Lloyd’s/London

European risks not "significantly" increased claims Ceiops

Risks have shifted in the EU/EAA area, although the recent developments concerning sovereign risk in the Euro area means they have not significantly increased compared to 2009.

Ascot and Hannover form power pact

Inter Hannover and Ascot Underwriting have formed a dedicated technical underwriting vehicle for the power and utilities industry.

Swiss Re: global non-life premium dips 0.1% in 2009 to $1 735bn

According to Swiss Re’s latest “World insurance in 2009” sigma study, world insurance premium volume fell 1.1% on an inflation-adjusted basis.

Hiscox to cut Lloyd's capacity by £100m in 2011

Hiscox has published a summary of its initial 2011 business forecast for Syndicate 33. A full 2011 business forecast for Syndicate 33 will be submitted to Lloyd's by 9 July.

Lloyd's insurer Catlin to set up $1bn Swiss reinsurance arm

Catlin plans to form a reinsurance company in Switzerland to "significantly expand the European-based reinsurance business underwritten by the group," it said today.

Duo agrees London market technology deal ahead of 1 Jan 2011 roll out

Perspective Technologies, the messaging solutions specialist and Exari, the provider of automated document assembly, have reached an agreement whereby that they will jointly offer a document automation service to practitioners involved in the cross…

CEA calls on G20 to distinguish between insurers and banks

The CEA, the European insurance and reinsurance federation, has today called on the G20 to take full account of the specific characteristics of insurance when designing regulatory initiatives to respond to the global financial crisis.

AM Best affirms Brit’s A rating

Credit rating agency AM Best has affirmed Brit Insurance’s A rating and Brit Insurance Holding's ICR rating of BBB.

Forbes launches treaty reinsurance arm

Price Forbes & Partners today announced the expansion of its business through the establishment of a treaty reinsurance division.

THB profits up in first half

THB this morning reported a 21% rise in broking profit to £3.9m on fees and commissions of £24.6m (H1 2009 £23.3m).

Hiscox withdraws from "flawed" solicitors' indemnity market

Hiscox is to withdraw from the solicitors’ professional indemnity market.

US increases terror cover take-up

US terrorism insurance take-up rates continued to climb in 2009 across all industries, according to Marsh.

Post in print - 24 June

Post reporter Dan Dunkley provides a 60-second run down of the major news headlines from tomorrow's issue of Post.

Canopius confirms KGM talks

Canopius, the largest privately owned Lloyd's insurer, has confirmed it is in talks to acquire up-for-sale motor underwriter KGM.

Marsh appoints new property and casualty practice leaders

As part of its drive to grow its property, business interruption and casualty risk and insurance solutions Marsh has appointed Caroline Woolley as property practice leader, and Alain Petit-Lambotte as casualty practice leader, for Europe, the Middle East…

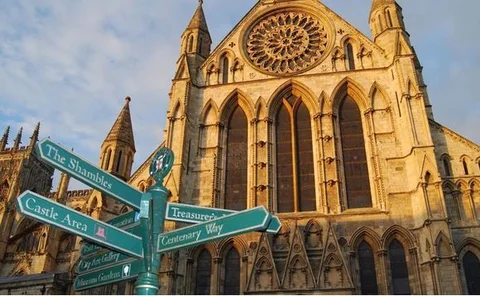

Levene laments 2010, the year of "direct hits"

The chairman of Lloyd’s has described 2010 as the year of “direct hits”.

Marston quits Cunningham

Cunningham Lindsey is searching for an environmental services boss following Mike Marston's announcement that he plans to leave the business after six years.

CII London market award

The Chartered Insurance Institute has outlined its new qualification in London market insurance.

Top 5 Post stories

The top five most popular stories on postonline.co.uk over the last week were:

RICS chooses Howden

The Royal Institution of Chartered Surveyors has appointed specialist Lloyd's broker Howden as its preferred UK professional indemnity broker.

Lloyd's appoints Jardine

Lloyd's has appointed Paul Jardine from Catlin Syndicate as deputy chairman of The Council of Lloyd's, following Ewen Gilmour's retirement from the position earlier this month.

Postscript - 20 years ago: Skuld makes offer to ferry fire victims

Looking through Post's back catalogue paints a unique picture from more than 150 years of insurance news, as this highlight from 20 years ago reveals.

Solvency II - Cost V opportunity: A cost worth paying

After complaints over the amount of management time needed to comply with Solvency II and the costs associated with this, Rachel Gordon asks if the grumbles are justified.

Ex-Fusion bosses outline MGA plan

The new managing general agency led by Fusion founders Kevin Pallett and Geoff Crisp aims to establish at least five offices as it gears up for its launch next year, backed by Bermuda-based insurance group Aspen.