Insurer

ULR Additions to rebrand as Motorplus

ULR Additions has vowed to refocus on the products and services “in which it excels” following a rebrand that will see the company name changed to Motorplus.

Client demand tipped to trigger broader coverage for terrorism 'non-events'

The changing face of global terrorism is likely to cause an influx of insurance products to target terror-related threats as the scale and scope of terror events expand.

Biba bites: Russell Bence

Post caught up with Markerstudy’s Russell Bence, ahead of the Biba conference in Manchester.

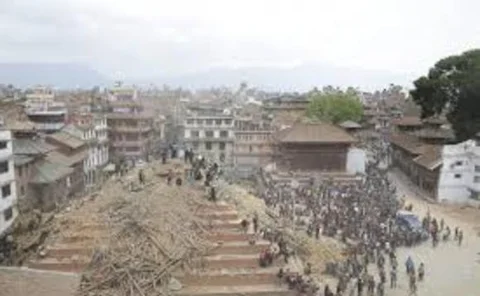

Allianz Global Assistance repatriates 55 travellers following Nepal quake

Travel assistance provider Allianz Global Assistance is continuing to provide assistance to travelers affected by last month’s earthquake in Nepal.

IRM unveils guidance to ensure Solvency II risk models are 'fit for purpose'

The Institute of Risk Management’s Internal Model Industry Forum has published a guidance document based on its research into the effective validation of risk models created by the insurance industry to comply with the requirements of Solvency II.

Marintec and Partner Re strike strategic partnership

Italian underwriting agency Marintec has announced a strategic partnership with Partner Re Wholesale, the specialist SME division of global reinsurer Partner Re.

Trust Insurance Campaign: A thirst for knowledge

The Chartered Insurance Institute’s Made Simple campaign is the result of a year spent listening to customers and realising how much uncertainty surrounds insurance – and how much the buying public wants to learn.

FCA finds insurers and brokers wanting on premium finance advice

The Financial Conduct Authority has found insurers and brokers do not always provide customers with clear information about payment options for general insurance products.

Allergies: Food for thought

A tightening of regulations around food supply should be good for consumers – and consequences of businesses getting it wrong are serious.

Bangkok Insurance warns on Thailand premium growth

The CEO of Bangkok Insurance Chai Sophonpanich has warned that general insurance premiums will only expand by 5% this year as opposed to the target of 9%.

Latest insurer data leak reignites calls for tougher CMC regulation

Insurers and claimant lawyers have united in calling for tighter regulation of the claims management industry after the latest data breach involving an insurance company employee selling confidential customer information sparked a police inquiry.

ABI's Evans praises government as one insurers can work with

Association of British Insurers director general Huw Evans has deemed the Conservative government elected today (8 May) as one the insurance industry can work with.

Civil justice issues in danger of being sidelined by EU referendum

An insurance law firm has warned of a "strong possibility" civil justice reforms will take a back seat under the newly elected Conservative government while it focuses on the proposed 2017 European Union referendum.

Insurance rates decrease for eighth consecutive quarter, states Marsh report

Global insurance rates decreased during the first quarter of 2015, according to the results of Marsh's latest market quarterly briefing.

Watson hails commercial action plan for improved COR

Ageas UK CEO Andy Watson says the 31.6 percentage point improvement in his firm's commercial combined ratio for the first three months of 2015 was the result of a sustained action plan of which the next phase is to grow the account.

Nepal earthquake to have minimal impact on global reinsurers

A.M Best believes that the recent earthquake in Nepal is not expected to have a major impact on the current reinsurance market, but local and regional players will feel some adverse effects.

Case managers guide to be published alongside rehab code this summer

Proposed changes instigated as part of a revised rehabilitation code will include a separate process for lower-value injuries and the introduction of an accompanying guide for case managers.

The insurance quiz of the week

How much do you know about insurance developments in the last seven days?

Ageas reports ‘profitable but challenging' Q1 figures

Ageas UK has reported a net profit of £12m for the first three months of 2015 compared to a loss of £4.5m in the same period of 2014.

Ageas COO Barry Smith to retire

Ageas Group chief operating officer Barry Smith is to retire as of 1 October 2015 and will be succeeded by AG Insurance CEO Antonio Cano.

ICA appoints Russell and Troup to its board

The Insurance Council of Australia has appointed David Russell, CEO of RAA Insurance and Helen Troup, managing director, Commonwealth Insurance to its board of directors.

Generali Asia secures option to buy 70% of Malaysia's MPIB

Italian giant Generali has completed the purchase of a 49% stake in Malaysia general insurer Multi-Purpose Insurance to enter its tenth Asian market.

Markerstudy launches affinity 'super division'

Gibraltar-based personal lines insurer Ultimate Insurance Company co-founder Paul Hampshire will lead a new affinity “super division” launched by Markerstudy Group.

RSA boss Lewis hopeful for Irish division turnaround in 2016

RSA UK and Western Europe CEO Steve Lewis is confident the insurer's Irish business will be moving towards profitability in 2016, but has admitted there is still a lot "heavy lifting" to do in the division.