News

Barbican Insurance group merges capabilities into single brand

Barbican Insurance Group has launched Barbican Protect, which brings together the underwriting expertise and service capabilities of Barbican Underwriting Limited, PI Protect and Barbican Channel Islands into a single brand.

Reinsurance pricing floor remains elusive at 1 January renewals

Despite the signs of pricing stabilisation in peak property catastrophe zones at the June/July 2015 renewals, the forecasts for a “softening in the softening” in reinsurance pricing have proved illusory, according to Willis Re.

Airmic urges a 'pragmatic and flexible' approach for corporate customers following flooding

The current flooding in the north of England has underlined the need for businesses to buy insurance that is fit for purpose, and to support it with effective crisis planning according to the Association of Insurance and Risk Managers.

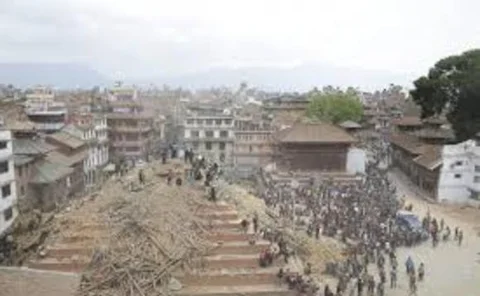

Insured catastrophe losses were $27bn in 2015, says Munich Re

Insured natural catastrophe losses were $27bn (£18.3bn) in 2015 down from $31bn in 2014 and an average of $34bn over the past 30 years according to reinsurance giant Munich Re.

Di Meo leaves Italy for Generali Asia broker role

Giovanni di Meo has left his marketing role at Generali global corporate and commercial in Milan for a broker leadership role in Asia.

Penny Black's New Year 2016

As the insurance industry rings in the New Year, Penny Black asked commentators how they like to celebrate and what resolutions they will be making for 2016.

EY predicts busy 2016 for insurers with SII implementation

Professional services firm EY has warned insurers and regulators to prepare for a busy 2016 as companies start to embed the Solvency II Directive.

Penny Black's Ghost of Christmas Keys

Last year at Keycare alone, 25 claims were made on Christmas Day for lost keys. Penny wonders if the ghosts of Christmas Past, Present or Future were involved.

More rainfall predicted as Cunningham Lindsey calls in international team to help cope with Storm Eva claims

A team of specialist property adjusters, from Cunningham Lindsey's overseas offices in Canada, New Zealand, Australia and South Africa, will be arriving in the UK from 5 January 2016 to boost the firm's expert technical resources.

Penny Black's Christmas disasters 2015

Penny Black has asked insurers to share their stories of Christmas disasters. Loss adjusters have also told her about their most festive business claims.

Government insists whiplash reforms will be introduced "as soon as possible"

Insurers have committed to give customers 100% of the savings made from new Government reforms to reduce fraudulent whiplash claims, it was announced today.

Insurers warned flooding losses could exceed £1bn in wake of Eva

The insured losses from the 2015 flooding could exceed £1bn in the aftermath of storm Eva, endangering some firm’s end of year results, an industry expert has warned.

Alistair McGowan stars in latest Protect Your Bubble TV ad

Specialist insurer Protect Your Bubble has today (24 December) launched the latest advert in its TV campaign series, focusing on its gadget insurance product.

Crawford appoints Malaysia boss Fong to Asia CEO role

Crawford & Company has promoted the boss of its Malaysian operation, Phillip Fong, to the role of CEO of Asia.

Customers hit by flooding get policy extension from Euler Hermes

Trade credit insurer Euler Hermes is offering a 30 day policy extension for clients hit by Storm Desmond or subsequent flooding.

Storm Eva to bring more rain to northern England

More bad weather and possible flooding is on its way to northern England ahead of Christmas, with Storm Eva set to bring heavy rains and up to 70mph winds in coming days.

Trak Global hires CIS engineering boss Street

Telematics specialist Trak Global has hired The Cooperative Insurance Service’s former national engineering and technical manager Nick Street to the new position of insurer solutions and claims manager.

Xchanging and CSC deal moves closer

A deal between technology provider Xchanging and US-based Computer Sciences Corporation (CSC) is closer today with CSC purchasing another 10% of Xchanging shares.

Unrecovered stolen vehicles cost insurers £450m last year

Stolen vehicles not recovered by police represent an estimated £450m cost to insurers in 2014, based on figures from a Freedom of Information request by anti-fraud company Asset Protection Unit (APU).

Watchstone shares skyrocket as ex-Quindell investors receive pay-out

Shares in the business formerly known as Quindell have skyrocketed following the re-named Watchstone Group’s re-entry onto the junior AIM stock exchange.

P&I clubs to face premium pressure in 2016

Protection and indemnity insurance will face premium pressure at 1 January 2016 renewals, according to analysis from Willis Group.

Broker banned by FCA for failure on client money

Insurance broker Vroni O’Brien has been banned by the Financial Conduct Authority from undertaking any functions of “significant influence” after it was found she transferred money incorrectly between business and client accounts.

Renewal of DLG contract with RBS questioned by research firm

The future of Direct Line Group’s home insurance contract with RBS has been questioned in the aftermath of Nationwide’s decision to switch underwriting responsibilities to RSA.

Covéa reports 180% increase in claims volumes after floods

Covéa Insurance has experienced a 180% increase in claims volumes to date as a result of Storm Desmond which hit North West England on 5 and 6 December.