AIG

Post Intelligence Benchmarking - Commercial Insurers: Waving - or drowning?

Insurance 360's groundbreaking survey of commercial insurers' performance reveals which ones have got their acts together and which ones need to raise their game. Peter Joy reports.

View from the top: Time for a reality check

Operating efficiently and profitably in a recession certainly focuses the mind as most of us are all too well aware. The characteristics of this recession for the commercial insurance market are, perhaps, different compared with previous downturns.

Regional review - Leeds: Leeds from the front

Leeds is a vibrant and thriving market, reports Amy Ellis, with many insurers —and possibly too many brokers — setting up shop in the heart of west Yorkshire.

Travel insurers go it alone on fraud database

Mondial Assistance has called for a travel insurers' database, after revealing it has entered a data sharing agreement with four other insurance firms.

ABI and Apil lead calls to reject asbestos ruling

Personal injury lawyers are urging all insurers to continue paying claims for mesothelioma on a traditional basis until the issue over policy triggers is ultimately resolved — which could take another year.

Top six insurers only ones safe from SII M&A wave

The incoming Solvency II regime could lead to increased merger activity among European mid-tier insurers, Allianz's Andreas Berger has claimed.

Major brokers fail to sign Aldermanbury Declaration

Three of the UK's major brokers are conspicuous in their absence from a list of signatories to the Chartered Insurance Institute's Aldermanbury Declaration.

Ironshore names vice president

Peter Ignell has been appointed vice president of Ironshore Insurance Services.

Post Europe: European rates review

Insurers’ appetite to diversify into new product lines and geographical areas is bringing heightened levels of competition to lines across Europe. In the short term this is of benefit to insurance buyers but Edward Murray asks what the long term impact…

Top 100 UK insurers - 2009

AM Best's top 100 insurer rankings in full, according to Financial Services Authority returns for 2009.

BIS 2010 - News: ERM reduces volatility

In highlighting the need for clients to understand an insurer's risk, Nigel Bamber, XL Insurance head of client relationship management UK, asked: "Is the insurer like a doctor who smokes?"

Antur Insurance warns ambulance companies on getting the right cover

Antur Insurance said it has seen a rise in the number of new enquiries from private ambulance companies that are operating without the correct insurance cover.

BIS 2010 - News: UK industry 'too fragmented' to have international impact

The UK insurance industry may fail to get its voice heard at home and on an international stage because it is too "fractured".

Bahrain firms eye UK Takaful tie-up

A joint venture between UK-based distributors and Middle-Eastern insurers is the most successful formula for launching a Takaful operation in the UK, according to the chief executive of the Bahrain Economic Development Board.

Interview - James Shea: Going back to basics

Two years on from 'AIG day' Mairi MacDonald met the newly appointed managing director of Chartis UK James Shea to discover his plans for the company.

Editor's comment: Breaking up: hard to do?

Last week's British Insurance Summit certainly stirred up some lively debate within the walls of the conference facility, as well as in the blogosphere and on social networking sites.

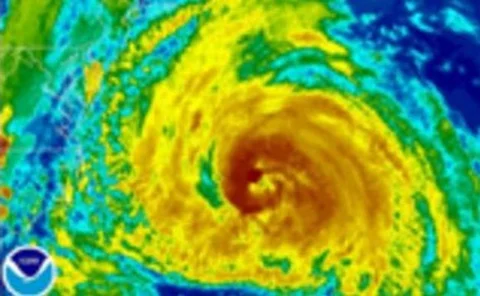

Top 100 Insurers 2010: Navigating choppy waters

This year's top 100 rankings show the major players dropping anchor in stormy seas, while smaller groups make waves of their own with significant jumps in GWP. Jonathan Swift examines the statistics.

Brand analysis: A robust year for insurance brands

Despite the ongoing disruption in the financial services sector, the brand value of insurers has seen a healthy increase. James Park reports on the results and looks at the opportunities for the coming year.

Post powerlist 2010: The influential crowd

Over the past 12 months the UK insurance industry has faced the global recession head on, taken the change of government in its stride and has shown that it is ready to face oncoming regulation in the form of Solvency II. Below we name the major players…

Top 100 UK insurers - Top 20 spotlight

Sponsored by KPMG

Legal: Deafening whispers

Potentially massive claims related to financial products and major economic events such as the Madoff case and the collapse of Lehman Brothers indicate that reinsurance should brace itself for an upturn in disputes, writes Michael Lum

Rethink: Rates caution as Monte Carlo approaches

Our monthly round-up of readers' opinions shows that rates are stable with little sign of imminent change as the market gears up for the Monte Carlo Rendezvous.

Q2 cat bond issuance surge

Guy Carpenter has announced the completion of eight catastrophe bond transactions, totaling $2.05bn of risk capital as investor appetite remains strong.

BIS 2010: Baugh claims UK insurance industry lacks cohesive voice

The UK insurance industry may fail to get its voice heard at home and on an international stage because it is too “fractured”.