Insurer

‘Complementary’ Sterling deal tipped to boost Covéa’s growth ambitions

Insurer edges closer to top 20 insurers with acquisition of HNW specialist

Dual pricing looks certain to come under FCA spotlight warns ABI chairman

Evans equates practice to bank teaser rates currently being scrutinised by FCA

ABI 2014 Motor Conference round-up

All the big stories from the ABI motor conference.

Editor's comment: The regulation pantomime

As we head into the pantomime season, it seems the insurance market’s Sleeping Beauty has awoken – and she means business.

PRA senior insurance managers regime sparks fears of bank-like regulation

Consultation reveals plan for more stringent controls on senior staff

ABI boss Evans urges fraud task force to take on CMCs

The Association of British Insurers has joined member firms in welcoming the government’s decision to launch a fraud task force, but claimed it must tackle claims management companies if it is to be deemed a success.

Insurers urged to avoid repeat of credit hire ‘debacle’ in future FCA reforms

Association of British Insurers chairman Paul Evans has called on member firms to “not wait until the last possible moment” to act on expected regulatory interest around introductory offers for new customers.

C-suite - Insurer: Scaling the mountain of bad press

What can the industry do to quell the forces of negative sentiment?

Roundtable: Customer retention: Holding on to customers in the aggregator age

With price comparison sites making customers more price-focused than ever, how can insurers ensure they stand out for other reasons and also improve their retention rates?

MoJ’s Grayling outlines 1 April start for whiplash portal MedCo

The new regime to accredit and distribute work to medico legal firms will go live on 1 April 2015 it was announced today.

CMCs face new regulation after MoJ sets up Hertzell-led fraud task force

The Law Commissioner David Hertzell, pictured, is to chair a new government fraud task force that could lead the way for greater regulation of claims management companies.

No amendments added to 'fundamental dishonesty' Bill in Commons reading

The Criminal Justice and Courts Bill received no further amendments during its latest reading in the House of Commons yesterday, despite criticism from the shadow justice minister relating to clause 56 on fundamental dishonesty.

Review of the Year: Legal

Grabbing the headlines in the legal sector this year were M&A activity, closer ties between insurers and law firms and the ongoing fallout of civil justice reforms. Key figures from the sector give their views on 2014

MP moots option of second CMA review into motor insurance

A Conservative MP has raised the prospect of a second Competitions and Market Authority review into the motor insurance sector after the next election.

Legal Update: Autonomous Vehicles: Motor evolution is imminent

Nick Rogers explores the coming changes to insurance that driverless cars will bring

Penny Black’s Insurance Week - 4 December

There is nothing like adversity to bring people together, especially when it is being played out in both the national media and the insurance trade press.

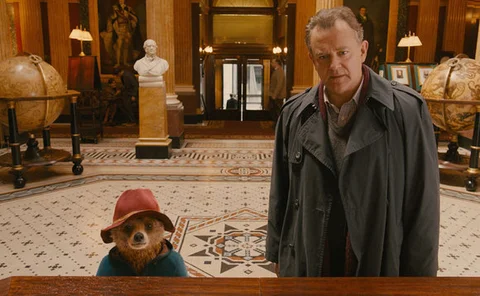

Penny Black's Social World – Hugh Bonneville: Risk assessor?

Hugh Bonneville, best known for his roles as Lord Grantham in Downton Abbey and BBC head of values Ian Fletcher in W1A, has taken on a new role. In his latest film, Paddington – from the producer of the Harry Potter series – Bonneville plays Mr Brown, a…

Claims Club News: Connected-home devices could cut claims costs

Insurers can proactively reduce their claims costs by encouraging the uptake of connected-home devices, according to Ninety Consulting’s Geoff Knott.

Claims Club News: Insurance implications of automated cars depend on level of human interaction

The extent of human interaction is one of the biggest challenges companies face in the race to develop driverless cars.

Claims Club News: Periodic payment orders tipped to make up a third of insurers’ liabilities

Periodic payment orders could account for a third of insurers’ future liabilities amid increasing frequency in bodily injury claims, according to KPMG non-life actuarial partner David Brown.

Career development: Covéa commercial claims team wins customer service accreditation

Covéa has obtained the Institute of Customer Service’s Service Mark accreditation for commercial claims.

Market Moves - 4 December 2014

All the latest job moves in the insurance market.

Open GI and Powerplace complete MBO worth upwards of £300m

Open GI and sister company Powerplace have completed a management buyout valued in excess of £300m after tying up a deal with Montagu Private Equity following approval form the Financial Conduct Authority.

Richfords founder to takeover as chairman of BDMA

Steven Richford, founder and managing director of Richfords Fire and Flood, will takeover as chairman of the British Damage Management Association from 1 December.