Reinsurance

Financial market volatility hits Swiss Re’s core combined ratio

Swiss Re saw the combined ratio for its property and casualty segment increase to 80.8% for the third quarter of 2011 due largely to financial market volatility.

Swiss Re reports 118% net income rise

Swiss Re reported a 118% increase in net income in its third quarter to $1.3bn (2010 $0.6bn).

Interview - Konsta & Payton: Let's get together

The high-profile merger of Clyde & Co and Barlow Lyde & Gilbert has impacted the legal and insurance industries. Michael Payton and Simon Konsta explain the differences.

Comment: Delivering definitive data

The ability to know precisely where property risks are located and what risks surround those locations are vital elements of successful and accurate underwriting and pricing. To know that such data is regularly updated and maintained – and meets ISO…

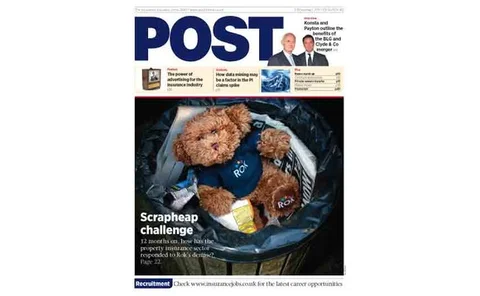

Post magazine – 3 November 2011

The latest issue of Post magazine is now available to subscribers as a digital and interactive e-book.

AIG reveals $972m payment to US Treasury after MetLife deal

AIG has announced that it had paid the United States Department of the Treasury $972m to reduce the liquidation preference on one of the special purpose vehicles created as part of the government's assistance to AIG.

Alterra merges Irish operations

Alterra Capital Holdings has merged its Irish underwriting companies, Alterra Europe and Alterra Reinsurance Europe.

Lancashire raises Fascione in Bermuda

Lancashire Holdings has promoted Simon Fascione to chief underwriting officer of the company's Bermuda operation, Lancashire Insurance Company.

Japanese, Swiss and Bermudian regimes largely equivalent to Solvency II, says Eiopa

The supervisory systems operating in Switzerland, Bermuda and Japan are largely equivalent to Solvency II, but not for all classes, according to the European Insurance and Occupational Pensions Authority.

Munich Re launches $100m cat bond

Munich Re has a $100m catastrophe bond to cover US hurricane and European windstorm risks.

Standard & Poor upgrades Swiss Re to AA-

Standard & Poor has upgraded Swiss Re from A+ to AA- following the firm success in derisking its asset portfolio, convertible perpetual capital instrument with Berkshire Hathaway and stabilised its net income.

Swiss Re upgraded to 'AA-'

Standard & Poor's Ratings has raised its long-term counterparty credit and insurer financial strength ratings on Swiss Re and its core subsidiaries to 'AA-' from 'A+'. The outlook on all of these entities is stable.

Aon reports 38% jump in profits for third quarter

Aon net revenue increased 38% to $198m (£122.8m) for the quarter ended 31 September 2011, compared to $144m for the previous year.

Axis launches liability unit in Argentina

Loss adjusting network Axis has launched a liability claims units in Argentina to provide dedicated specialist support to local carriers and the international reinsurers.

Aspen suffers nine month losses of $193m

Aspen Insurance Holdings reported underwriting losses of $193.8m in the first nine months of this year compared to a profit of $74.6m last year.

BLG to close Singapore office

Insurance law firm Barlow Lyde & Gilbert will close its office in Singapore following its merger with Clyde & Co.

Munich Re receives A+ (superior) rating

Munich Re has had its financial strength rating affirmed of A+ (Superior) and issuer credit ratings of “aa-” along with its subsidiaries.

Extending the ELD could have damaging consequences

A proposal today by the EC for a new law to regulate safety standards for offshore oil and gas operations could have unintended consequences for the environmental liability market, according to the CEA.

Mapfre sees 13.9% increase in GWP up to Q3 in 2011

Spanish reinsurer Mapfre’s gross written premiums for the first three quarters of 2011 were $14.7bn, a 13.9% increase year on year.

Parabis commits to reinsurance with trio of appointments

Parabis has today announced three high-profile appointments under the banner of Argent Audit & Legacy in a bid to expand its reinsurance offering.

$3bn Thai flood losses set to escalate as city centre inundation begins

Loss adjusters have told Post there is a “whiff of Katrina” about the Thailand floods, following predictions the disaster could cost more than the estimated $3.3bn (£2.1bn) insured losses.

Market moves: All change at Zurich and Willis

Following a slow period, large insurers made a number of key appointments this week, including major moves at Zurich, Allianz and RSA.

Broking supplement - Interview Toby Esser: Expansive thinking

Toby Esser talks about striking serious deals, his acquisitive ambitions and plans to penalise paper-lovers

Thai floods: Waters set to overwhelm Bangkok

Loss adjusters are preparing for the complete flooding of Bangkok as waters reach the centre of the city.