UK general insurance chief executive David McMillan has insisted the group's proposed £200m worth of new spending cuts will not amount to a "big headcount" reduction for his division.

ECJ ruling delivers blowover outsourcing VAT costs

VAT experts have predicted insurance companies could be liable for increased costs, after being dealt a blow by the European Court of Justice.

Comment - Competition commission: Devising the solution

The Competition Commission has delivered its final verdict on the UK payment protection insurance market. Martin Jenns reports on the result, what this means for the sector and how it can move forward.

Am Trust pulls deal after six weeks

Am Trust has withdrawn from a deal to provide capacity to UK General for a social housing insurance scheme just six weeks after it was signed.