Reinsurance

Katrina may see capacity cut rethinks

London Market News

Adjusters awaiting Katrina green light

The insurance industry was holding its breath as the true extent of the damage caused by Hurricane K...

Could Katrina bring new investment and harder rates?

It was interesting that Lloyd's considered cancelling its first capacity auction this week following...

Wellington CEO predicts positive price impact

The chief executive of Wellington Underwriting said positive moves in its share price this week coul...

BHSF Vauxhall deal after MG Rover loss

Health Report

Fitch to review 'stable' outlook

Ratings agency Fitch said on Tuesday it would reconsider its stable outlook for the reinsurance sect...

Reinsurance rendezvous

Monte Carlo Preview

Katrina figures are misleading

Figures estimating insurers' losses for Hurricane Katrina are wildly misleading because "information...

New corporate start-up targets 5% market share

Benfield formally launched its new primary broking operation this week, with the stated ambition of ...

Beazley to rethink capacity after Katrina

Beazley Group has confirmed that it will be rethinking its strategy to drop capacity for 2006 in the wake of Hurricane Katrina.

Hurricane Katrina’s impact by industry sector.

Aon has commented on the effects of Hurricane Katrina on various sectors of the industry including Oil & Gas, Agribusiness, Transportation, Aviation, Property, Security and Film and Television.

Katrina possibly biggest ever hit on market, claims Brit CEO

Losses from Hurricane Katrina could be the largest ever to hit the (re)insurance market, according to Dane Douetil, chief executive of Brit.

Global reinsurance sector stable, claims Fitch

Fitch Ratings’ latest global report has maintained its Stable rating Outlook on the Global reinsurance sector.

Goshawk joins market in predicting "substantially improved rates" in Katrina's wake

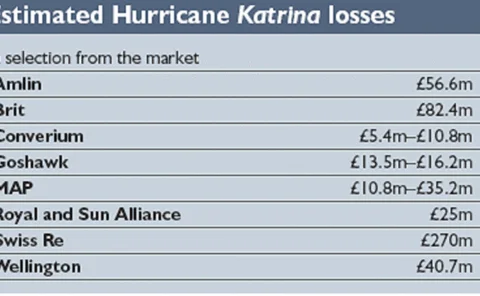

Goshawk has estimated that as a result of Hurricane Katrina it will incur losses on its property and marine books of business.

Brit expects Katrina to "extend the hard market" as it reports £112.2m profit

Brit today reported profit before tax of £112.2m, up 61.0%, for the first six months of 2005. It added that it believes Hurricane Katrina would help extend the hard market, and that “Brit is extremely well positioned for the opportunities that this price…

Lloyd's auctions on despite market uncertainty

Lloyd's admitted it was under pressure from managing agents to cancel or delay the market's annual auctions, due to begin today, because of losses arising from hurricane Katrina.

Wellington hurricane losses equal to entire '04 season

Lloyd's insurer Wellington Underwriting has estimated a net loss of $75m (£40.7m) from hurricane Katrina, which is comparable to the losses it incurred from the entire 2004 hurricane season.

Katrina: Newspaper damage estimates are

Sunday newspaper figures estimating insurer losses for Hurricane Katrina are wildly misleading because “information is scant” according to Joe McMahon, managing director of loss adjustor Bateman Chapman.

Katrina damage estimates climb

Estimated insured losses from Hurricane Katrina's direct impact have increased to $20-$35bn, according to Risk Management Solutions (RMS).

Amlin forecasts Katrina loss as $110m as it unveils record first half profit

Lloyd’s insurer Amlin this morning reported half year profit before tax of £134.1m, up 56% over first half of 2004. However, it warned that its net losses attributed to Hurricane Katrina had been provisionally estimated at $110m.

RMS hikes Katrina loss estimate to $100bn

Risk Management Solutions has claimed that the economic loss from Hurricane Katrina and subsequent flooding in New Orleans is expected to exceed $100 billion.

Katrina: AM Best positive, but sees some downgrades

AM Best has stated that it expects that virtually all rated companies will be able to meet their commitments arising form hurricane Katrina, despite the projected magnitude of the potential losses, although it said that “a few individual companies’…

Hannover Re hit by Katrina

Hurricane Katrina is possibly set to become the most expensive ever natural disaster suffered by insurers in industry history, according to Hannover Re. Estimates of the total insured losses currently amount up to $30bn.

Moody’s doubts P/C rating action over Katrina

Moody's Investors Service has stated that despite the apparent severity of Hurricane Katrina, it does not anticipate taking extensive rating actions on property & casualty insurers.