Insurer

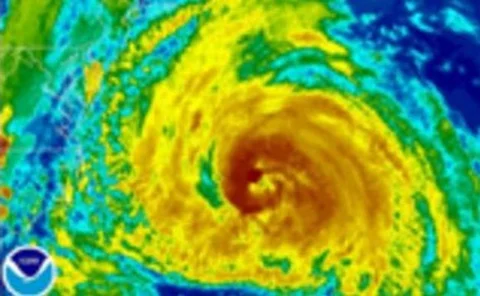

Hurricane season leaves companies facing rating pressures

Insurance companies could be left facing rating pressures as the potential for continued hurricane-related activity increases throughout the peak season, according to experts at A.M. Best Co.

Insured losses from Irene could reach $3.4bn

Risk modelling firm Eqecat has estimated that hurricane Irene could cost insurers between $1.8bn and $3.4bn.

Columbus Direct to offer ash cloud cover

Columbus Direct has launched a new ash cloud travel cover designed to protect customers in the event their travel plans are disrupted by a volcanic eruption.

Keelan Westall and CKW renegotiate claims deal

Property insurance brokers Cadogan Keelan Westall and Keelan Westall have renegotiated their delegated authority agreement with insurer Zurich to allow the in-house claims team to process and settle claims up to £5000 net of policy excess.

Omega points to H1 catastrophes following early losses

Record industry-wide catastrophe losses have been blamed by Lloyd’s insurer Omega for an after-tax loss of $44.5m (£27.2m) in the first half of 2011.

Audience with Zurich: Techmedia sector in the spotlight

Zurich Insurance today launched independent research which found that more than half of Britain’s mid-size technology companies feel at risk from losing skilled employees, with the figure rising to 70% amongst companies with a £25-£100m annual turnover.

L&G puts Holweger in charge of brokers

Legal & General’s general insurance business has appointed Coverwise founder Mark Holweger to the new role of broker & intermediary director.

Guernsey comes top in domicile poll

Guernsey's position as one of the leading captive insurance domiciles globally has been reinforced by the results of a new study into the sector.

No major Caribbean losses from Irene

The Caribbean Catastrophe Risk Insurance Facility has announced that, while Hurricane Irene resulted in registered losses in six of its member countries (Anguilla, Antigua & Barbuda, the Bahamas, Haiti, St. Kitts & Nevis and the Turks & Caicos Islands),…

Swiss Re warns of challenging market for Nordic insurers

In Oslo today, Swiss Re, will use its flagship Nordic Risk & Insurance Summit conference to warn that the economic environment in the wake of the financial crisis is still very challenging and turbulent.

Hurricane Irene could cost insurers as much as $6bn

Catastrophe modeling firm Air Worldwide estimates insured losses from Hurricane Irene to onshore properties in the US will be between $3bn and $6bn.

RDT reports 36% growth

RDT has reported a 36% year-on-year growth in turnover as it celebrates two decades of trading.

Insurance Insight weekly update live

Insurance Insight’s weekly update is live with an article on harmonising European compensation systems; and an article on the opportunities for brokers in the international PMI market.

US Solvency equivalence poll results

Find out what the market voted for on Solvency II equivalence in the US.

Compensation harmonisation across the EU

The European Union has a raft of measures to try and achieve harmonisation between member states but as Sarah Hamilton reports there is a long way to go in achieving a single compensation system.

International PMI: the brokers opportunity.

Many brokers fear branching out into unknown lines but Tim Mutton argues there is an excellent untapped opportunity for many European brokers in the international PMI market.

QBE launches travel product alongside RMCI

QBE has teamed up with yearabroadinsurance.com, a trading name of RMCI Insurance Brokers, to offer a new travel insurance product designed for students studying and working overseas.

Antares appoints new compliance chief

Lloyd’s insurance firm Antares has named Lucy Peake as its new compliance manager.

Half of UK’s brokers managing schemes

Schemes specialist insurer MMA has today revealed a new study that suggests a significant uptake in the number of brokers undertaking schemes work.

Phoney insurer stopped after Gibraltar regulator warning

The website of the alleged phoney car insurer Unique Car Insurance has been disabled after the Gibraltar Financial Services Commission warned the public the firm was not regulated as claimed.

Willis develops nuclear exclusion risk cover

Willis Group Holdings has developed insurance to cover business interruption costs for companies with key locations, suppliers or customers situated in the vicinity of a nuclear power station.

Polish insurer PZU sees profits rise after restructure

PZU SA, Poland’s largest insurer has posted profits up 33% after major restructuring.

Swiss insurance market remains stable

Fitch Ratings has said its sector rating outlooks for the Swiss life and non-life insurance sectors remain stable, despite the challenges of financial market turbulence and low interest rates.