Commercial

Bowring Marsh opens Tokyo office

Bowring Marsh, the specialist international placement broker at Marsh, has expanded its footprint in Asia with the opening in Tokyo of its eighth office.

BIBA 2010: Open GI launches online quote and buy for SMEs

Open GI has launched Ebroker for Open Trader, a new online quote and buy solution the firm claims will enable brokers to sell SME products to clients via the web.

Interview - Ben Wright: Property boom

Despite the recession, Keelan Westall's head Ben Wright tells Mairi MacDonald the business has ambitious expansion plans.

Bluefin buys GM book

Bluefin has acquired the general insurance business of Peterborough-based GM Towns & Partners for an undisclosed sum.

Lloyd's China granted licence to write direct insurance

Lloyd’s China has been granted a licence by the China Insurance Regulatory Commission to write direct insurance in addition to their existing reinsurance licence.

RSA unveils launches to regain SME ground

RSA is to launch more commercial products in its bid to become a top-five player in the SME market.

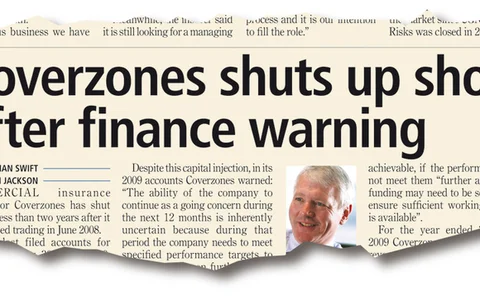

Coverzones boss vows it will come back "within months"

Coverzones chief executive Simon Ball has vowed the online commercial aggregator will make a profitable return to the SME market within months.

FSA corruption warning

The Financial Services Authority has warned of brokers exposure to corruption in its review of anti-bribery and corruption systems and controls.

BIBA 2010: Ace launches four new enhanced business covers

Ace UK was today due to launch a suite of new products targeting companies with one or more overseas branches, retailers, hotel groups and machinery manufacturers.

BIBA 2010: Bluefin ties up APC deal

Commercial insurance underwriting agency APC has struck a deal with Bluefin to provide its network brokers with access to a full range of commercial insurance packages.

BIBA 2010: Lorega in online tie up

Loss recovery insurance specialist Lorega has struck a deal with internet trading solution Broker 2 Broker to enable brokers to bind business online from 1 June.

Chaucer reports 11% hike in motor rates

Lloyd's insurer Chaucer this morning reported a drop in gross written premium income to £250.1m (2009 Q1: £257.8m).

Lloyd's China granted licence to write direct insurance

Lloyd’s China has been granted a licence by the China Insurance Regulatory Commission to write direct insurance in addition to their existing reinsurance licence.

BIBA 2010: Over half of brokers see value in online platforms

Over half of British insurance brokers believe using an online platform to trade with carriers will help them retain commercial insurance business that would otherwise go direct.

BIBA 2010: Galbraith calls on government to introduce the "right legislation"

The British Insurance Brokers’ Association is set to launch a major lobbying campaign to promote the role of the broker to the Liberal-Conservative coalition government.

Swiss Re: Insurers should not ignore 'the elephant in the room'

Against the backdrop of the upcoming regulatory framework in Europe – Solvency II – Swiss Re has outlined how it believes insurance risk managers can shape their companies’ risk management culture in the post-crisis world.

Brightside to raise £9m via share-listing for latest acquisition

Broking group Brightside has unveiled a plan to raise £9.0m via the placing of 36m new ordinary shares to fund an acquisition.

Swiss Re: Insurers should not ignore 'the elephant in the room'

Against the backdrop of the upcoming regulatory framework in Europe – Solvency II – Swiss Re has outlined how it believes insurance risk managers can shape their companies’ risk management culture in the post-crisis world.

Risk presentation key, claims international broker survey

According to new research commissioned by Bowring Marsh, the quality of the presentation of risk information is crucial to insureds obtaining the most competitive terms from insurers.

Risk presentation key, claims international broker survey

According to new research commissioned by Bowring Marsh, the quality of the presentation of risk information is crucial to insureds obtaining the most competitive terms from insurers.

Hardy CEO admits 2010 profits will be "diminished" after Q1 losses

Hardy Underwriting said it expects to increase gross written premium volume for the 2010 financial year to more than £300m (2009: £242m).

Allianz CEO bemoans commercial rate inactivity as profits dip 10.7%

Allianz reported gross written premium was up 4.4% to £411.3m (2009 Q1: £393.8m) over same period in 2009.

Allianz CEO bemoans commercial rate inactivity as profits dip 10.7%

Allianz reported gross written premium was up 4.4% to £411.3m (2009 Q1: £393.8m) over same period in 2009.

Dual to offer PII to Lloyd's brokers

Specialist professional indemnity underwriting agency, Dual Corporate Risks, has secured new capacity for underwriting broker’s professional indemnity cover.