Insurer

Welsh police crackdown on metal theft

Police in Gwent have arrested 862 people in connection with metal theft offences in the past 16 months- as the ongoing countrywide effort to crack down on the crime gathers pace.

Regional broker buys could boost Oval headcount by 200

Oval's plan to acquire insurance brokers in the next two years could add up to 200 more people to its 24-strong regional office network.

Amlin adds experienced non-executive director to its ranks

Amlin has appointed Shonaid Jemmett-Page, former chief operating officer of the UK government's CDC development finance institution, as a non-executive director.

Post Blog: Before they were famous

Great actors, fast food entrepreneurs and Olympians all have to start somewhere – sometimes even in the insurance industry.

Argent hands ex-Willis manager Scott business development role

Argent, a division of the Parabis Group, has recruited former global vacant property specialists VPS boss Chris Scott to the role of business development director.

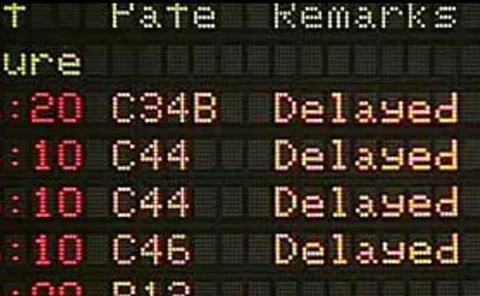

Travel claims double in China with flight delays main culprit

Flight delays are the main reason for claiming on travel insurance policies in China.

QBE records 26% increase in insurance profit in H1 2012

QBE Insurance Group made an insurance profit of $965m for the first half of the year ended June 2012, an increase of $203m on 2011.

Aviva Asia acquires stake in Singapore PIAS

Aviva Asia is to acquire a majority stake in the holding company that owns Professional Investment Advisory Services, a financial advisory firm in Singapore.

Dispute resolution: Mediation consideration

When should be mediation be used, and how can it settle disputes? Maurice Nichols explains.

Oval GWP jumps to £391m after 'substantial growth and contract wins'

Oval Insurance Brokers has posted a gross profit of £90m for the year ended 31 May 2012, a £4.7m increase on last year.

CCV chief operating officer Barr steps down

Graham Barr, pictured, has left his job as chief operating officer of Cullum Capital Ventures after less than a year.

Zurich boss hails 'strong' H1 results despite £19m flood loss

Zurich UK has admitted to losses of £19m as a result of the floods in the UK and Ireland during the first half of the year.

PWC: Eurozone crisis unlikely to cause widespread downgrades

The crisis in the Eurozone will not result in rating agencies downgrading general insurers en masse, according to PWC UK insurance leader Mark Stephen.

Williams: claims colleagues deserve equal pay and greater recognition

Axa's David Williams has called for parity in remunerating claims employees who possess equivalent knowledge and experience to their underwriting counterparts, as he departed the field last week to focus purely on underwriting.

Insurance Stategy 2012: Chartis UK MD Aubert to offer insights into volatile market

Chartis UK managing director Nicolas Aubert will join the Insurance Strategy line-up next month to take part in a panel discussion.

Fitch upgrades Hiscox to A+

Fitch Ratings has upgraded Hiscox Group's core entities insurer financial strength rating to A+ owing to the Lloyd's player's "track record of profitability".

Aon Risk Solutions appoints new broking head after restructure

The former head of broking, corporate and affinity has been promoted to head of broking following a business reshuffle.

Willis: Unprecedented stability for aviation market

The lack of large losses in aviation has created stability, a report has found.

Solarif extends PV cover after customer demand

Solar Insurance and Finance has expanded its policy terms and conditions for solar photovoltaic insurance to "align with customer wishes".

Indian resolution poll

Is a resolution mechanism needed for India?

Boom times ahead for India's online insurance market

India is experiencing internet growth at a time when consumers are more comfortable buying insurance online, creating opportunities for insurers with a successful online strategy, according to Anushri Bansa, Rajesh Sabhlok and Vivek Jalan.

Hiscox entities upgraded to 'A+'

Hiscox Group's core entities insurer financial strength ratings have been upgraded to 'A+' from 'A'.

Understanding cyber risks

Cyber risks have become high profile but, as David Froud explains, insurers need to conduct more than simple Q&A assessments to understand the true nature of a company’s data value and the potential cost of a loss.

Cyber insurance struggles to take off in Europe

Cyber exposures are headline news but, as Francesca Nyman reports, with ample capacity in the market and a lack of regulatory guidance, insurance uptake remains low.