Technology

Motor Claims 2011: Industry needs to reform to rejuvenate

"If we do nothing, body shops and the whole supply chain will become inefficient".

Motor Claims 2011: Industry needs to look outwards

The insurance industry has been warned to stop looking inwards and start judging itself against other industries or lose the customer service battle.

Motor Claims 2011: Food for thought

The annual Post motor claims conference has become a must-attend event for those leading the motor insurance sector.

Aviva agrees online trading deal

Online wholesaler Policyfast has struck an exclusive deal to provide Aviva Homework cover through the broker market.

Schemes - Conception & construction: Special delivery

Setting up schemes to cover specialist sectors can be a lucrative business - but it requires brokers, insurers and customers to work together. Stephanie Denton looks at this evolving market.

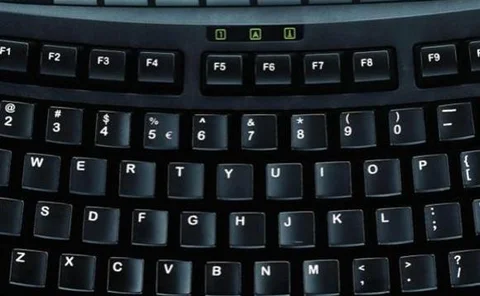

Mobile technology - Brokers: How can technology benefit the way brokers do business

With more advanced smartphones and tablet computers, Rachel Gordon asks if mobile technology is merely the latest passing fad, or the shape of the future for the broking community.

Zurich seeks to reduce fleet claims through deal

Global driver-safety firm Greenroad has signed a deal with Zurich fleet client Iron Mountain to roll out its service across the UK.

Powerplace hit by Reed departure

Towergate-owned trading platform Powerplace has confirmed the departure of chief executive Matthew Reed.

Aviva enhances outsourcing agreement with nine year HP deal

Hewlett-Packard today announced Aviva has signed a nine year messaging contract based on Microsoft Business Productivity Online Suite designed to improve productivity and enhance collaboration across all of Aviva's global regions.

Brightside still on target despite life arm difficulties

Brightside's broking chairman has insisted the group is on target to meet its general insurance business plan, despite admitting its life offering is "not at the level it had hoped for".

Nationals call for FSA talks as Towergate seals £200m deal

Chief executives from some of the UK's largest brokers have called for a meeting with the Financial Services Authority to discuss concerns over the increasing level of intervention in compliance issues by the regulator.

Insure & Go strengthens ties with Healix

Travel insurance firm Insure & Go has integrated the Healix medical risk assessment tool into its web sales channel allowing travellers with pre-existing medical conditions to receive online quotes.

Towergate extends RDT technology partnership

Towergate has widened the use of RDT insurance application Landscape to include its let properties business line of products.

IBM validates SSP solution

IBM has validated Insure J, SSP's component-based general insurance solution, against the IBM insurance industry framework.

Citymain launches insurance for the Ipad

Citymain has launched a new insurance solution for Apple’s Ipad as well as tablet PCs.

Motor Claims 2011 – Roundtable: Communication over crash claims

As motor insurers seek to reduce claims costs, Post gathered a group of industry experts together to debate whether a law change would help. Jonathan Swift reports.

Interview – Robert Hiscox: Opinions of the insurance industry

Robert Hiscox is never one to hold his tongue. When Daniel Dunkley met him to talk about current market conditions, he was as forthright as expected on the FSA, ABI, government policy and price-matching practices.

Motor claims: Can insurers stem the rising cost of whiplash claims?

With 93% of GPs seeing patients they believe to have exaggerated injuries in order to make a claim, Leigh Jackson asks how insurers can stem the rising cost of whiplash cases.

Natural catastrophes: A model example of assessing earthquake exposure

Earthquake costs are rising steadily. Jane Bernstein examines insurers' current use of modelling, recent event responses and solution sustainability.

Post history - 10 years ago: Insurers to give genetic evidence

Looking through Post's back catalogue paints unique picture of more than 150 years of insurance news, as this highlight from 10 years ago reveals.

Europa Technologies launches Cresta upgrade

Geodata service provider Europa Technologies has upgraded to its digital Catastrophe Risk Evaluating and Standardising Target Accumulations zone product for the insurance and reinsurance sectors.

Risk modelling - Underwriter responsibility: Model behaviour

Models have quickly become a valued tool for underwriters. Matthew Washington examines how the advent of Solvency II could really make them fly.

RSA boasts of UK first with scoping innovation

RSA has agreed a deal with technology firm Innovation Group to become the first UK insurer to adopt its property claims scoping software.

Call Credit seals acquisition of The Trading Floor

Call Credit Information Group has announced the purchase of data provider The Trading Floor, which it claims will allow it to offer clients an even more comprehensive range of services.