Reinsurance

Lloyd’s – China: Chasing the Chinese dream

As the world’s second largest economy, China is a tempting opportunity for insurers. Leigh Jackson reports on the key role being played by Lloyd’s, the difficulties in gaining traction and the reality checks on expectations.

View from the top: The going gets tough

Tough is probably a rather English understatement to describe the state of the world — and the world of reinsurance and insurance — today.

Post Magazine – 11 August 2011

The latest issue of Post magazine is now available to subscribers as a digital and interactive e-book.

Insurer estimates hit £750m as city riot damage racks up – Insurance News Now

Post reporter Callum Brodie outlines this week's major general insurance stories which include how RSA, Aviva and Axa are likely to incur the biggest losses from commercial property claims, based on market share, as the latest riot bill estimate hits …

CGSC names first-ever group CIO

Brent Kruger has appointed as Cooper Gay Swett & Crawford’s first group chief information officer.

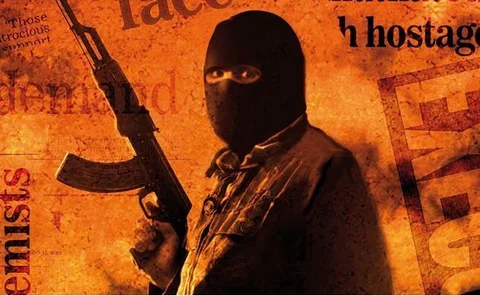

Terrorism remains major threat to insurance industry

The reinsurance industry continues to meet the current demands for terrorism risk transfer despite high levels of terrorism according to a new report.

THB recruits senior broker for Europe

Following positive interim results, THB has announced plans to expand its European division, part of THB’s Lloyd’s broking operation Thompson Heath & Bond.

Terrorism remains a risk warns Guy Carpenter

Recorded incidents of terrorism around the world remain at historically high levels and terrorism remains a serious risk to the insurance and reinsurance industry Guy Carpenter has warned.

Canopius appoints underwriters to sabotage and terrorism team

Canopius has appointed Tim Davies and Jennie Beard as underwriters to its sabotage & terrorism team.

Swiss Re teams with Aon Benfield to implement Acord

Swiss Re and Aon Benfield have worked together to implement automated technical accounting, claim and cash transactions using Association for Cooperative Operations research and Development (Acord) messaging standards in the US and Canada.

Munich Re's losses slow in second quarter

Munich Re posted a consolidated loss of €210m for the first half of 2011, compared with a profit of €1194m in the same period last year.

Swiss Re reports second quarter P&C COR of 78.4%

Swiss Re has reported a net income of $960m (£587m) in the second quarter of 2011, compared to $812m in the same period of 2010.

Munich Re's losses slow in second quarter

Munich Re posted a consolidated loss of €210m for the first half of 2011, compared with a profit of €1194m in the same period last year.

Swiss Re reports second quarter P&C COR of 78.4%

Swiss Re has reported a net income of $960m (£587m) in the second quarter of 2011, compared to $812m in the same period of 2010.

Hiscox bemoans 'costliest year ever'

Specialist insurer and reinsurer Hiscox was stung by a pre-tax loss of £85.6m (2010: £97.2m profit) in the first half of the year but claims to be "heading towards the sunny uplands of profit".

News analysis - Lancashire Tax move: Bringing business back to Blighty

With Lancashire set to move its tax residence to the UK, Amy Ellis looks at proposed reforms to the controlled foreign companies rules and asks whether other insurers may follow suit.

Broking focus - Regulation: The new broom

The Financial Conduct Authority will assume responsibility for the regulation of brokers taking over from the Financial Services Authority at the end of 2012. The Institute of Insurance Brokers, the British Insurance Brokers' Association and the London &…

Post Magazine – 4 August 2011

This week the Post team reports on Lloyd’s decision to begin investigating Equity syndicate’s reserve deterioration. A Names protest group says the outcome should prove influential to its own campaign over Equity’s losses.

Marsh sees H1 growth in broking reveune and profit

Marsh has reported a 5% rise in the underlying reveune in its risk and insurance business to $3.3bn for the six months to 30 June 2011 (H1 2010: $2.95bn).

Lloyd’s pursues own probe into Equity syndicate losses – Insurance News Now

Post senior reporter Amy Ellis outlines this week's major general insurance stories including Lloyd’s decision to begin investigating Equity syndicate’s reserve deterioration. A Names protest group says the outcome should prove influential to its own…

Amlin expects to fall short on profit expectations

Amlin bosses have admitted the company is unlikely to meet end of year profit expectations, claiming that an “unprecedented level of catastrophes” have severely impacted performance.

AIG and Gen Re convictions overturned

A US appeals court has overturned the fraud convictions of four former General Re executives and a former AIG official and has ordered a retrial.

Exclusive IP and catastrophe articles now live

Insurance Insight’s weekly update is live with articles on intellectual property and natural catastrophes.

Aon reports 3% organic growth in American and international broking arms

Aon today announced its revenue increased 48% to $2.8bn for the second quarter of 2011 compared to the prior year quarter, due to a 42% increase in commissions and fees resulting from acquisitions, primarily that of Hewitt.