Insurer

David Bowie: The insurance industry reflects on the music legend

With the sad passing of music icon David Bowie this week, Post asked a number of insurance industry music fans for their own personal reflection on what the Brixton-born legend meant to them.

Ace completes Chubb deal predicting $650m savings by 2018

Ace has completed its acquisition of Chubb, adopting the Chubb name and commencing trading today (15 January) on the New York Stock Exchange under the symbol CB.

Accelerate seals three year capacity deal with sports specialist JRW

Specialist managing general agent Accelerate Underwriting has agreed a three year deal with Manchester-based sports player JRW Group.

Quiz of the week – 15 January

Test your knowledge of the week's insurance news, with the Post insurance quiz of the week.

Blog: Solvency II to fuel further consolidation in 2016

During the last 12 months, insurers have responded to the prevalent commercial, economic and regulatory pressures by stepping up mergers and acquisitions activity, cutting costs and rationalising non-core activities.

Storm Desmond cost insurers £759m, says Perils

Perils, which provides consolidated catastrophe insurance data, has estimated the insured cost of Storm Desmond for properties affected by flooding and wind at £759m.

Strong premium growth expected across Asia, says Swiss Re

Swiss Re is predicting robust growth across Asia for general insurance over 2016 and 2017 despite economic headwinds.

Gravity of cyber risk stressed as climate change tops risk list

Failure to act on climate change was named the top global risk by the World Economic Forum today (14 January), as a Marsh leader claimed cyber risk is widely underestimated outside the US.

Allianz backs Thatcham stance on fitting AEB as standard

Allianz has backed calls by the motor insures’ research facility Thatcham for automated emergency braking technology to be fitted as standard to all new cars sold in the UK.

Motor premiums see largest hike in five years

Motorists were hit with the highest quarterly rate rise in five years for comprehensive car insurance in Q4 which saw prices rise by 7% to an average of £672, according to the latest Confused car insurance price index.

Pressure building on Hong Kong's CORs, says Swiss Re

Clarence Wong, chief economist Asia at Swiss Re, believes the soft market conditions in Hong Kong are "unsustainable".

End of marine market cycles, suggests Munich Re's Berg

Dieter Berg, executive general manager at Munich Re, believes the traditional marine market cycle might be over as premiums decline in a prolonged soft market.

NIG puts 71 roles at risk in offshoring move

Commercial insurer NIG is shrinking staff numbers at its Bristol and Manchester underwriting centres as part of an offshoring move, Post can reveal.

Flood Re completes exec team with hires from Pro Sight and Pen

Flood Re has completed its executive team with the appointment Harriet Boughton as its general counsel and Karen Clautour as head of operations.

Night-time curfews for young drivers to be introduced in Northern Ireland

A comprehensive package of new measures to improve road safety has been passed by the Northern Ireland Assembly that includes night restrictions on young drivers carrying passengers.

AIG strategy failing to win support among majority of investors

Only a small minority of shareholders back AIG’s present strategy amid pressure from activists such as Carl Icahn for a change to the insurer’s approach, according to a poll by investment management firm Bernstein.

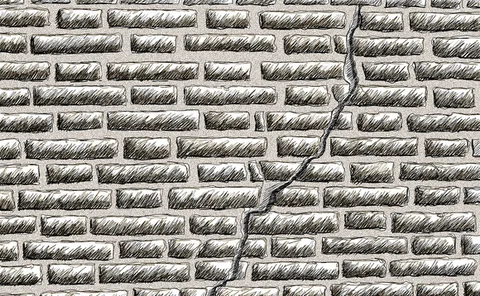

Subsidence: A close call with cracks

While subsidence claims have been insignificant of late, some subsidence experts believe another event year could be around the corner.

Insurers encouraged to improve claims experience as poll highlights delays

More than two in five (41%) motor and home insurance customers have suffered delays and problems when making claims, according to research by Consumer Intelligence.

Businesses are paying later in China but economy is resilient, says Euler Hermes

Credit insurer Euler Hermes believes domestic consumption in China will support the economy but volatility is delaying business payments.

Analysis: Hong Kong's 2016 prospects

Insurers in Hong Kong look set to have a testing year in 2016 as competition remains intense, margins are tight and the market gears up for a new regulatory regime writes Nicky Burridge.

Business interruption from cyber attacks a growing concern, says AGCS

Business interruption is the top risk globally for the fourth year in succession according to Allianz's Risk Barometer 2016 - an annual survey of risk managers.

Blog: What will Maurice Tulloch's legacy as Aviva UK GI CEO be?

The news that Maurice Tulloch is to step down from his post as CEO of Aviva’s UK general insurance business should not have come as much surprise.

C-Suite - Insurer: Taking it personally

The pace of change in the IT landscape means insurers must listen and act on feedback from brokers