News

‘Significant increase’ in tinnitus claims since whiplash reforms

Law firm HF has warned that tinnitus has become a common symptom appearing in road traffic accident claims since the whiplash reforms.

Covéa and Markel win Covid BI reinsurance disputes

Covéa and Markel have won a court battle to secure reinsurance cover for Covid-19 business interruption losses.

IFB warns of uptick in ‘underreported’ romance insurance fraud

Following the rise in romance insurance fraud, when a fraudster takes advantage of a romantic partner to extort money out of either them or an organisation, the Insurance Fraud Bureau has told Insurance Post that the issue remains ‘underreported.’

Tysers on the necessity for ‘data-driven’ transformations

Steve Jolley, chief information officer at Tysers, shares how the company transitioned from a traditional to a “truly data-driven” digital insurance platform with low-code.

Insurance surge brings Money Supermarket record revenue

Increased premiums meant consumers shopped around more in 2023, which means Money Supermarket's insurance revenue increased 28% in 2023, leading to the group generating “record revenue”.

Aviva to return to Lloyd’s ‘by the end of the year’

Aviva will be in Lloyd’s by the end of the year, after years of rumours suggesting the insurer's return to the marketplace, a source has told Insurance Post.

Allianz exposes fundamentally dishonest hearing loss fraudsters

Allianz, along with DWF, has successfully seen two court cases for noise-induced hearing loss dismissed by judges, following the claimants being found to have been fundamentally dishonest.

Nigel Walsh named global head of insurance at Google Cloud

Walsh revealed in a LinkedIn post that he was starting his “next chapter at Google Cloud”.

Shaw promoted to CEO at Tokio Marine Kiln

Tokio Marine Kiln has promoted its chief underwriting officer, Matthew Shaw, to CEO amid leadership changes at parent group Tokio Marine.

Insurers liable for loss of credit hire rental income, rules Supreme Court

The Supreme Court has ruled that insurers are liable to pay for loss of rental income when credit hire vehicles are taken off the road by traffic accidents.

SSP in a ‘process’ to rebuild trust with clients

Following a data breach in November 2022, as well as other disruptions over the past few years, SSP has been investing in its security measures and is currently in a process to rebuild trust within the industry

How the Post Office scandal set a new precedent for ATE insurance

Alan Pratten, chair of M&A, litigation and tax insurance solutions at Gallagher, details the broker’s involvement in the well-publicised Post Office scandal, and how this particular case changed the placement of after the event insurance.

Allianz’s claims fraud savings; WTW’s cyber facility; Biba’s London committee chair

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Allianz's Dixon among raft of senior hires heading to Dual

Former Allianz chief underwriting officer Catherine Dixon is set to join Dual UK in June amid a raft of senior appointments.

Aviva looking to expand in London Market and specialty lines

Following an internal restructure and a business simplification exercise, Aviva is looking to expand its presence in the specialty and London Markets.

CRIF calls on insurers to challenge ESG credentials in the supply chain

CRIF has launched its own ESG evaluation tool to support UK insurers to better assess risks, ahead of prospective regulations, Insurance Post can reveal.

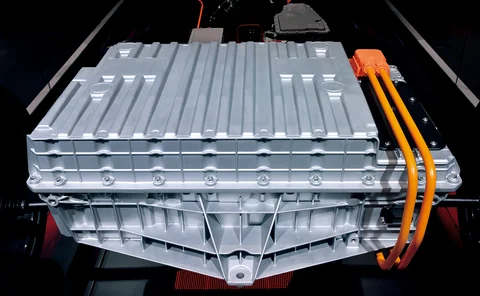

LV partners with Altilium and Synetiq to recycle EV batteries

Clean technology group Altilium has announced a partnership with LV and vehicle salvage supplier Synetiq, aiming to recycle electric vehicle batteries from written-off vehicles.

Admiral partners with Google Cloud for new products

Admiral has struck a deal with Google Cloud, which will see the technology giant host the provider’s policy management and billing platforms plus use generative artificial intelligence to produce new products and services.

Ombudsman tells pet insurers to be more ‘interrogative’

The Financial Ombudsman Service has confirmed that it has communicated with pet insurers over a string of exclusions-related complaints.

Post launches new Benchmarking Service

Insurance Post’s unique service will benchmark UK insurers’ strategies across key areas, including claims, fraud and technology.

RSA acquisition of NIG to close at start of May

RSA’s acquisition of Direct Line Group’s brokered commercial lines business is set to be completed on 1 May.

Canopius loses arbitration over hair salons’ Covid claims

More than 300 small businesses that had claims declined by Canopius did in fact have cover for Covid-19 closures, a judge has ruled following arbitration.

Impact of hidden plastic pipework on claims costs laid bare

Analysis of more than 3000 escape of water claims by McLarens found that “trace and access” cover was required in more than half of all claims (51%).

Deadline to enter British Insurance Technology Awards fast approaching

The countdown has started for you to get entries in for the inaugural 2024 British Insurance Technology Awards (BITAs).